Gap Spinning Top Doji

Yesterday we saw the SPY gap down and closed with a Spinning Top Doji. I don’t subscribe to the idea of a Doji being a buy signal as many do, I do believe the Doji represents indecision, a time for rest, re-think direction. $270.60 is about 50% of the recent low and recent high making it an important horizontal line to have on a chart. Sellers are still in control and can be easily seen by adding a downtrend line to the tops of price action. It has been my experience more money can be made by trading with the trend, not against the trend and to have patience when you think the trend is turning.

Thanksgiving Week Trade Ideas

Thanksgiving Week Trade Ideas

With this being a holiday week low market volume, Thursday market closed and Friday a half day I have decided to suspend any new trade ideas until Monday. We will post trade ideas as they appear on LTA-Live Trading Alerts Real Time Market Scanner in the trading room.

_______________________________________________________

Trading Services We Offer

- Hit and Run Candlesticks

- Right Way Options

- Top Gun Day Trading

- 30-Day Trial

321% This Year

The two most important pieces of software Rick uses is LTA – Live Trading Alerts Get your 30-Day Trial, and TC2000 Charting Receive $25.00 Off

Rick has dialed them in for max performance, and he freely shares his insights on what makes the tools the best and how to use them. Rick is also one of the only traders in the industry that shares his trading account. Traspaerancey and Trading Results.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

YouTube Videos

Trading at the Beach • How to set up the T-Line Regression Lines • MetaStock Automated • Trading the T-Line Trap • Shorting the Blue Ice Pattern

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from us should be considered as financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates or representatives is intended for educational purposes only. You are advised to test any new approach before implementing it. Past performance does not guarantee future results. Terms of Service

QQQ

Yesterday as I evaluated the index charts I mentioned my biggest concern was the vulnerability of the QQQ chart and its ability to drag the market lower. Unfortunately, with the WSJ reporting fresh concerns about FB leadership and AAPL cutting production of its new iPhone’s, the QQQ’s broke support as the tech index tumbled 3.25%.

Yesterday as I evaluated the index charts I mentioned my biggest concern was the vulnerability of the QQQ chart and its ability to drag the market lower. Unfortunately, with the WSJ reporting fresh concerns about FB leadership and AAPL cutting production of its new iPhone’s, the QQQ’s broke support as the tech index tumbled 3.25%.

Asian markets follow the US lower overnight, and European markets are lower across the board this morning. As a result, US Futures indicate a substantial gap down with the QQQ set to test Octobers low at the open. As the holiday approaches volumes are very likely to decline after Wednesday’s open so plan your risk carefully and remember cash is a position!

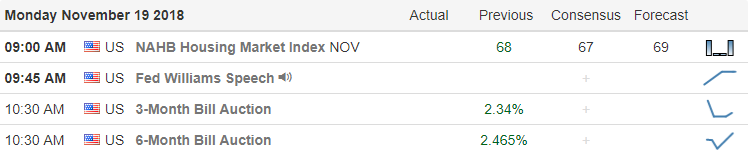

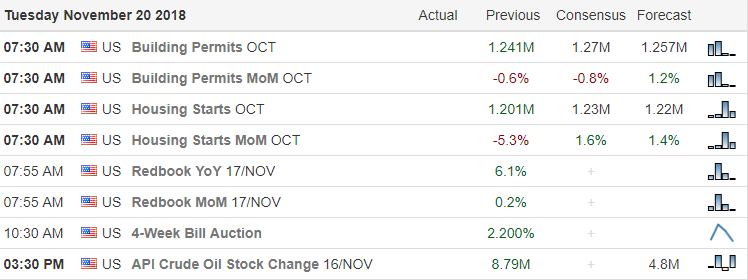

On the Calendar

On the Earnings Calendar, we nearly 60 companies reporting earnings today. Notables include A, ADI, BBY, BECN, CPB, HRL, INTU, JEC, KSS, LB, LOW, MDT, NUAN, PSTG, ROST, SFL, TGT, TJX, URBN.

Action Plan

My concern about the QQQ chart became a reality yesterday with new that AAPL has slashed production of its new iPhone’s and more concerns about FB leadership surfaced. The NASDAQ broke support sliding 3.25% dragging the rest of the market lower as it declined. Now a test of the October low and possibly lower seems inevitable for the QQQ. Currently, the US Futures indicate sharp declines at the open as the technical damage in the charts continues to grow.

Historically the influence of Santa should begin, but those eight little reindeer have to battle a tremendous headwind this year. Asian markets were sharply lower overnight, and currently European are down across the board. As bearish as all that sounds be careful not to chase short positions near support with a gap down open. Wait to make sure there are follow-through sellers supporting the gap. At this time the VIX is indicating fear, but if the market breaks to new lows, we will have to watch for signs of panic selling. Keep in mind volume will likely decrease substantially on Wednesday so plan your risk carefully as we head into the holiday.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/LESUEzKiE0I”]Morning Market Prep Video[/button_2]

November 15 Lows Hold For Now?

The SPY slide yesterday but held above the November 15 lows for now. I am not boosting that is fantastic or anything just simply an observation. The bulls are getting their butts kicked as they try to fight back. Until we have a winner, this will be a troubled market to trade. I have fewer positions on and less invested in lowering my risk exposure. The SPY weekly chart is hanging from the 50-SMA, and that is never good. If the bulls can’t find a way to get back above the 50-SMA price action will need to find friendly support and the $246.00 area could be the story.

The first step for the bulls is to find a reason to find support above $270.50, then $275.90 and lastly (for now) $281.15. Below $270.50 the sellers will work for $265.30 and $260.00

Thanksgiving Week Trade Ideas

With this being a holiday week low market volume, Thursday market closed and Friday a half day I have decided to suspend any new trade ideas until Monday. We will post trade ideas as they appear on LTA-Live Trading Alerts Real Time Market Scanner in the trading room.

_______________________________________________________

Trading Room Services

- Hit and Run Candlesticks

- Right Way Options

- Top Gun Day Trading

- 30-Day Trial

321% This Year

The two most important pieces of software Rick uses is LTA – Live Trading Alerts Get your 30-Day Trial, and TC2000 Charting Receive $25.00 Off

Rick has dialed them in for max performance, and he freely shares his insights on what makes the tools the best and how to use them. Rick is also one of the only traders in the industry that shares his trading account. Traspaerancey and Trading Results.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

YouTube Videos

Trading at the Beach • How to set up the T-Line Regression Lines • MetaStock Automated • Trading the T-Line Trap • Shorting the Blue Ice Pattern

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from us should be considered as financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates or representatives is intended for educational purposes only. You are advised to test any new approach before implementing it. Past performance does not guarantee future results. Terms of Service

Happy Thanksgiving Week

Happy Thanks Giving Week. This week will be a challenge for sure with Tuesday getting ready for Thanksgiving, Wednesday Thanksgiving Day, Thursday the day after Thanksgiving. Friday is Black Friday, and the market is open ½ day, then teres Cyber Monday. The volume in the markets will likely dry up to near dust. In the trading room today we will look at my dark chart with no candles or price action, moving averages only. You will see the trouble the bulls are fighting. The 34-EMA is barely hovering over the 200-SMA, and the 50-SMA started to turn down in early October. Under $275.85 the bulls are sitting ducks and could be forced to test the November possible the October lows. 7:30 am SPY futures down 10.00 and DIA down 85.00

FEYE On The Watchlist

FEYE is on the watchlist because of the trend, and the possible follow through freon the current chart pattern. Bullish trend. Volume break on October 31, and now price is having around supporting about $17.90. Thursday and Friday showed buyer interest near the Volatility Stop. Over $18.80 probable test of $19.50. Over $19.50 probable teat of near the recent high, so on and so on.

Add FEYE to your LTA-Live Trading Alerts Real Time Market Scanner watchlist and be alerted for a bullish entry/trade. Members trade ideas will be on the member’s blog.

Trading Services We Offer

- Hit and Run Candlesticks

- Right Way Options

- Top Gun Day Trading

- 30-Day Trial

321% This Year

The two most important pieces of software Rick uses is LTA – Live Trading Alerts Get your 30-Day Trail and TC2000 Charting Recieve $25.00 Off

Rick has dialed them in for max performance, and he freely shares his insights on what makes the tools the best and how to use them. Rick is also one of the only traders in the industry that shares his trading account. Traspaerancey and Trading Results.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

YouTube Videos

Trading at the Beach • How to set up the T-Line Regression Lines • MetaStock Automated • Trading the T-Line Trap • Shorting the Blue Ice Pattern

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from us should be considered as financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates or representatives is intended for educational purposes only. You are advised to test any new approach before implementing it. Past performance does not guarantee future results. Terms of Service

Choppy Holiday Price Action

Thanksgiving vacations, Black Friday and Cyber Monday typically set the stage for choppy holiday price action. There are a lot of good-looking charts showing up after the rally relief last Thursday and Friday, but as the holiday nears they may find it difficult to find the energy follow-through. Of course, news such as a China trade deal would be a game changer but short of something like that this could be a challenging week.

Thanksgiving vacations, Black Friday and Cyber Monday typically set the stage for choppy holiday price action. There are a lot of good-looking charts showing up after the rally relief last Thursday and Friday, but as the holiday nears they may find it difficult to find the energy follow-through. Of course, news such as a China trade deal would be a game changer but short of something like that this could be a challenging week.

You may have to very flexible and nimble willing to taking profits and cutting losers quickly. After the morning rush on Wednesday expect volume to drop like a rock unless driven by a surprise new event. Expect choppy price action on the half day of Black Friday trading and the Cyber Monday holiday sales events. If you’re heading out early for your holiday plans, I want to wish you safe travel and a very Happy Thanksgiving!

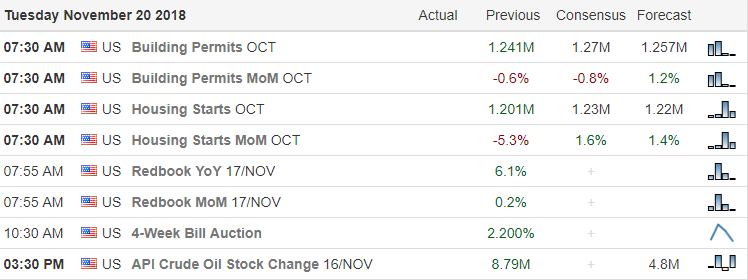

On the Calendar

There are 66 companies reporting earnings today. Notables today are AABA and JD which both report before the bell this morning.

Action Plan

Major holidays weeks typically see a significant decline in volume adding an additional challenge to our trading. We may find plenty of good long and short entry signals, but they may lack the energy to follow-through and profit. Thursday the market is closed, and Friday it’s only open half a day. In the past, both Black Friday and Cyber Monday are also light volume days with everyone focuses on the holiday shopping deals and travel.

Futures are suggesting a slightly bearish open with the Dow currently indicated to gap down about 75 points. Asian and European markets were bullish overnight. Because of the risks of holding over a holiday weekend, if I do trade, I will plan to take profits quickly and cut losers without mercy. I intend to be light in my portfolio on swing trades by Wednesday and will most likely stay that way until next week. If the holiday sales events go well then perhaps Santa can begin working his magic by next week. If sales disappoint, then watch the emergence of the Grinch.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/FvpgiSvf5gk”]Morning Market Prep Video[/button_2]

Nice bounce, but?

I don’t know about you, but I certainly wanted to see a little bullish follow-through after yesterdays nice bounce. Unfortunately, the current futures market is proving once again that what I want has nothing to do with what the market does! Sadly a lesson that took me a long time to learn.

I don’t know about you, but I certainly wanted to see a little bullish follow-through after yesterdays nice bounce. Unfortunately, the current futures market is proving once again that what I want has nothing to do with what the market does! Sadly a lesson that took me a long time to learn.

With volatility so high anything is possible. If the market provides us with a quick profit, we should consider taking some or all of it off the table during turbulent market conditions. It may not be what you were planning for hoping for but it far better to take small gains consistently than letting those gains diminish or disappear overnight. As we head into the weekend, consider your risk carefully and remember that Thanksgiving is just around the corner which means volume will likely decline sharply heading into the holiday.

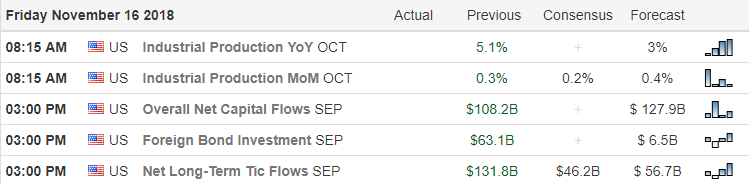

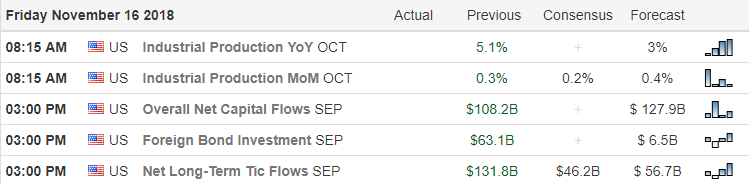

On the Calendar

On the Earnings Calendar, there are only 16 companies reporting as the 4th quarter season winds down.

Action Plan

After the nice bounce yesterday, I’m guessing that everyone was hoping for a follow-through push higher this morning. I know that’s what I wanted to see! However, what we want has nothing to do with what the market gives us. The unfortunate truth is that currently, the Dow Futures look to take back some of the reality with a gap down of more than 100 points. Disappointing yes, but not all that surprising given the recent market volatility.

As we head into the weekend, consider your risk carefully with high market volatility in mind. If you have current profits, it may be wise to take some if not all the gains and tuck that safely away in your account over the weekend. As 4th quarter earnings wind down, expect the market to become even more sensitive to any reports China trade and the likelihood of an agreement. Also, as Thanksgiving approaches, keep mind that volume can quickly dry up as traders take time off for the holiday, adding to the already challenging price action. Have a great weekend everyone!

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/D1NmsubofDc”]Morning Market Prep Video[/button_2]

Thanksgiving Week Trade Ideas

Thanksgiving Week Trade Ideas

Yesterday as I evaluated the index charts I mentioned my biggest concern was the vulnerability of the QQQ chart and its ability to drag the market lower. Unfortunately, with the WSJ reporting fresh concerns about FB leadership and AAPL cutting production of its new iPhone’s, the QQQ’s broke support as the tech index tumbled 3.25%.

Yesterday as I evaluated the index charts I mentioned my biggest concern was the vulnerability of the QQQ chart and its ability to drag the market lower. Unfortunately, with the WSJ reporting fresh concerns about FB leadership and AAPL cutting production of its new iPhone’s, the QQQ’s broke support as the tech index tumbled 3.25%.

Thanksgiving vacations, Black Friday and Cyber Monday typically set the stage for choppy holiday price action. There are a lot of good-looking charts showing up after the rally relief last Thursday and Friday, but as the holiday nears they may find it difficult to find the energy follow-through. Of course, news such as a China trade deal would be a game changer but short of something like that this could be a challenging week.

Thanksgiving vacations, Black Friday and Cyber Monday typically set the stage for choppy holiday price action. There are a lot of good-looking charts showing up after the rally relief last Thursday and Friday, but as the holiday nears they may find it difficult to find the energy follow-through. Of course, news such as a China trade deal would be a game changer but short of something like that this could be a challenging week.

I don’t know about you, but I certainly wanted to see a little bullish follow-through after yesterdays nice bounce. Unfortunately, the current futures market is proving once again that what I want has nothing to do with what the market does! Sadly a lesson that took me a long time to learn.

I don’t know about you, but I certainly wanted to see a little bullish follow-through after yesterdays nice bounce. Unfortunately, the current futures market is proving once again that what I want has nothing to do with what the market does! Sadly a lesson that took me a long time to learn.