Follow-Through?

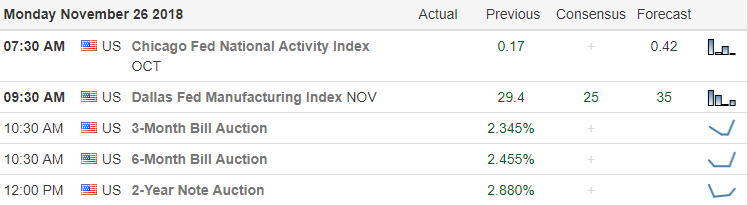

After the big gap and rally yesterday I was hoping for a little follow-through today, but a little profit taking would not be that unusual. So far this morning presidential trade war threats have trumped the record-breaking Cyber Monday sales event. (pun intended) As a result, AAPL is under a little pressure this morning as the hits keep on coming for the battered tech sector.

After the big gap and rally yesterday I was hoping for a little follow-through today, but a little profit taking would not be that unusual. So far this morning presidential trade war threats have trumped the record-breaking Cyber Monday sales event. (pun intended) As a result, AAPL is under a little pressure this morning as the hits keep on coming for the battered tech sector.

If the Bulls can defend yesterday’s low in the QQQ’s, then the strong holiday sales should extend the relief rally. However, if the Bears are allowed to breach yesterday’s index lows fear could easily win the day, and a retest of last Tuesdays low would not be out of the question. Volume should return of the next few days so be patient, disciplined and focused on price action. We all want to see the market recover but what we want is not important. See the chart for what it is not as we want it to be!

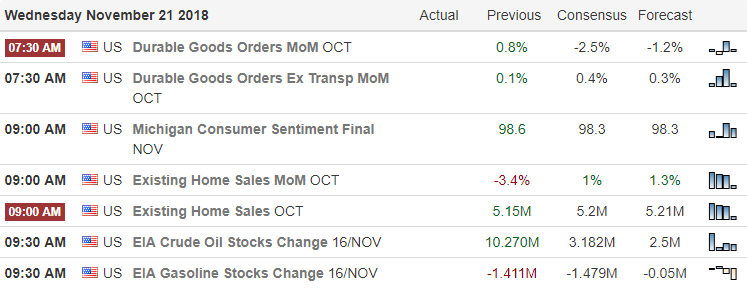

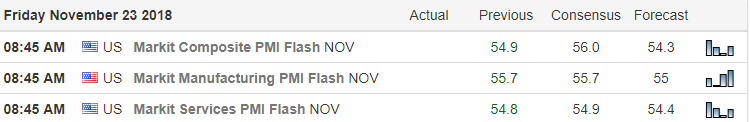

On the Calendar

On the Earnings Calendar, we have 33 companies reporting result today.

Action Plan

The online shoppers worked hard all day yesterday increasing yesterdays Cyber Monday sales by nearly 20% over last year and setting new records. Now that the Thanksgiving shopping events are over and vacations ending volume should begin to return over the next couple of days. Unfortunately, futures are pointing to modest gap down this morning with the president threatening tariffs on all imported iPhone’s from China. Consequently, AAPL is under a little pressure this morning putting even more pressure on the already vulnerable tech sector.

After such a big rally yesterday some profit taking would be normal but if the sellers breach yesterday’s low a retest of last Tuesday’s could be possible. However, if the bulls can defend yesterday’s low’s then a move higher to test resistance seems likely assuming trade war rhetoric doesn’t get in the way. Be patient, flexible and focused on price action without bias, remembering there is no need to rush to a trade. The volume will return, but I would not be at all surprised if it does so slowly over the next few days.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/MzLIP5wzzVc”]Morning Market Prep Video[/button_2]

SPY 2-Day Chart Printed Bullish Engulf

The good news: The SPY 2-day chart has printed a double bottom Bullish Engulf all on the 200-SMA. So is this the start of a bullish turnaround? The answer is in whether or not we have bullish follow through over the first hurdle $273.25. The bad news is the SPY like the other indices are in a painful downtrend with a ton of resistance above. Trade considerations and rate hikes continue to add bearish weight to this market. Smaller and fewer positions and quicker profits seem to be the key in this market.

TAL RBB Setup

TAL is an (RBB) Rounded Bottom Breakout Setup and finding support on one of our lower band lines. In the last few weeks price has rallied up and rested with a Flag formation. The rule of thumb is that on a breakout price should move to the next resistance level. The typical RBB trade target direction is the 200-SMA. Adding TAL as a trade candidate to add to our LTA-Live Trading Alerts Real Time Market Scanner watchlist for a buying alert. TAL bullish above $29.15, stop below $27.75

****VXX – Yesterday the VXX chart shows that a little fear was leaving the party. Be careful this party can start up again at any time.

321% This Year

Rick uses three main trading tools and has dialed them in for max performance. Rick also freely shares his insights on what makes the tools the best and how to use them. Rick is also one of the only traders in the industry that shares his trading account. Traspaerancey and Trading Results.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

YouTube Videos

Trading at the Beach • How to set up the T-Line Regression Lines • MetaStock Automated • Trading the T-Line Trap • Shorting the Blue Ice Pattern

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from us should be considered as financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates or representatives is intended for educational purposes only. You are advised to test any new approach before implementing it. Past performance does not guarantee future results. Terms of Service

Record-Breaking Holiday

It would seem the record-breaking holiday spending is bringing out a wave of bulls this morning squeezing the bears that held short positions over the weekend. The Dow is currently expected to gap up nearly 250 points. As nice as is to see some relief in the selling be careful not to get caught up in the morning hype chasing into the gap. First, consider that volume has the potential of being light today as many traders extend vacations and that the Cyber Monday sales event will attract a lot of attention away from the market.

It would seem the record-breaking holiday spending is bringing out a wave of bulls this morning squeezing the bears that held short positions over the weekend. The Dow is currently expected to gap up nearly 250 points. As nice as is to see some relief in the selling be careful not to get caught up in the morning hype chasing into the gap. First, consider that volume has the potential of being light today as many traders extend vacations and that the Cyber Monday sales event will attract a lot of attention away from the market.

Secondly, keep in mind that one day does not make a trend and that all the index charts have significant price resistance levels above. While it’s true, this could be the beginning of a Santa Claus rally it could also be nothing more than a pop and drop unless we see real buyers stepping in to support the gap after the open. If you happen to be in long positions, then remember that gaps are gifts, consider taking some profits. If, like me, your mostly flat this morning then we have already missed the move which means there is no need to rush. Maintain, your discipline, don’t chase and wait for the next entry that provides you an edge.

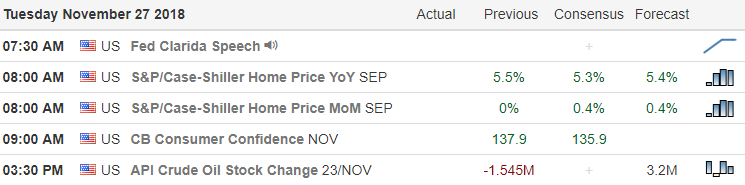

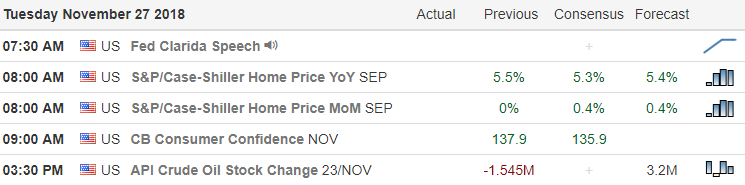

On the Calendar

We have 42 companies on the Earnings Calendar expected to report results this Cyber Monday to keep us on our toes.

Action Plan

The bulls seem very inspired today as holiday shopping blows past all previous records and its far from over. The estimates for today’s so-called Cyber Money sales event is expected break records as well with more than 7 billion in online sales with the vast majority coming from mobile devices. It would seem shopping from the phone has now become the preferred method of holiday shoppers.

As I write this the Dow futures are pointing to a gap up of more than 250 points. Anyone caught short will most certainly experience the pain of a short squeeze this morning. With the nasty winter storm that swept across the central US, travelers found themselves trapped at the airport as 1000’s of flights canceled. Combine extended vacations, travel issues and Cyber Monday I would be very careful about chasing into this mornings pop until we see buyers stepping up to support the gap. It’s entirely possible that volume could be light today after the morning rush so keep a very close eye and price action. As nice as it is to see a relief rally keep in mind the indexes have significant resistance levels above which means a pop and drop day is not out of the realm of possibility.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/bjSg4ZQo0wY”]Morning Market Prep Video[/button_2]

SP-500 Set To Open Higher

The SP-500 is set to open higher this morning and the DJ-30 set with a triple-digit open, but the big question is this the start of a bullish turnaround? To be a bullish turnaround, we would need to see a bullish bottom constructed and price above $271.90 on the SPY. On the other hand, a good bullish bounce would make for a great relief rally. Last week was another hard week for stocks, and the negative candles on the indices proved it. FANG stock remains weak as can be seen on the FNGU chart, price below the T-Line and the T-Line below the 34-EMA.

BECN RBB Setup

BECN is an (RBB) Rounded Bottom Breakout Setup, not that price has closed above the 50-SMA, and there is at least 10% between the 50-SMA and 200-SMA. The Bullish Engulf a few days ago was a bottom test followed by bullish follow through. With a swing target near the $42.50 area, BECN is a trade candidate to add to our LTA-Live Trading Alerts Real Time Market Scanner watchlist for a buying alert. BECN bullish above $31.75, stop below $29.90

****VXX – At the close Friday the VXX chart was on the bullish side suggesting fear, below $36.00 would suggest fear is under control while over $36.00 would suggest fear is once again fueled.

Trading Services We Offer

- Hit and Run Candlesticks

- Right Way Options

- Top Gun Day Trading

- 30-Day Trial

321% This Year

Rick uses three main trading tools and has dialed them in for max performance. Rick also freely shares his insights on what makes the tools the best and how to use them. Rick is also one of the only traders in the industry that shares his trading account. Traspaerancey and Trading Results.

- LTA – Live Trading Alerts Get your 30-Day Trail

- TC2000 Charting Get $25.00 Off

- TradeHawk Trading Platform

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

YouTube Videos

Trading at the Beach • How to set up the T-Line Regression Lines • MetaStock Automated • Trading the T-Line Trap • Shorting the Blue Ice Pattern

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from us should be considered as financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates or representatives is intended for educational purposes only. You are advised to test any new approach before implementing it. Past performance does not guarantee future results. Terms of Service

Black Friday

If the news reports are correct, holiday shopping in-store and online as consumers displayed their economic confidence and ravenous desire to grab a Black Friday bargain. Unfortunately, that has not translated into bullish price action the US Futures. Instead, the market is reacting bearishly this morning with news reports suggesting the US/China trade war could extend well past the end of this year.

If the news reports are correct, holiday shopping in-store and online as consumers displayed their economic confidence and ravenous desire to grab a Black Friday bargain. Unfortunately, that has not translated into bullish price action the US Futures. Instead, the market is reacting bearishly this morning with news reports suggesting the US/China trade war could extend well past the end of this year.

Currently, the Dow is pointing to a gap down of nearly 150 points testing Tuesdays low after the morning rush don’t be surprised to see very light and choppy price action as traders extend their holiday vacations and join the Black Friday shopping masses. My plan for the day is to monitor current positions only and avoid adding risk into the weekend.

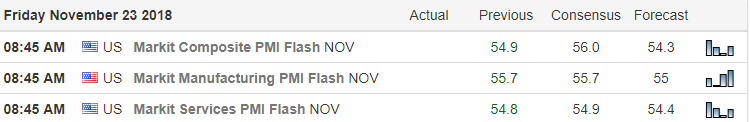

On the Calendar

We have only 9-companies reporting earnings on this partial day of trading. That number will jump up between the 40’s the and 50’s next week as some of the last 4th quarter reports continue to trickle in.

Action Plan

New concerns that the China trade war could extend through the 2020 presidential election has the US Futures turning south this morning. According to news reports Thanksgiving in-store and online sales may have hit new record highs yesterday as confident consumers shopped a good deal of the holiday. Best Buy has reported Thursday transactions numbers were higher than ever. With the Black Friday shoppers already filling the stores this morning it looks like Santa is doing his part at least in the retail space.

My plan today is to monitor current positions and avoid the temptation of adding new risk ahead the weekend. Volume will likely be extremely light and price action choppy which makes the risk greater than the potential reward in my opinion. As a result, I intend to extend my holiday as will most other traders. If you do decide to trade today, I would suggest keeping in it small and remember that Cyber Monday often is a very last luster day as well so plan your risk accordingly.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/B48HmICy1Pg”]Morning Market Prep Video[/button_2]

This is my old school planner. Feel free to use it and modify it but please understand I will not be providing support for the product. If you make modifications please share it with the group.

Trade Planner,Trade Log

Negative Territory

Another nasty day of selling in the tech sector, breaking below Octobers low, and lead the overall market into negative territory for the year. On the positive side the DIA, SPY, and IWM managed to hold at the support of Octobers low, but there is so much technical damage in the charts its difficult to call that victory. Both the QQQ and the SPY are at risk of joining the IWM with their 50-day averages crossing below the 200-day averages in the very near future. The so-called death cross.

Another nasty day of selling in the tech sector, breaking below Octobers low, and lead the overall market into negative territory for the year. On the positive side the DIA, SPY, and IWM managed to hold at the support of Octobers low, but there is so much technical damage in the charts its difficult to call that victory. Both the QQQ and the SPY are at risk of joining the IWM with their 50-day averages crossing below the 200-day averages in the very near future. The so-called death cross.

Yesterday before the market had even closed there were traders predicting this is the bottom. Really? Yes, this could be a bottom, and this morning we are getting a nice oversold bounce but consider the fact it may be just a resting point before resuming the downtrend. See the price action for what it is not for what you want it to be! Gamble and you may win, but you have an equal chance of just providing liquidity. Remember volume is likely to decline sharply after the morning rush so plans your risk into the holiday carefully! I wish you all the very best and Happy Thanksgiving.

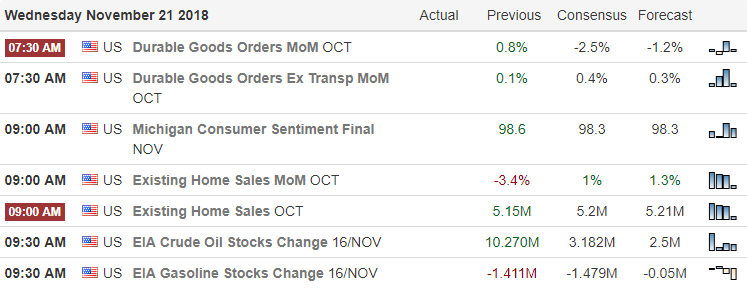

On the Calendar

On the Earnings Calendar, we have less than 40 companies reporting earnings as we head into the holiday. Notable reports today are ADSK, BILI, BJ, BZUN, CPRT, DE, FL, GPS, KEYS, SE.

Action Plan

After yesterdays nasty gap down and selloff, the indices are once again in negative territory for the year. Now the question is will the October lows hold as the price support for the DIA, SPY, and IWM? The QQQ’s yesterday broke support creating yet another layer of resistance as the tech sector continues to slide lower. This morning futures are suggesting a bounce this morning, and I’m already seeing traders trying to predict that this is the bottom.

After sliding 1000 points in just two days, it might be wise to consider that this mornings rally is merely a short-term oversold rally! Sure you could gamble and win but its still a straight up gamble nothing more! We have a very busy economic calendar this morning and some important earnings reports, but after the morning rush volume is likely to drop quickly as traders head out for their holiday plans. I want to wish every one of you a very Happy Thanksgiving!

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/QlWMHLIWkiY”]Morning Market Prep Video[/button_2]

After the big gap and rally yesterday I was hoping for a little follow-through today, but a little profit taking would not be that unusual. So far this morning presidential trade war threats have trumped the record-breaking Cyber Monday sales event. (pun intended) As a result, AAPL is under a little pressure this morning as the hits keep on coming for the battered tech sector.

After the big gap and rally yesterday I was hoping for a little follow-through today, but a little profit taking would not be that unusual. So far this morning presidential trade war threats have trumped the record-breaking Cyber Monday sales event. (pun intended) As a result, AAPL is under a little pressure this morning as the hits keep on coming for the battered tech sector.

It would seem the record-breaking holiday spending is bringing out a wave of bulls this morning squeezing the bears that held short positions over the weekend. The Dow is currently expected to gap up nearly 250 points. As nice as is to see some relief in the selling be careful not to get caught up in the morning hype chasing into the gap. First, consider that volume has the potential of being light today as many traders extend vacations and that the Cyber Monday sales event will attract a lot of attention away from the market.

It would seem the record-breaking holiday spending is bringing out a wave of bulls this morning squeezing the bears that held short positions over the weekend. The Dow is currently expected to gap up nearly 250 points. As nice as is to see some relief in the selling be careful not to get caught up in the morning hype chasing into the gap. First, consider that volume has the potential of being light today as many traders extend vacations and that the Cyber Monday sales event will attract a lot of attention away from the market.

If the news reports are correct, holiday shopping in-store and online as consumers displayed their economic confidence and ravenous desire to grab a Black Friday bargain. Unfortunately, that has not translated into bullish price action the US Futures. Instead, the market is reacting bearishly this morning with news reports suggesting the US/China trade war could extend well past the end of this year.

If the news reports are correct, holiday shopping in-store and online as consumers displayed their economic confidence and ravenous desire to grab a Black Friday bargain. Unfortunately, that has not translated into bullish price action the US Futures. Instead, the market is reacting bearishly this morning with news reports suggesting the US/China trade war could extend well past the end of this year.

Another nasty day of selling in the tech sector, breaking below Octobers low, and lead the overall market into negative territory for the year. On the positive side the DIA, SPY, and IWM managed to hold at the support of Octobers low, but there is so much technical damage in the charts its difficult to call that victory. Both the QQQ and the SPY are at risk of joining the IWM with their 50-day averages crossing below the 200-day averages in the very near future. The so-called death cross.

Another nasty day of selling in the tech sector, breaking below Octobers low, and lead the overall market into negative territory for the year. On the positive side the DIA, SPY, and IWM managed to hold at the support of Octobers low, but there is so much technical damage in the charts its difficult to call that victory. Both the QQQ and the SPY are at risk of joining the IWM with their 50-day averages crossing below the 200-day averages in the very near future. The so-called death cross.