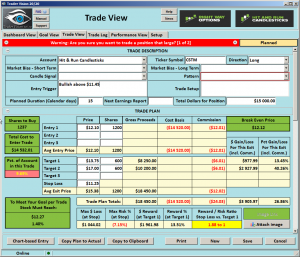

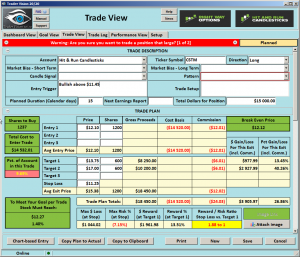

CSTM – Bullish Above 11.45

CSTN (Constellium NV), The CSTM Chart has consolidated for the past couple of months and is now Bullish above $11.45. Last week CSTM broke out and closed above a double top after finding support from the 34-EMA and 50-SMA. On a 2-Day chart of CSTM, you can see the Ascending Triangle and the Bullish Engulf.

CSTN (Constellium NV), The CSTM Chart has consolidated for the past couple of months and is now Bullish above $11.45. Last week CSTM broke out and closed above a double top after finding support from the 34-EMA and 50-SMA. On a 2-Day chart of CSTM, you can see the Ascending Triangle and the Bullish Engulf.

If you need coaching on setting up your trade plan Click Here

►Train Your Eyes

CSTM • Trend • Ascending Triangle •Rising 34-EMA • Bullish Engulf • (Hit: Look at a 2-day chart)

Good Trading – Hit and Run Candlesticks

► Ticker Update (ALGN)

You could have profited more than 35% or about $6100.00, with 100 shares when we posted to our members on August 8. If you are interested contact • Coaching With Rick

► Eyes On The Market

Friday ended on a Bullish note with the SPY printing a Bullish J-Hook Continuation pattern. (The 2-Day chart printed a Bullish Morning Star). Price vs-Line and T-Line Bands are bullish, price vs. price is bullish, price vs. V-Stop is bullish. I would say the market is bullish. Below $255.60 or about the T-Line would bring the VIX up a little. The VIX closed below the Lower T-Line Band and below the VStop but support and bottom construction are still evident.

Rick’s trade ideas for the day – MEMBERS ONLY

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

Remain Objective

With such a strong bull run underway it can be difficult to remain objective. There are those with a wildly bullish market bias and those expecting an imminent collapse as a result of the being overbought. The financial news only serves to fan the flames of both sides of this drama. Toss in turbulent government and about 1500 earnings reports and you have the makings for a very wild week. So whats a trader to do?

With such a strong bull run underway it can be difficult to remain objective. There are those with a wildly bullish market bias and those expecting an imminent collapse as a result of the being overbought. The financial news only serves to fan the flames of both sides of this drama. Toss in turbulent government and about 1500 earnings reports and you have the makings for a very wild week. So whats a trader to do?

What works for me is to turn off all the noise, focus on price action, my trading rules, goals and discipline. Price is King. I can only make money if I’m on the right side a price move. What I think or feel should happen is completely irrelevant and only clouds my view of actual price action. Turn off the noise, set your bias aside and trade the chart.

On the Calendar

The Economic Calendar begins with a potential market-moving report at 8:30 AM Eastern. The Personal Income and Outlays core number is expected to rise by only 0.1% September with the year over year rate stuck at 1.3%. However, personal income is expecting an increase of 0.4%, and consumer spending is expected to jump 0.9% as a result of post-hurricane auto replacements. At 10:30 AM is the Dalla Fed Mfg. Survey is not expected to move the market with a strong number of 21.3 according to forecasters.

The Earnings Calendar will be front and center this week with more than 1500 companies reporting. Today we get it kicked off with just over 180 posting results. I highly recommend taking the time to make sure of the reporting dates of companies you hold or those you are considering as new purchases.

Action Plan

Last week ended with a bang due to some great big tech earnings reports. Both the SPY and the QQQ closed at new record highs while DIA and IWM lagged slightly behind. Currently, futures are pointing to lower open as I write this but with so many earnings reports coming out that could easily change. There is widespread speculation today of possible arrests from the Russian investigations. That, of course, could temper the bulls enthusiasm as it could slow or even stop the tax plan.

As for me, I will stay the course, trading with the trend which is bullish but extended. With such a huge number of companies reporting this week anything is possible. Don’t be surprised to volatile moves up or down as the market reacts to earnings as well as the news. Fast intraday whips are not out of the question so avoid chasing and wait for low-risk defensible positions. My suggestion is to turn off the news, avoid the drama and stay focused on the price the action.

Trade wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/ZYDSFcTFYX0″]Morning Market Prep Video[/button_2]

Greed

The Bulls continue to dominate, and thus far earnings reports are supporting their efforts. There is a saying here in farming country, “There is nothing like rising prices to break farmers.” When corn prices are running higher farmers will buy and develop more cropland. Heavily invest in more equipment to get the job done and plant every square inch of ground they can find with corn. As a result, corn supplies soar, and prices per bushel begin to fall like a rock. That’s the effect of greed.

The Bulls continue to dominate, and thus far earnings reports are supporting their efforts. There is a saying here in farming country, “There is nothing like rising prices to break farmers.” When corn prices are running higher farmers will buy and develop more cropland. Heavily invest in more equipment to get the job done and plant every square inch of ground they can find with corn. As a result, corn supplies soar, and prices per bushel begin to fall like a rock. That’s the effect of greed.

As traders, it’s very important to guard against greed. When the market is bullish trade it long, but take caution not to over-trade. A Bull market is fantastic, but complacency will destroy an account. Hold fast to your rules and maintain your discipline. It’s also very important to take profits along the way. Give us a dollar, and we want two. That’s human nature. Any business requires consistent profits to prosper, and trading is a business like any other. Never allow greed to prevent you from taking a profit. One day tide will go out, and profits will quickly evaporate.

On the Calendar

There is not much on Friday’s Economic Calendar, but it kicks off at 8:30 AM Eastern with the very important GDP. The 3rd quarter GDP is expected to slow to a 2.5% annualized rate from 3.1% last quarter. The decline is a reflection of the major hurricane impacts on the economy. Consumer Spending is also expected to decline to 2.3% vs. 3.3% last quarter. Forecasters believe business investment may have softened slightly while vehicle sales moved higher. The GDP price index could rise as to 1.6% overall vs. the 1.0 reading in the second-quarter. At 10:00 AM Consumer Sentiment is expected to remain very strong at 101.0 on this reading.

The Earnings Calendar is showing about 130 companies reporting today. Make sure you are checking reporting dates as part of your daily trading preparation.

Action Plan

Big tech knocked the cover off the ball with the after the bell reports. Futures are once again pointing to a gap up open as GOOG and MSFT gap to new record highs. Everything seems to be coming up roses for the market but do not forget the weekend ahead and the possibility of profit taking into strength. Next week is even bigger than this on the earnings calendar so keep in mind anything is possible. Keep that in mind as you plan for the weekend and the week ahead.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/g5NAH3hL7wQ”]Morning Market Prep Video[/button_2]

Four Day Work Week

(It’s Friday) Back when I worked at a job I always wished we only had a four day work week. Well, when I started trading for a living I cut the tie and almost have a four day work week. The last thing I do is glue myself to the computer screen all day because I think I have to be. You’re the boss now, take some time off, enjoy your Friday. Besides it’s a good day to count your money and think back how you did this past week and work on any adjustment or maybe it’s a good day to catch up on the trading education.

(It’s Friday) Back when I worked at a job I always wished we only had a four day work week. Well, when I started trading for a living I cut the tie and almost have a four day work week. The last thing I do is glue myself to the computer screen all day because I think I have to be. You’re the boss now, take some time off, enjoy your Friday. Besides it’s a good day to count your money and think back how you did this past week and work on any adjustment or maybe it’s a good day to catch up on the trading education.

Good Trading – Hit and Run Candlesticks

Learn more about Hit and Run Candlesticks, and today’s trade idea and plan plus the 10 or more members trade ideas, starting at 9:10 EST AM every morning. Every day we teach and trade using the T-Line, Candlesticks, Support and Resistance, Trends, chart patterns and continuation patterns.

Give us a try If you would like to learn what and how we do it click here to give us a try, cancel at any time.

►Eyes on The Market

The Bearish Engulf still lurks as of the close yesterday; price closed as an inside day below the T-Line. Price also closed above the Lower T-Line Band showing the Bulls are not ready to give up the fight. The futures are up this morning, mostly because of AMZN… Ya AMZN!

Rick’s trade ideas for the day MEMBERS ONLY

Start your education with wealth and the rewards of a Swing Traders Life – Click Here

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

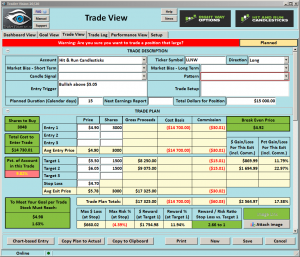

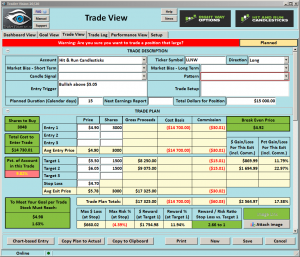

LLNW – Waiting For The Signal

LLNW (Limelight Network), The LLNW Chart has trended nicely on the back of the T-Line and has now felt a little profit taking. A few buyers stepped in with a little Doji yesterday above the T-Line, both T-Line Bands and the VSTOP Dots. LLNW has pulled back to the T-Line for a “PBO setup.” Now just waiting for an entry signal. If you need coaching on setting up your trade plan Click Here

LLNW (Limelight Network), The LLNW Chart has trended nicely on the back of the T-Line and has now felt a little profit taking. A few buyers stepped in with a little Doji yesterday above the T-Line, both T-Line Bands and the VSTOP Dots. LLNW has pulled back to the T-Line for a “PBO setup.” Now just waiting for an entry signal. If you need coaching on setting up your trade plan Click Here

►Train Your Eyes

LLNW • Trend • Bullish Harami •T-Line Run• J-Hook Breakout • PBO • Flag

Good Trading – Hit and Run Candlesticks

► Ticker Update (PYPL)

You could have profited more than 19% or about $1133.00, with 100 shares when we posted to our members on August 16. If you are interested in trades and profits, Rick Saddler founder of Hit and Run Candlesticks offers private recorded coaching • Coaching With Rick

► Eyes On The Market

Yesterday the SPY closed in a bearish Doji continuation pattern as I described in yesterday’s blog report. Price also closed below the upper T-Line band and the T-Line. The 3-Day chart has printed a Bearish Engulf and on the daily chart, price is below the VStop Dot. Looking at the VIX price has started to tren, the T-Line is above the 34-EMA and price challenged the 200-SMA yesterday. I’m not trying to paint a bleak bearish picture but trying to create caution.

Rick’s trade ideas for the day – MEMBERS ONLY

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

Maintain an Edge.

My knowledge of technical analysis and reading price action is what gives me an edge in the market. To make a living as a full-time trader, I have to recognize when I have an edge and when I don’t if I want to make consistent profits. We all know that individual earnings are unpredictable. When we get them in groups of 500, they can easily swing the entire market before the open or after it closes. That means to trade today I have to be willing to give up my edge, toss caution to the wind and embrace gambling. I choose to maintain an edge!

My knowledge of technical analysis and reading price action is what gives me an edge in the market. To make a living as a full-time trader, I have to recognize when I have an edge and when I don’t if I want to make consistent profits. We all know that individual earnings are unpredictable. When we get them in groups of 500, they can easily swing the entire market before the open or after it closes. That means to trade today I have to be willing to give up my edge, toss caution to the wind and embrace gambling. I choose to maintain an edge!

I’m very light in my accounts and don’t expect to add new risk today. With so many unpredictable earnings reports I have to forfeit my technical analysis edge to trade today. Gambling has never been a winning strategy for me. When my edge is gone, I prefer to stand on the sideline watching the battle and protecting my capital. Buckle up friends; it could be a bumpy ride!

On the Calendar

One hour before the market opens the Economic Calendar get the day going with International Trade and the weekly Jobless Claims reports. International trade is expected to widen the deficit in September with a consensus reading of $63.9 vs. $63.3 billion. Also at 8:30 AM Eastern the weekly Jobless claims were expecting 235K only slightly higher than the 222K last week. At 10:00 AM Pending Home Sales number is expected to rise 0.4% after last months 2.6% drop due to hurricane impacts. There is a Fed Speaker at 10:30 AM as well as a few lessor reports and bond auctions.

Today is a huge day on the Earnings Calendar with more than 500 companies expected to fess up to last quarters results. There are a lot of potential market-moving reports today with the likes of GOOG, MSFT, INTC, WDC, WYNN, AAL, BMY, COP, MO just to name a few.

Action Plan

Yesterdays light sell-off is being met this morning with futures are currently pointing to a slight bounce back at the open. With so many companies reporting the bulls and bears will have a lot to fight about in the next 2 hours before the market opens. Anything is possible. Then after the market close will some really big hitters report, so no matter what happens during the day, it could all change in the after-hours session.

Trade Wisley,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/qCyjzwZfd3k”]Morning Market Prep Video[/button_2]

CSTN (Constellium NV), The CSTM Chart has consolidated for the past couple of months and is now Bullish above $11.45. Last week CSTM broke out and closed above a double top after finding support from the 34-EMA and 50-SMA. On a 2-Day chart of CSTM, you can see the Ascending Triangle and the Bullish Engulf.

CSTN (Constellium NV), The CSTM Chart has consolidated for the past couple of months and is now Bullish above $11.45. Last week CSTM broke out and closed above a double top after finding support from the 34-EMA and 50-SMA. On a 2-Day chart of CSTM, you can see the Ascending Triangle and the Bullish Engulf.