Uncomfortable About Chasing A Trade

Honestly, folks, I feel so uncomfortable about chasing a trade today that I am not posting any. The market is in an angry phase that shreds accounts. If we see a trade during the day, we will post it in the trading room and on our Smart Phone App. Trading because of an addiction or desperation is not smart trading.

We will any discuss charts you may have in the trade in detail during our Members Morning Prep starting at 8:45 AM Est. With Steve Risner and Rick Saddler at 9:10 am this morning. members morning briefing

Recently closed

VXX 6% • CAT 39% • TWTR 50% • FEYE 28% • OCN 39% • TWTR 54% • QQQ 28% • QQQ 179% • TWTR 180% • VXX 375% VIPS 118% • WTW 21.9% •

[button_1 text=”Turn%205K%20into%2010K%20%E2%80%A2%20Bull%20Crap%20or%20Not” text_size=”30″ text_color=”#ffffff” text_bold=”Y” text_letter_spacing=”0″ subtext_panel=”Y” subtext=”Click%20This%20Button%20To%20Learn%20More” subtext_size=”14″ subtext_color=”#ffffff” subtext_letter_spacing=”0″ text_shadow_panel=”N” styling_width=”40″ styling_height=”30″ styling_border_color=”#000000″ styling_border_size=”1″ styling_border_radius=”6″ styling_border_opacity=”100″ styling_gradient_start_color=”#000000″ styling_gradient_end_color=”#000000″ drop_shadow_panel=”N” inset_shadow_panel=”N” align=”center” href=”https://ob124-5a86cf.pages.infusionsoft.net/” new_window=”Y”/]

Event Calendar

SPY • Relief Rally

Friday the SPY fell again and landed on the daily 200-SMA, also very near price support. Pre-market numbers suggest a relief rally bounce just as we talked about Friday. A common relief rally to about $263.35 would be normal, maybe even between $263.35 and $265.90. The SPY felt pain and damage last week, and if today’s bounce is the start of a bottom, we will need to see a constructed reversal pattern. If the Bulls are not ready for a repair job, we could slide into the February low area.

The VXX short-term futures

THE VXX chart demonstrated it’s fear last week by breaking out and holding into Friday’s close. The pullback I see premarket is still above the downtrend line. Fear and volatility are in the house.

Rick’s Swing Trade Ideas Reserved for Subscribing Members

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Focus Trading Education

Candlesticks • Price Action • T-Line • T-Line Bands • Support • Resistance • Trend • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Profit Zones • Entry Zones • Protective Stops • RBB Rounded Bottom Breakout Strategy • Pop Out of The Box Strategy • Pinball Strategy • Trade Planning, Fibonacci, Stoch/RSI

To learn more about our trading tools join us in the trading room or consider Private Coaching.

Investing and Trading involve significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

Trade The Direction Of The Market

One of our subscribers said in the trading room yesterday “So nice to be trading in the direction the market is moving; There was a time I would hold on to a position for months or years.”

The SPY has lost over 5% in the past nine trading days, failing the 50 Day-SMA and now testing the Dotted Duece FWL200. The SPY is very oversold now, so a bounce is near but I doubt it will help much. I believe the 200 day-SMA will be eventually be tested after some sort of relief rally. I have no doubt the market will turn around but only after a complete reversal pattern has been constructed. There were two traders and a pot of gold, one trader was patient and one not so much. Who do you think won the pot of gold?

Road Trip with A Trend

My Promise To You…. is to teach what works from having 30 years of trading teaching and coaching experience. And, to share with you the knowledge and tools you need to trade continuation patterns with ease and resulting profits!

[button_1 text=”Rpoad%20Trip%20With%20Continuation%20Patterns” text_size=”32″ text_color=”#000000″ text_bold=”Y” text_letter_spacing=”0″ subtext_panel=”Y” subtext=”Knowledge%20Wins%20-%20Click%20Here” subtext_size=”15″ subtext_color=”#ffffff” subtext_bold=”Y” subtext_letter_spacing=”0″ text_shadow_panel=”N” styling_width=”40″ styling_height=”30″ styling_border_color=”#000000″ styling_border_size=”1″ styling_border_radius=”6″ styling_border_opacity=”100″ styling_gradient_start_color=”#2285dd” styling_gradient_end_color=”#2285dd” drop_shadow_panel=”N” inset_shadow_panel=”N” align=”center” href=”https://ob124-5a86cf.pages.infusionsoft.net/” new_window=”Y”/]

The 15% Bonus Discount Will End Soon

Fact! All profitable swing trades come from some continuation pattern.

Benefits of Using Continuation Patterns

- Number 1 reason… easy to profit from the patterns

- Easy to train your eyes for spotting the patterns

- Easy to scan for the patterns

- Easy to enter the pattern

- Easy to set protective stops

- Easy to trade the pattern

- Trade time ranges from overnight to about 20 days

Investing and Trading involve significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

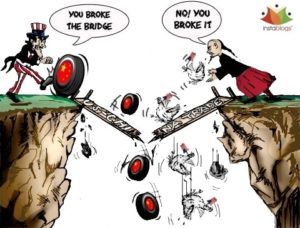

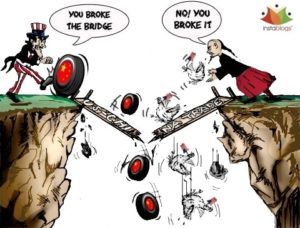

Trade war gloom.

As gloomy as the charts may seem just keep in mind that one day the selling will stop and there will be great companies at offered up for a nice discount. Let’s also keep in mind that the economy is still showing tremendous strength; labor demand, manufacturing growth, and consumer confidence are near record levels. The selling right now is politically motivated and will eventually pass because there is one thing for certain. Politicians always want to be reelected, and a compromise will eventually happen so they can ride in on their white horses to save the day.

As gloomy as the charts may seem just keep in mind that one day the selling will stop and there will be great companies at offered up for a nice discount. Let’s also keep in mind that the economy is still showing tremendous strength; labor demand, manufacturing growth, and consumer confidence are near record levels. The selling right now is politically motivated and will eventually pass because there is one thing for certain. Politicians always want to be reelected, and a compromise will eventually happen so they can ride in on their white horses to save the day.

On the Calendar

We wrap up this week’s Economic Calendar with two important reports. At 8:30 AM Eastern is the Durable Goods report which according to forecasters will bounce back 1.7% in February. Capital goods should rise about 0.7% and remove ex-transportation is expected to show a solid gain of 0.6%. New Home Sales numbers at 10:00 AM is expected to come in with a strong 620,000 annualized vs. January’s reading of 593,000. We have Fed Speakers at 10:30 AM and 11:30 followed by the Oil Rig count at 1:00 PM to finish off the calendar week.

On the Earnings Calendar, there are only 24 companies expected to report, and I don’t see any that would be particularly market moving.

Action Plan

The bears hit the ground running yesterday with about a 200 point gap down at the open as a head start. After fall 500 points there was a brief rally, but tough tariff talk brought the bears back in force closing the day down 724 point in the Dow. With yesterdays selloff all four of the major averages are now below their 50-day moving averages. Future markets this morning are only adding to the pain currently pointing to 100 point gap down, but that is an improvement from the overnight lows if you’re looking for a little silver lining. The SPY only has about 57 points to reach the 200-day average while the Dow would need to drop another 600. I know no one wants to see that happen but it sure looks like that’s a good possibility.

If your short, congratulations, its time to watch for clues of a relief rally to take some profits. Those standing aside stay focused on price action, manage your watchlists and prepare. The selling will eventually end there will be nice discounts prices on good stocks when it does.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/sWoIspUpvmw”]Morning Market Prep Video[/button_2]

Stop Digging

I have the privilege of working with a lot of traders from all over the world. A common theme I’ve heard over the last couple months is that many are seeing their accounts chopped to pieces. I hear things like; Everything that was working last year is now delivering a lot of losses. What they have failed to recognize is that the market has changed and they have not adapted to the change. There is an old saying, “if you find yourself in a hole, Stop Digging.” The market has changed and has become very challenging even for very experienced traders.

I have the privilege of working with a lot of traders from all over the world. A common theme I’ve heard over the last couple months is that many are seeing their accounts chopped to pieces. I hear things like; Everything that was working last year is now delivering a lot of losses. What they have failed to recognize is that the market has changed and they have not adapted to the change. There is an old saying, “if you find yourself in a hole, Stop Digging.” The market has changed and has become very challenging even for very experienced traders.

If you find that the market is handing you one loss after another, then it’s time to stop digging and reevaluate. If you have no “edge,” then your likely only providing liquidity to those that have adapted. Stop, reevaluate, wait for your edge to return or adapt your trading to the current market conditions. The only alternative is to watch your capital disappear along with your dreams of financial independence.

On the Calendar

The Thursday Economic Calendar is a full-one, but there are only two potential market-moving reports today. First is the 8:30 AM Jobless Claims that consensus expects to decline 1000 to 225,000 as labor demand continues to be steady and strong. Secondly, we have the PMI Composite at 9:45 AM which consensus suggests will remain strong at 55.2 with PM Manufacturing at 55.7 and PMI services at 55.7. Reports today that are not expected to move the market, FHFA Housing Price Index, Consumer Comfort index, Leading Indicators, Natural Gas report, Kansas City Manufacturing Index, Fed Balance Sheet, Money Supply, and 8-bond related events.

The Earnings Calendar shows 84 companies are expected to report earnings today.

Action Plan

When I ran out early yesterday for an eye doctor appointment, the price action was still whippy but leaning slightly toward some hopeful bullishness. Sadly the bulls were unable to hold on to that bullish sentiment with only the IWM managing to close the day positive. It would seem jitters over additional tariffs, and the potential of a trade war with China is to blame. Yesterday I mentioned that the indexes were sitting at the edge of a very big cliff and it wouldn’t take much to push them over the edge. With the Dow futures pointing to more than a 150 point gap lower this morning, it would appear tariff fears could give us that push.

Remember big morning gaps can often create whipsaws and very fast price action. Be careful not to chase the gap. The next visible price support lower on the Dow is still several hundred points away. If the bulls don’t fight back hard, we could experience another significant selloff today. Protect your capital.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/R_Ya7RNxy9Q”]Morning Market Prep Video[/button_2]

TDOC • Daily Chart • Bullish J-Hook

TDOC and the Daily chart is forming a Bullish J-Hook continuation pattern with a 2-day chart Bullish Morning Star. Lets back up, and look at the weekly chart. The past seven months the chart has floated sideways (consolidation) and formed a Bullish Morning Star with a mini Inverse Head and Shoulder off the (50-SMA weekly) back to the daily chart- Price broke out and tested, rallied to now form a Bullish J-Hook.

We will discuss the trade in detail in our Members Morning Prep starting at 8:45 AM Est. With Steve Risner and Rick Saddler at 9:10 am this morning. members morning briefing

Recently closed

VXX 6% • CAT 39% • TWTR 50% • FEYE 28% • OCN 39% • TWTR 54% • QQQ 28% • QQQ 179% • TWTR 180% • VXX 375% VIPS 118% • WTW 21.9% •

For more benefits Click Here

Event Calendar

SPY and Price Action

Mr. Powell has spoken, and the SPY closed above the most recent low ($268.62) yesterday. We wake up to see lower premarket trying to test the resent low ($268.62). The decision Bulls need to make today will be to let go and allow the bears to take us to $264.80 or fight for the 50-SMA.

The VXX short-term futures

Keep an eye on the VXX; it can give clues to the amount of fear or lack of fear in the market. The VXX chart closed yesterday with minimal fear, but the pattern is dangerously poised like a snake waiting to strike.

Rick’s Swing Trade Ideas Reserved for Subscribing Members

Focus Trading Education

Candlesticks • Price Action • T-Line • T-Line Bands • Support • Resistance • Trend • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Profit Zones • Entry Zones • Protective Stops • RBB Rounded Bottom Breakout Strategy • Pop Out of The Box Strategy • Pinball Strategy • Trade Planning, Fibonacci, Stoch/RSI

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

To learn more about our trading tools join us in the trading room or consider Private Coaching.

Investing and Trading involve significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

Doji Sammich In A Rounded Bottom Breakout

WIN has presented us with a Doji Sammich in a Rounded Bottom Breakout Pattern. The T-Line and the 20-SMA have also started to rise. Recently WIN has been in a downtrend and back in February WIN planted its feet with a double bottom. We are looking for an about 20% trade with the normal bumps and hurdles.

The big game changer FOMC today. Let’s trade wise and profitable while preserving our capital.

We will discuss the trade in detail in our Members Morning Prep starting at 9:10 EST this morning. members morning briefing

Recently closed

VXX 6% • CAT 39% • TWTR 50% • FEYE 28% • OCN 39% • TWTR 54% • QQQ 28% • QQQ 179% • TWTR 180% • VXX 375% VIPS 118% • WTW 21.9% •

[button_5 bg=”red” text_color=”dark” text=”reserve-your-spot.png” align=”center” href=”https://ob124-5a86cf.pages.infusionsoft.net/” new_window=”Y”/]

SPY and Price Action

Yesterday was a Doji close above the previous days low of $268.62 and the higher high / higher low chart pattern is still working. Today is all about the FOMC and how the market reacts. Below $264.50 would likely create a bigger bear, above $273.50 the bull has a chance to do its job. Stay back from the edge.

Candlesticks • Price Action • T-Line • T-Line Bands • Support • Resistance • Trend • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Profit Zones • Entry Zones • Protective Stops • RBB Rounded Bottom Breakout Strategy • Pop Out of The Box Strategy • Pinball Strategy • Trade Planning

The VXX short-term futures

Keep an eye on the VXX; it can give clues to the amount of fear in the market.

Rick’s Swing Trade Ideas Reserved for Subscribing Members

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

To learn more about our trading tools join us in the trading room or consider Private Coaching.

Investing and Trading involve significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

What if?

Waiting is never fun. It allows the mind to wander through all the “What If” scenarios and invites speculation of the unknown. The financial media will do it’s it part to whip up the emotion with dramatic headline graphics and bumper music that would make Hollywood jealous. What does all that drama and speculation accomplish? Nothing but make us emotional.

Waiting is never fun. It allows the mind to wander through all the “What If” scenarios and invites speculation of the unknown. The financial media will do it’s it part to whip up the emotion with dramatic headline graphics and bumper music that would make Hollywood jealous. What does all that drama and speculation accomplish? Nothing but make us emotional.

The “what if” game is endless and unproductive. We still have to wait for the FOMC decision, and no one knows what that will be until its released. Will they add additional interest rate increases to the forecast? We will find out at 2:00 PM Eastern and no amount of talking head conversations will change that.

What we can do as retail traders is prepare. If you’re very nervous about the announcement, then perhaps your over-trading and need to make some adjustments to your risk. If you’re new to trading or lack sufficient experience for such events perhaps standing aside is your the best course of action. Work to make good business decisions without bias or prediction and be prepared to react without emotion.

On the Calendar

A big day on the Economic Calendar on this hump day. We get started with important reports at 10:00 AM Eastern when Existing Home Sales which consensus expects a slight increase to 5.420 million annualized rate. At 10:30 AM the Petroleum Status Report which as recently shown a decline in supplies helping to bolster oil stocks ever so slightly. After that it’s all about the FOMC Announcement at 2:00 PM along with the FOMC Forecasts. Then at 2:30 PM the newly seated Chairman Powell will have the entire world focused on every word he utters during the Press Conference.

On the Earnings Calendar, there are 56 companies expected to fess up on their quarterly results.

Action Plan

Today the entire financial world will be focused on the FOMC and what our new Fed Chairman will have to say at the press conference. Based on his introduction speech where Chairman Powell seemed to lean hawkish has the market speculating more interest rate increases in the FOMC forecast. Interest-sensitive securities have experienced some selling this week in anticipation of this report. It’s understandable that the market is pensive as we wait for their decision but all the speculation is, and drama is a waste of time. As retail traders, all we can do is wait for the decision and react once the decision is known.

I’m expecting choppy price action ahead of the 2:00 PM announcement. However, after the release of the statement and forecast, we can expect very wild price action as the market reacts. Today is likely too much more volatile than we have recently experienced. Currently, the futures are pointing to a mixed open. The spooky thing is that the DIA and the SPY are sitting right on the edge of a very steep cliff. Any miss step or poorly chosen word could easily push them over the edge. Let’s hope that’s not the case and instead that Chairman Powell offers a steady hand that prevents a fall.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/BBSoIMcuuo0″]Morning Market Prep Video[/button_2]