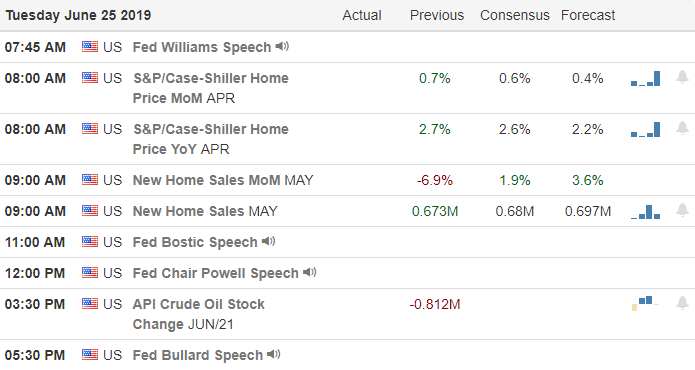

Taking a break ahead of more Fed speak as Jerome Powell speaks with the New York Times at 1:00 PM Eastern today. Some are speculating that he may try to reduce the current market exuberance of expected rate cuts. Certainly this adds some uncertainty to the day as if we didn’t already have enough of that with growing Iranian tensions and a pending G20 with US/China trade hanging in the balance.

Asian markets closed lower across the board during the night and European markets are modestly lower in reaction to the new US sanctions on Iran. US Futures are also modestly lower ahead of a busy economic calendar day and a few noteworthy earnings reports. There is a lot to consider as we plan today amid the uncertainties but as for now the bulls are firmly in control and I would not expect them to give up easily.

On the Calendar

On the Tuesday Earnings Calendar we have 21 companies stepping up to report. Among the notable reports are MU, FDX, FDS & LEN.

Action Plan

With more Fed speak today and the pending G20 meeting it would seem the market is taking a wait and see approach. Some are concerned that Jerome Powell may temper the market’s exuberance over possible rate reductions in his interview with the New York Times at 1:00 PM Eastern today. Of course what he will say and how the market will react only time will tell but should be a consideration as trader plan how to approach the market today.

Technically speaking a little resting consolidation after such a big move this month seems logical even without pending uncertainty. The bulls are in control and unless the Fed changes the market’s perception I don’t see that changing. While a pullback may be in the card for the near future, a hold above the 50-day averages builds a bullish case.

Trade Wisely,

Doug

Comments are closed.