Upset the Apple Cart?

Let’s all hope cooler heads prevail or the 4th of July shortened trading week could create some wild fireworks in price action volatility. Futures markets have currently recovered since the report and now suggest a relatively flat open. However, it would be wise to consider the risk of this coming weekend and carefully plan how you can protect your capital given the price volatility that may result.

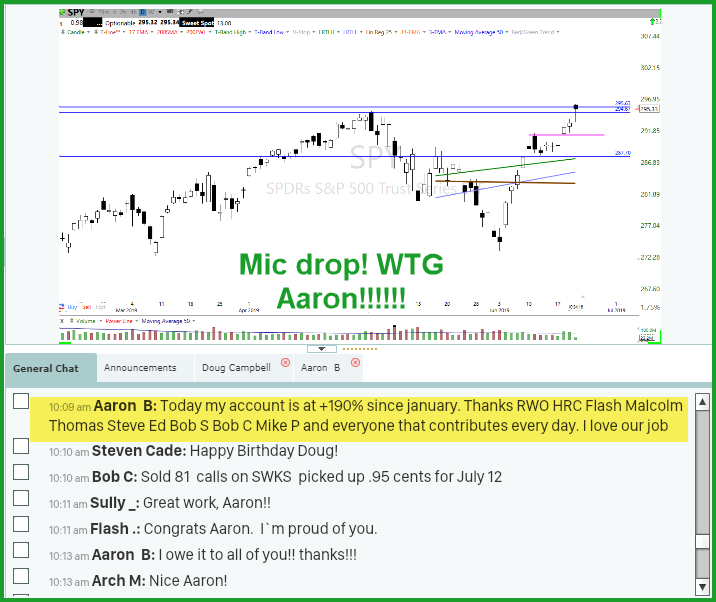

Early this morning the Wall Street Journal report seems to have upset the apple cart quickly reversing futures markets that had held positive all night. If the report is correct the list of demands that Chinese President XI Jinping will present to President Trump at the G20 seems only to inflame trade war tensions and diminish the odds of a deal.

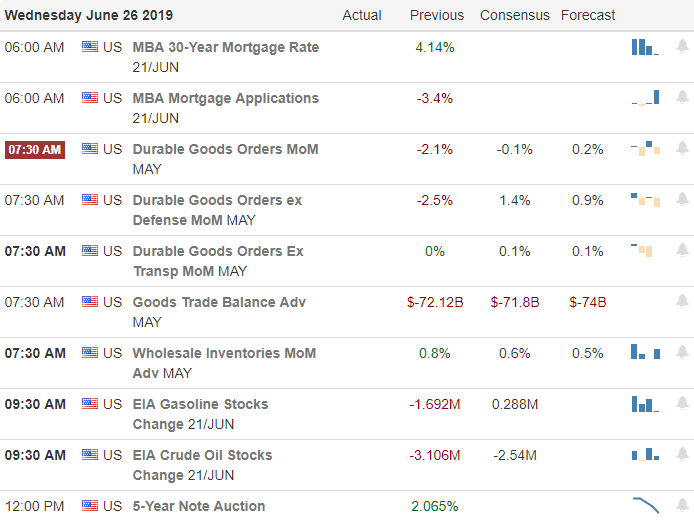

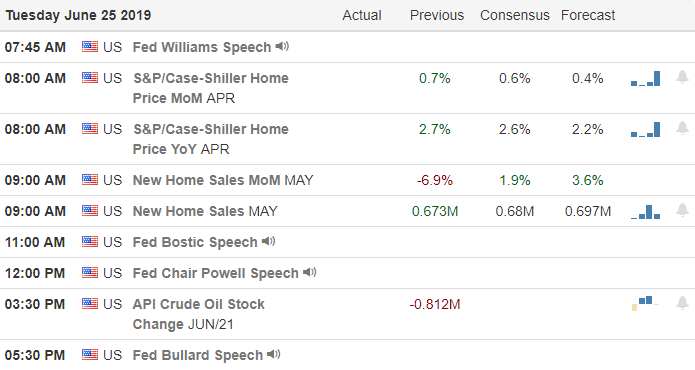

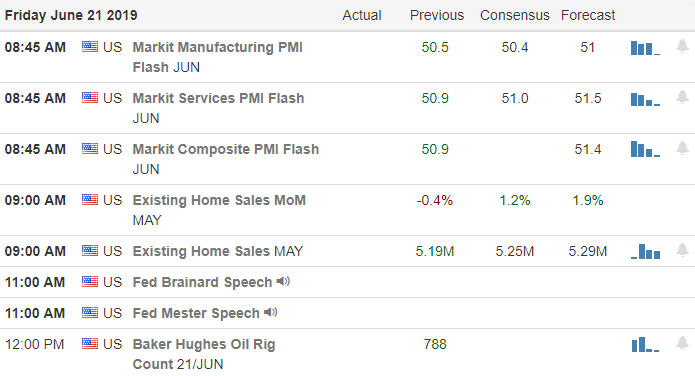

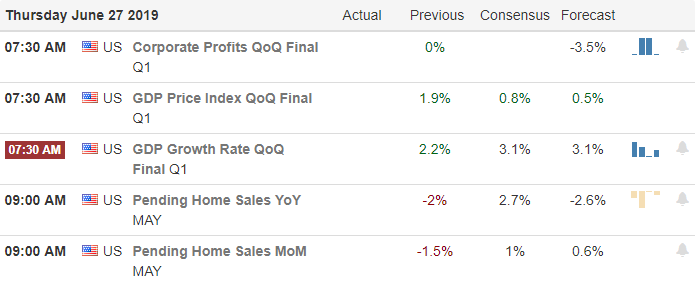

On the Calendar

On the Earnings Calendar we have nearly 40 companies reporting results today. Notable earnings include CAN, CAG, JEF, MKC, NKE & WBA.

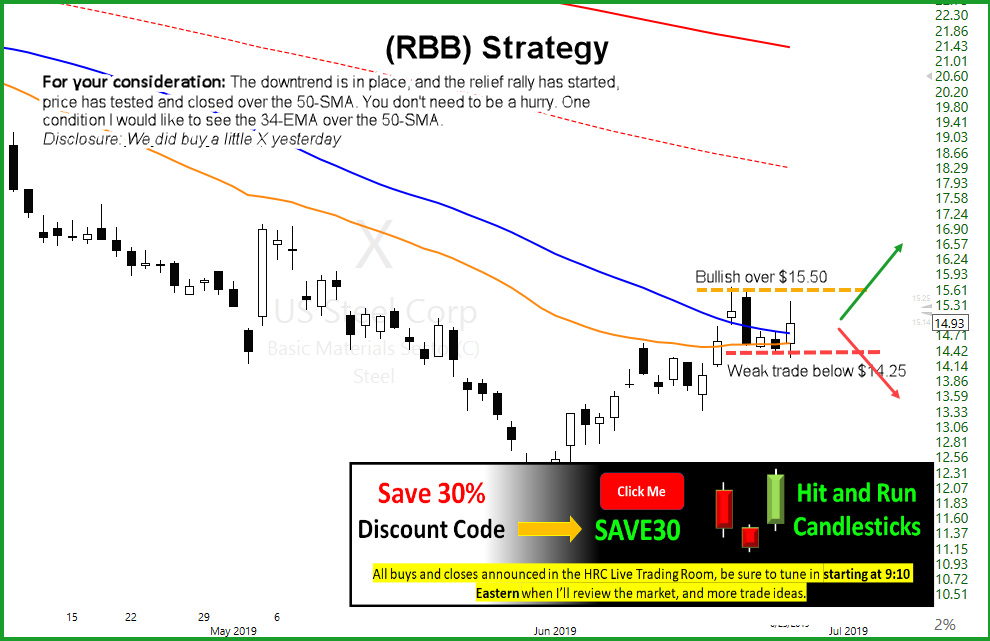

Action Plan

US Futures held positive most the night until but quickly reversed negative after the Wall Street Journal reported that Chinese President Xi Jinping will present a list of demands to resolve the trade war to President Trump at the G20 meeting. If the report is correct it would seem the odds of a deal at the G20 decline to zero. Let’s us all hope it’s not true or we are likely to face another round of tariff increases.

Other troubling news for the Dow Futures is the BA has reported it found another software problem in their grounded aircraft. BA is indicated to gap more than 4% lower at the open today. As you plan your risk for the weekend ahead consider the volatility that could result from the G20 developments and the 4th of July holiday the following week. It would seem to be a near impossibility to hold on to a trading edge heading into this weekend.

Trade Wisely,

Doug