A case for caution.

Earnings season creates lots of drama, intrigue, and hype as well as the dream of striking it rich by picking the big winner. It’s easy for even experienced traders to get caught up in the gold rush that earnings season creates. It’s the same business plan that built Las Vegas. Trading an earnings event is gambling pure and simple. Anything is possible, and I think a good reason to build a case for caution.

Earnings season creates lots of drama, intrigue, and hype as well as the dream of striking it rich by picking the big winner. It’s easy for even experienced traders to get caught up in the gold rush that earnings season creates. It’s the same business plan that built Las Vegas. Trading an earnings event is gambling pure and simple. Anything is possible, and I think a good reason to build a case for caution.

Successful trading is not a sprint; it’s a marathon that requires careful planning and endurance. We all want more but the allure of the big win is often the temptress leading us to slaughter. With more than 800 companies reporting the next two days anything is possible and could make for violent market action. I have learned over the years (often the hard way) I don’t have to trade every day to be successful. As technical traders, we give up our edge by over trading earnings. Think about it. If anything is possible, isn’t that gambling? How can technical analysis give us much of an edge if anything is possible?

On the Calendar

The hump day Economic Calendar has three potential market-moving reports. At 8:30 AM Eastern is the Durable Goods Orders which consensus expects a gain1.0% overall. Ex-transportation is seen as up 0.5% and core capital goods also increasing 0.5%. At 10:00 AM we get the New Home Sales report which is expected to moderate to a 555k annualized rate in September vs. the 560K in August. Then at 10:30 AM is the EIA Petroleum Status Report. There are no forecasts for petroleum, but a quick look at oil stocks would suggest traders are bullish and expecting demand to continue to lower national supplies.

The earnings calendar has more than 300 companies reporting today. If you need an example as to why you need to be aware of earnings reports take a look at CMG, JNPR, and AMD this morning. These companies reported after the close yesterday. Those traders will be singing the blues with big losses in their accounts today!

Action Plan

Although the DIA set new records yesterday on the back of great earnings reports from MMM and CAT, the other indexes took a little siesta from the rally. Futures are pointing to a flat open currently but with so many companies reporting earnings today that could obviously change in very quickly.

The overall trends are bullish, but for most traders, I think it’s time to exercise a little caution. With so much data coming out the next couple days could be very challenging. Big gaps and whipsaw price action can damage the accounts of even the most experienced traders. Try not to get caught up in the drama and hype surrounding earnings. Remember we want Quality over Quantity and not every day has to be traded to be successful.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/TMpZLUIU-jo”]Morning Market Prep Video[/button_2]

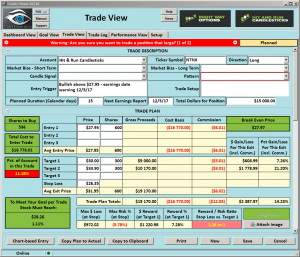

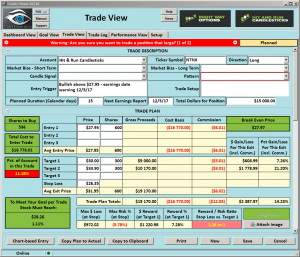

NTNX – May Challenge $33.90

NTNX (Nutanix Inc), The NTNX Chart looks like it wants to challenge the $33.90 area. Price has recently broken out of $24.90 and is currently painting a J-Hook continuation pattern. The J-Hook pattern is also the Handle to the Cup. Beware of earnings, please con

NTNX (Nutanix Inc), The NTNX Chart looks like it wants to challenge the $33.90 area. Price has recently broken out of $24.90 and is currently painting a J-Hook continuation pattern. The J-Hook pattern is also the Handle to the Cup. Beware of earnings, please con

firm date 12/5/17

►Train Your Eyes

NTNX • Cup and Handle • Morning Star • J-Hook • Flag • Trend

Good Trading – Hit and Run Candlesticks

[button_2 color=”teal” align=”center” href=”https://ob124.infusionsoft.com/app/orderForms/HRC-Hit–Run-Candlesticks-30-day-Trial-1497″ new_window=”Y”]$14.00 30-Day Membership Trial[/button_2]

► Ticker Update (SHW)

You could have profited more than 12.9% or about $4435.00, with 100 shares when we posted to our members on September 11. If you are interested in trades and profits, Rick Saddler founder of Hit and Run Candlesticks offers private recorded coaching • LEARN MORE

► Eyes On The Market

Even tho the SPY chart has printed a Bearish Engulf, and a Doji at the lower half of the candle price has still closed above the T-Line. Bullish or bearish signals require confirmation and with price closing above the T-Line is suggesting the buyers are stronger than the sellers. (At least for yesterday). As of the close yesterday, the trend is still bullish with a pullback or consolidation threatening the chart.

Rick’s trade ideas for the day – MEMBERS ONLY

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

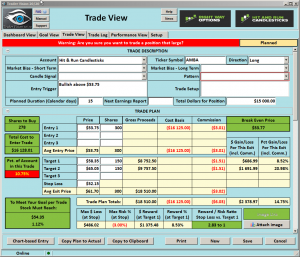

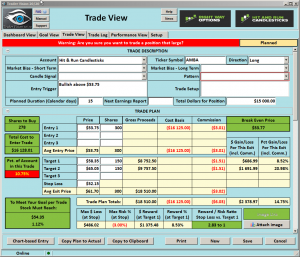

AMBA – Bull Kicker and Bullish J-Hook Continuation Pattern

AMBA (Ambarella Inc), The AMBA Chart, has printed a Bull Kicker and Bullish J-Hook continuation pattern in a long-term wedge pattern. A breakout and follow through is a must. If the Bulls can pull off a breakout AMBA has potential 50% + run in it.

AMBA (Ambarella Inc), The AMBA Chart, has printed a Bull Kicker and Bullish J-Hook continuation pattern in a long-term wedge pattern. A breakout and follow through is a must. If the Bulls can pull off a breakout AMBA has potential 50% + run in it.

►Train Your Eyes Contest

AMBA • Starting 9/5/17 find the Bullish Engulfs • The Bull Kicker • and the Bullish Morning Stars.

Email your answers to Rick Saddler; two winners will be drawn for a free month with HRC or RWO your choice.

Good Trading – Hit and Run Candlesticks

► Ticker Update (AZO)

You could have profited more than 11.25% or about $6000.00, with 100 shares when we posted to our members on August 31.

If you are interested in trades and profits, Rick Saddler founder of Hit and Run Candlesticks offers private recorded coaching • LEARN MORE

► Eyes On The Market

In yesterday’s market update I wrote, “With Friday’s close, we see support around the $256.00 area”. The SPY found intraday support at $256.02. The Bearish Engulf requires follow through to be damaging to the buyers. A close above $256.95 gives the short term sellers hope and encourages them.

Overall the trend is bullish, as of now we are looking pullback to be buying opportunities as long as the trend remains intact.

Rick’s trade ideas for the day – MEMBERS ONLY

Monthly • Quarterly • Semi-Annual • Annual

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

Anything is possible.

With the market having risen so much so fast it’s easy to assume that the market is overbought and thus must go down. As a result, traders will try to predict the roll over failing to consider the extreme bullishness of this rally and the huge number of earnings reports this week. The fact is, Anything is Possible! Good earnings reports could easily extend this bull run higher. If they disappoint some violent moves lower are possible.

With the market having risen so much so fast it’s easy to assume that the market is overbought and thus must go down. As a result, traders will try to predict the roll over failing to consider the extreme bullishness of this rally and the huge number of earnings reports this week. The fact is, Anything is Possible! Good earnings reports could easily extend this bull run higher. If they disappoint some violent moves lower are possible.

Yesterday the indexes left behind bearish patterns suggesting lower prices to come but the futures are pointing to a gap up open? I expect this will likely be a very challenging market for next several days with lots of premarket gaps and intraday whipsaws possible. Try to avoid predicting and attempting to apply your personal market bias and just follow price when it provides good entry signals. Also, keep in mind that successful trading does not require you to trade every day. Cash is a position that is often forgotten and underutilized.

On the Calendar

The Tuesday Economic Calendar kicks off at 9:45 AM Eastern with the PMI Composite Flash. The October Composite Index expected to remain unchanged with a comfortably strong reading of 54.8. Forecasters are expecting the manufacturing PMI to come up to 53.3 vs. 53.1. The services PMI has been the leader with a 55.3 reading in September which is expected to pull back slightly to 55.2 for October. FYI, PMI stands for Purchasing Managers’ Index.

There will lots of earnings news affecting the market today will about 190 companies reporting. Just a few to take note of; MCD, CAT, LMT, GM, JBLU, BIIB, MMM, GLW, SHW, AMTD, LLY, PHM plus much more. Make sure you are checking reporting date of companies you hold and those you are interested in buying. Preparation is very important.

Action Plan

For the first time in several weeks, we saw a little profit taking in the market as the day wore on yesterday. The DIA left behind a Dark Cloud Cover pattern while the SPY dropped in a full-on Bearish Engulfing Pattern. The QQQ also printed a Bearish Engulfing, but it actually finished the day looking more like an Evening Star Pattern. The IWM remained in its tight range consolidation but also printed an Evening Star type pattern. With all these bearish patterns does not mean the market has to go down? Nope! Let’s keep in mind the sheer momentum of this rally and the fact that huge numbers of earnings reports are rolling out. Anything and I mean ANYTHING, is possible!

Futures have been climbing all night and as of now suggest about a 50 point gap up in the Dow. Possibly another short squeeze like last Thursday? Your guess is as good as mine. I will first manage current positions and but will plan to wait until after the morning rush before looking for new trades.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/Q3erICCTZGE”]Morning Market Prep video[/button_2]

A huge week of market events.

With seven potential market-moving economic reports and well over 1000 earnings reports, this is a huge week of events. For new or inexperienced traders, weeks like this can be very challenging because volatility can suddenly shift market direction. For the most part, I avoid earnings reports like the plague. No matter how good a company may seem to play the earnings report is dangerous. All of your technical analysis skills are useless because anything is possible when a company reports.

With seven potential market-moving economic reports and well over 1000 earnings reports, this is a huge week of events. For new or inexperienced traders, weeks like this can be very challenging because volatility can suddenly shift market direction. For the most part, I avoid earnings reports like the plague. No matter how good a company may seem to play the earnings report is dangerous. All of your technical analysis skills are useless because anything is possible when a company reports.

Times of volatility will also test your greed emotion to the max. When your right on the direction and the stock move quickly in your direction, it’s wise to consider scaling out of the trade or exiting it all together. Stock and quickly shift when there is so much news rolling out. Also, remember gaps are gifts and a great time to go to the bank with at part or all of the position. Don’t allow greet to prevent you taking a profit.

On the Calendar

The Economic Calendar starts off slow but has several very important reports during the week and finishes up with the market moving GDP numbers. At 8:30 AM this morning we get the Chicago Fed National Activity Index. It’s very unlikely to move the market, and I only mention it because other than that all we have is some bond auctions to round out the day.

The Earnings Calendar ramps up this week is likely to create some volatility as big newsy reports roll out. Please keep in mind big market gap up’s and gap downs are common so plan your risk carefully. Today is the lightest day on the calendar with just short of 80 earnings reports.

Action Plan

Having taken several trades off last Friday, we enter the market today light in our accounts. Considering how stretched the market is I’m comfortable having less risk. The futures are of course pushing for a higher open with the Dow right now showing a 20-point gap up. Just like on Friday don’t be surprised to see whipsaw price action after the open.

I plan to give the market 15 to 30 minutes after the open to see there are real buyers interested at these levels before looking for new trades. If the earnings reports continue to roll our positive, there is every reason to believe the market could still move higher. I know logic says this rally can’t continue forever, but those that predict can easily get run over just like the those that got short last Thursday morning. Stay with the trend until price tells you differently.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/oL84TDVcSz0″]Morning Market Prep Video[/button_2]

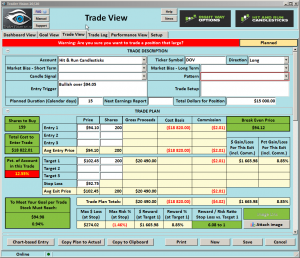

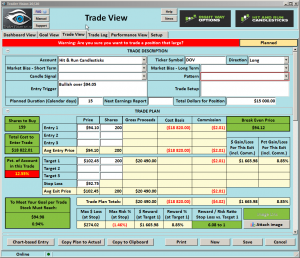

DOV – Trending Back Over The T-Line

DOV (Dover Corp), The DOV Chart is trending and now back over the T-Line after a gap down followed by a bullish rush to stay afloat. On a 2-Day chart, you can see a clean Bullish Belt-Hold that’s closed above the T-Line, the upper T-Line and the Volatility Stop.

DOV (Dover Corp), The DOV Chart is trending and now back over the T-Line after a gap down followed by a bullish rush to stay afloat. On a 2-Day chart, you can see a clean Bullish Belt-Hold that’s closed above the T-Line, the upper T-Line and the Volatility Stop.

►Candle Pattern

2-Day Chart • Bullish Belt-Hold

Low-risk entries • Trade with us • Learn more with us • Profit with us •. You will not find a better trading support group, up to you.

Good Trading – Hit and Run Candlesticks

► Ticker Update (ACLS)

You could have profited about 16.55% or about $470.00, with 100 shares when we posted to our members on October 2nd.

If you are interested in trades and profits Rick Saddler founder of Hit and Run Candlesticks offers private recorded coaching • LEARN MORE

Learn more about Hit and Run Candlesticks, and today’s trade idea and plan plus the 10 or more members trade ideas, starting at 8:45 EST AM every morning with the HOG and then Rick at 9:10 EST. Every day we teach and trade using the T-Line, Candlesticks, Support and Resistance, Trends, chart patterns and continuation patterns.

► Eyes On The Market

The SPY seems to be possessed with Bullishness. My overall plan is to remain bullish and trade charts that are ready to pay or to pay me. Following the trend and price action is not only easy but rewarding as well.

With Friday’s close, we see support around the $256.00 area.

Rick’s trade ideas for the day – MEMBERS ONLY

Monthly • Quarterly • Semi-Annual • Annual

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

The Bulls punish early Bears.

What an amazing recovery of yesterdays gap down is punishing those that attempted to predict the selloff was finally here. Those that got short in anticipation are now being squeezed out as the Bulls punish early Bears. A reminder that trying predicting the market is nothing more than gambling. Traders with big ego’s of their predictive prowess often find themselves fighting the market rather than working with the market. Believe me; I have the scars from making this mistake more than I care to admit. The solution is simple but it very hard to learn.

What an amazing recovery of yesterdays gap down is punishing those that attempted to predict the selloff was finally here. Those that got short in anticipation are now being squeezed out as the Bulls punish early Bears. A reminder that trying predicting the market is nothing more than gambling. Traders with big ego’s of their predictive prowess often find themselves fighting the market rather than working with the market. Believe me; I have the scars from making this mistake more than I care to admit. The solution is simple but it very hard to learn.

As the market is rallying, try to be a profit taker and sell into strength. When the market does roll over you will then be less affected. Then wait for the market to prove it’s ready to go lower before jumping on board. When your profits are safely tucked away in your account, you can afford to wait. Always remember you don’t have to trade everyday to be successful.

On the Calendar

The last day of the trading week begins with Existing Home Sales at 8:30 AM Eastern on the Economic Calendar. Forecasters expect the the number for September coming in a little lower at 5.300 million. The slide in existing sales is a result of hurricane impacts. The National Asso. Of Realtors has warned Hurricane effects may slow sales the rest of the year. We have a Fed Speaker at 2:00 PM and Janet Yellen will Speak today after the market close at 7:30 AM. Maybe at 2:00 PM is the Treasury Budget report which has already moved several times this week.

On the Earnings Calender, we have just short fo 50 companies reporting. A lot of eyes will be focused on the Earnings out of GE before the bell today. The companies stock has been in an ugly decline of around 25% this year. There is a rumor out there that GE may cut or even suspend it’s dividend today which would likely send the stock much lower. It will be interesting to see what happens.

Action Plan

After gapping lower yesterday the Bulls went back work and made quite a deminstration of strength. The DIA set another new record high close by the end of the day. The other indexed lagged behind but they all rallied signiffiantly off the morning lows. The Futures this morning are now wildly bullish pointing to gap up of more than 80 points. Count this as very good lession about trying to perdict the market. I can guarantee part of the rally yesterday and this morning will be because a lot of folks anticipated a sell off and got short. They are now getting run over and forced to buy to cover adding fuel to the rally. A painful lession I had to learn the hard way.

It’s Friday and for that means profit day. I will be much more focused on taking profits today rather than adding new risk. Also, keep in mind that this mornings gap up in the Dow could produce whipsaw price action. Chaiseing, today’s pop, would be very unwise in my opionion.

Treade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/gKzvSL0nY24″]Morning Market Prep Video[/button_2]

Earnings season creates lots of drama, intrigue, and hype as well as the dream of striking it rich by picking the big winner. It’s easy for even experienced traders to get caught up in the gold rush that earnings season creates. It’s the same business plan that built Las Vegas. Trading an earnings event is gambling pure and simple. Anything is possible, and I think a good reason to build a case for caution.

Earnings season creates lots of drama, intrigue, and hype as well as the dream of striking it rich by picking the big winner. It’s easy for even experienced traders to get caught up in the gold rush that earnings season creates. It’s the same business plan that built Las Vegas. Trading an earnings event is gambling pure and simple. Anything is possible, and I think a good reason to build a case for caution.