Hanging Man Confirmed Tuesday

Tuesday we saw the SPY sell off confirming the Hanging Man Candle and another failed attempt for the bulls to control price action above both the 50 and 200-SMA’s. The futures this morning will be punishing most long positions held. Taking a look at the weekly SPY chart, I can see a tight nasty Blue Ice Failure set up, (keep in mind follow-through is required). 2016 was the last time price action of the SPY was near the 200-SMA on the weekly chart, and it’s starting to look like a future test is in the game.

(BAC) Weekly Blue Ice Bearish Engulf

The weekly chart is showing a Bearish Engulf and a Blue Ice short set up which could be pointing price to the 200-SMA or about $21.70. We are adding BAC to the LTA-Live Trading Alerts Real Time Market Scanner watchlist for management and buying alert. I will consider BAC Jan 18, 2019, $28.00 PUT.

Members, please log in to the member’s blog for more Trade-Ideas. Start here for membership or a trial

362% November Statement

Rick uses three main trading tools and has dialed them in for max performance. Rick also freely shares his insights on what makes the tools the best and how to use them. Rick is also one of the only traders in the industry that shares his trading account. Traspaerancey and Trading Results.

****VXX – Bullish Morning Star closed over both the 50 and 200-SMA

Hit and Run Candlesticks INC. Trading Services

- Hit and Run Candlesticks

- Road To Wealth Account $362% Positive

- Right Way Options

- Top Gun Day Trading

- 30-Day Trial

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

YouTube Videos

Trading at the Beach • How to set up the T-Line Regression Lines • MetaStock Automated • Trading the T-Line Trap • Shorting the Blue Ice Pattern

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from us should be considered as financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates or representatives is intended for educational purposes only. You are advised to test any new approach before implementing it. Past performance does not guarantee future results. Terms of Service

Grinch Who Stole Christmas

US/China trade war concerns, sharply falling oil prices and the arrest of a Chinese tech CEO may have combined as the Grinch Who Stole Christmas. Asian stocks declined sharply overnight, and European markets are currently sharply lower across the board this morning. As a result, the Dow Futures are pointing to 400 point gap down at the open. The market hates uncertainty, and until we get some resolution on some of this politically generated uncertainty, this roller-coaster ride of market volatility is likely to continue. It seems hard to believe that it was just Monday we were looking futures gaping up 450 points.

US/China trade war concerns, sharply falling oil prices and the arrest of a Chinese tech CEO may have combined as the Grinch Who Stole Christmas. Asian stocks declined sharply overnight, and European markets are currently sharply lower across the board this morning. As a result, the Dow Futures are pointing to 400 point gap down at the open. The market hates uncertainty, and until we get some resolution on some of this politically generated uncertainty, this roller-coaster ride of market volatility is likely to continue. It seems hard to believe that it was just Monday we were looking futures gaping up 450 points.

Remember when the market is thrashing around like this you are not required to trade! As a trading coach, I’ve talked with a lot of traders that wish they would have taken the month of November off because it would have saved them a bucket load of capital. Only trade when you have an edge. If you are consistently losing money stop trading! The market will eventually calm down, and your edge will return, but if you lose your capital to this very emotional market, you could be out of business before that happens. It’s not personal its business and you have to know when the risks are just too high. Stay calm, disciplined and focused on price action.

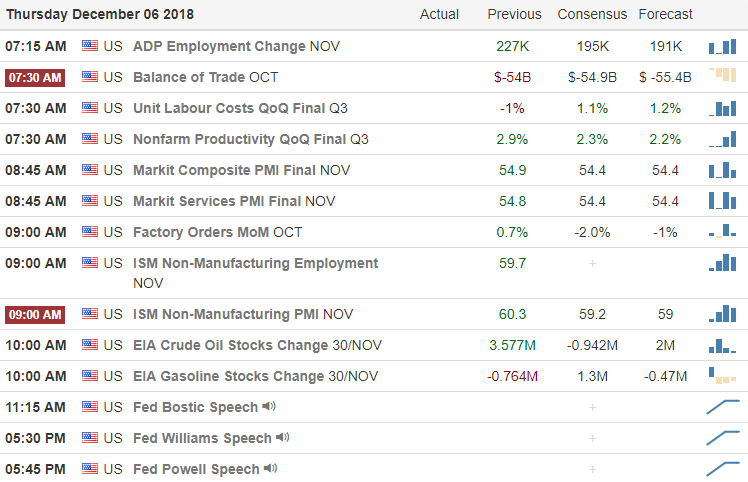

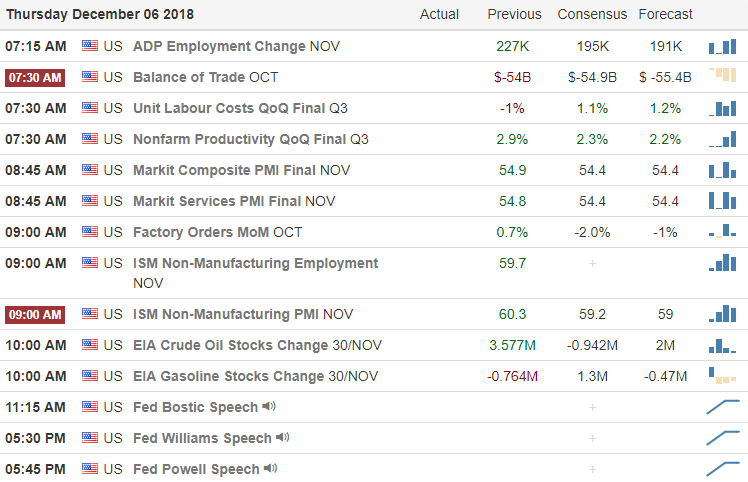

On the Calendar

On the Earnings Calendar, we have 57 companies reporting results today. Make sure to do your due diligence.

Action Plan

This morning we face a very ugly market open, and it looks as if the Grinch really has stolen Christmas this year. On Tuesday the 3-year bond yields rose the 5-year yield which is known as a yield curve inversion. Although the market reacted in a very negative way, typically a true yield curve inversion requires the 2-year bond yields to rise above 10-year which of course has not happened as of now. The US/China trade deal may have just become much more complicated as the CEO of a China tech company was arrested in Canada at the request of US. Also, this morning oil prices are sharply lower as OPEC production cutbacks were less than expected.

While it may seem like the sky is falling this morning, we must say calm, disciplined and focused on price action. We have a huge economic calendar today that could easily improve the or worsen the situation throughout the day. However, if we become compromised emotionally, then we risk missing out on the potential opportunities that could occur. Remember the high gap up on Monday found no buyers after the open. We must stay focused on price action waiting to see if the bears pile on after the open supporting the gap down or if the bulls step to defend price support and gobble up the bargain prices.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/cTeVAvgpNyw”]Morning Market Prep Video[/button_2]

Gap Fill?

Sadly yesterday’s hyped up big gap unfortunately and not that unsurprisingly found profit takers and raising the concern of an immediate gap fill. In Monday’s morning note and market prep video, I cautioned about the possibility of a pop and drop pattern. I received a lot of comments and emailed about making a great call, but please understand that was not a prediction. It was merely an observation after an unbiased study of the index charts.

Sadly yesterday’s hyped up big gap unfortunately and not that unsurprisingly found profit takers and raising the concern of an immediate gap fill. In Monday’s morning note and market prep video, I cautioned about the possibility of a pop and drop pattern. I received a lot of comments and emailed about making a great call, but please understand that was not a prediction. It was merely an observation after an unbiased study of the index charts.

Believe me; anyone can do what I do if you study the chart for what it is rather than what you want it to be. All you have to do is remove your bias, set aside your emotion and focus on the clues left in the price action of the chart. Today, with the market pointing a triple-digit gap we once again must be careful not to chase. Watch the price action a see if the bears pile on after the open supporting the bearish gap or if the bull set up to defend price support. Keep in mind; the market closes Wednesday for the national day of mourning and Friday night the government faces a shutdown. Plan your risk carefully as anything is possible with the market re-opens Thursday morning.

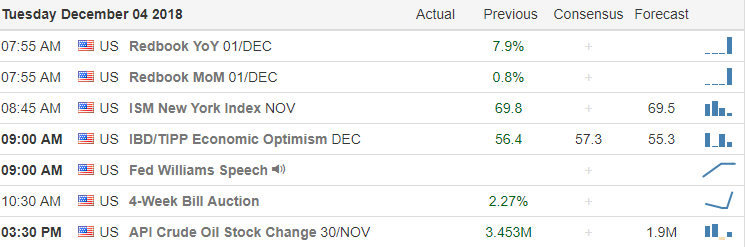

On the Calendar

On the Earnings Calendar, we have just over 30 companies reporting this morning, and there are 25 on the calendar reporting even with the closed on Wednesday.

Action Plan

Despite all the morning hype surrounding the trade negotiations and resulting in huge morning gap, the market found mostly sellers after the open. They are following through with that sentiment this morning with the futures pointing to 100 point gap down and opening the door for a possible fill of yesterday’s gap. With the market closed on Wednesday for a national day of mourning the possible government closure on Friday night, the market is understandably pensive.

The market is also beginning to worry about the possibility of a recession as it watches for the possibility of a yield curve inversion. Although I’m expecting the market remain quite volatile, I would not be at all surprised to see the price action become light and choppy today as we head into the Wednesday closure. With yet another triple point gap we must be careful not to chase and wait to see if sellers pile on in support of the bearish gap or if the bulls set up to defend support levels after the morning rush. Remember anything is possible Thursday morning when the market reopens so plan your risk carefully.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/HugXDWqJldE”]Morning Market Prep Video[/button_2]

The Bulls are Celebrating

This morning the bulls are celebrating as the G20 meeting produced an agreement to kick the 25% tariff increase 90 days down the road as the US and China try to work out a trade agreement. As a result of this extension Asian and European markets reacted with sharp gains and the US Futures are pointing to a 400 point gap up. It’s great to see such a big bullish reaction this morning, but let’s keep in mind that until we get a completed agreement, we can expect this wild market ride to continue!

As you plan your week keep in mind, the market will close on Wednesday to honor the life of George H. Bush. Also, keep in mind that, the Federal Government will shut down Friday night unless Congress reaches a budget agreement. If that not enough pressure the president is planning to end the NAFTA in an attempt to force the Congress to pass the new trade agreement. What could go wrong! I think it would be wise to prepare for very high volatility, big gaps, and possible overnight reversals in the days and week ahead.

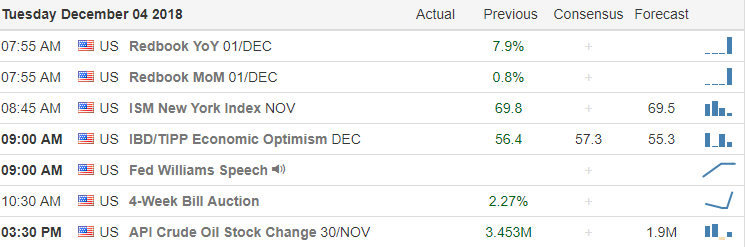

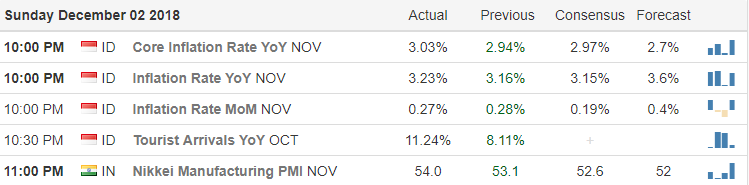

On the Calendar

On the Earnings Calendar, we have 31 companies expected to report today. Make sure your checking against current holdings and before entering new positions as part of your daily preparation.

Action Plan

About all, we can do this morning is hang on tightly and prepare for volatility with the futures indicating a huge gap up the open. The US and China have agreed to hold the more than 200 billion in tariffs at 10% for another 90 days. If they are unable to complete the agreement within the additional 90 days, the tariffs will ratchet up to 25%. I guess the good news here is that the countries are talking, but I must admit I have trouble understanding how kicking the decision down the road for 90 days equates to 400 points Dow rally this morning.

What this means to me is that we should expect the wild market ride to continue as the battle over the details in the coming months. Also, take note that this Friday, the Federal government could shut down unless a budget deal can be agreed upon by Congress. The major sticking point is the border wall. If that’s not enough turmoil, the president plans to exit the NAFTA agreement in a force Congress to pass the newly negotiated agreement! The President declared Wednesday a national day of mourning with the passing of former president George H. Bush which will also close the stock market for the day. Plan your week accordingly and don’t be surprised to if we experience some hyper-volatility and big overnight swings in the days ahead.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/UQ6ktAR6d0A”]Morning Market Prep Video[/button_2]

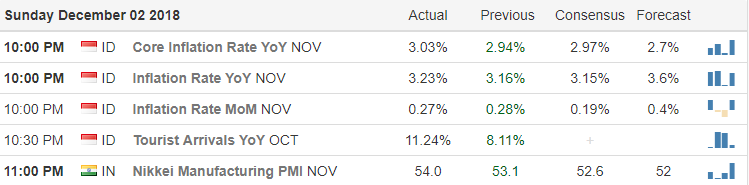

Risk of the G20

Unable to follow through on Wednesday’s momentum traders face some difficult decisions as we head into the weekend and the outcome risk of the G20 meeting. Will the US and China kiss and makeup or will the tensions between the only increase when the tow very stubborn leaders meet? Unfortunately, the answer to that question will happen over the weekend. Will you accept the additional risk of holding into the weekend or will you choose close positions to avoid the unknown?

Unable to follow through on Wednesday’s momentum traders face some difficult decisions as we head into the weekend and the outcome risk of the G20 meeting. Will the US and China kiss and makeup or will the tensions between the only increase when the tow very stubborn leaders meet? Unfortunately, the answer to that question will happen over the weekend. Will you accept the additional risk of holding into the weekend or will you choose close positions to avoid the unknown?

If you look at the index charts from a technical perspective, they are at a critical point of decision. Can they break through the downtrend resistance or will they fail, creating yet another higher low an increasing the technical damage. A tough call for sure and the fact that futures are pointing to a triple point gap down this morning does not make that decision any easier! No matter what you decide to go into the weekend with your eye’s wide open about the potential risks or rewards depending on the outcome of the G20 meeting.

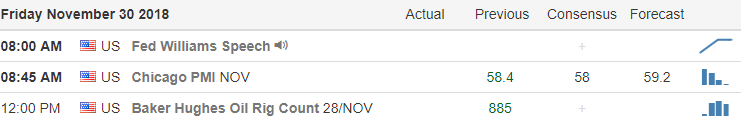

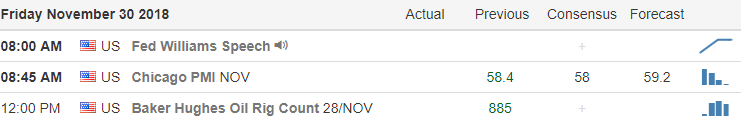

On the Calendar

On the Earnings Calendar, we have only 17 companies reporting as we slide into the weekend.

Action Plan

For a brief time yesterday, it looked as if the momentum of Wednesday would win the day but sadly heading into the close indexes slipped back into the red. Now the will market look to the G20 meeting for inspiration, but unfortunately, the outcome of that meeting will occur of the weekend. This morning futures are suggesting a triple point gap down amid swirling speculation of the possible outcome. The question for today is will we see follow-through selling after the open with traders avoiding the weekend risk or will volume simply dry up as we wait?

Technically speaking even after the big Wednesday rally the indexes are still in a downtrend. A failure at or near the downtrend could create more technical damage and raise concerns of yet another test of the lows. Keep an on the VIX for clues of fear creeping back in the mind of the market. Honestly, I hope cooler heads prevail, and we simply slide quietly into the weekend as we wait. However, putting our head in the sand an not preparing for all possibilities is irresponsible. Stay focused on the price action after the morning rush for clues and consider the risk carefully as we head into the weekend.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/Thk5-3hBvTw”]Morning Market Prep Video[/button_2]

US/China trade war concerns, sharply falling oil prices and the arrest of a Chinese tech CEO may have combined as the Grinch Who Stole Christmas. Asian stocks declined sharply overnight, and European markets are currently sharply lower across the board this morning. As a result, the Dow Futures are pointing to 400 point gap down at the open. The market hates uncertainty, and until we get some resolution on some of this politically generated uncertainty, this roller-coaster ride of market volatility is likely to continue. It seems hard to believe that it was just Monday we were looking futures gaping up 450 points.

US/China trade war concerns, sharply falling oil prices and the arrest of a Chinese tech CEO may have combined as the Grinch Who Stole Christmas. Asian stocks declined sharply overnight, and European markets are currently sharply lower across the board this morning. As a result, the Dow Futures are pointing to 400 point gap down at the open. The market hates uncertainty, and until we get some resolution on some of this politically generated uncertainty, this roller-coaster ride of market volatility is likely to continue. It seems hard to believe that it was just Monday we were looking futures gaping up 450 points.

Sadly yesterday’s hyped up big gap unfortunately and not that unsurprisingly found profit takers and raising the concern of an immediate gap fill. In Monday’s morning note and market prep video, I cautioned about the possibility of a pop and drop pattern. I received a lot of comments and emailed about making a great call, but please understand that was not a prediction. It was merely an observation after an unbiased study of the index charts.

Sadly yesterday’s hyped up big gap unfortunately and not that unsurprisingly found profit takers and raising the concern of an immediate gap fill. In Monday’s morning note and market prep video, I cautioned about the possibility of a pop and drop pattern. I received a lot of comments and emailed about making a great call, but please understand that was not a prediction. It was merely an observation after an unbiased study of the index charts.

Unable to follow through on Wednesday’s momentum traders face some difficult decisions as we head into the weekend and the outcome risk of the G20 meeting. Will the US and China kiss and makeup or will the tensions between the only increase when the tow very stubborn leaders meet? Unfortunately, the answer to that question will happen over the weekend. Will you accept the additional risk of holding into the weekend or will you choose close positions to avoid the unknown?

Unable to follow through on Wednesday’s momentum traders face some difficult decisions as we head into the weekend and the outcome risk of the G20 meeting. Will the US and China kiss and makeup or will the tensions between the only increase when the tow very stubborn leaders meet? Unfortunately, the answer to that question will happen over the weekend. Will you accept the additional risk of holding into the weekend or will you choose close positions to avoid the unknown?