The tenacious bulls pushed the market to new record highs with a glass half full attitude that the FOMC would give them a bigger rate cut than it now seems the Fed is not quite ready to give. Then they grabbed on to a late night headline from Secretary Munchin that the US/China trade deal is 90% complete reversing afternoons yesterday bearishness. Finish reading the story and what Munchin said he hoped for a completed deal by years end.

If he’s right could mean another six months of negotiations and market uncertainty. It would seem the bulls once again see the glass half full. A trade deal with China would be a game changer but six more months of news cycle spin and possible tweet storms means the road ahead could be full of potholes and very challenging to navigate. The news-driven gap this morning could create a short squeeze but it also has the potential of a pop and drop pattern. Stay focused and disciplined to your rules.

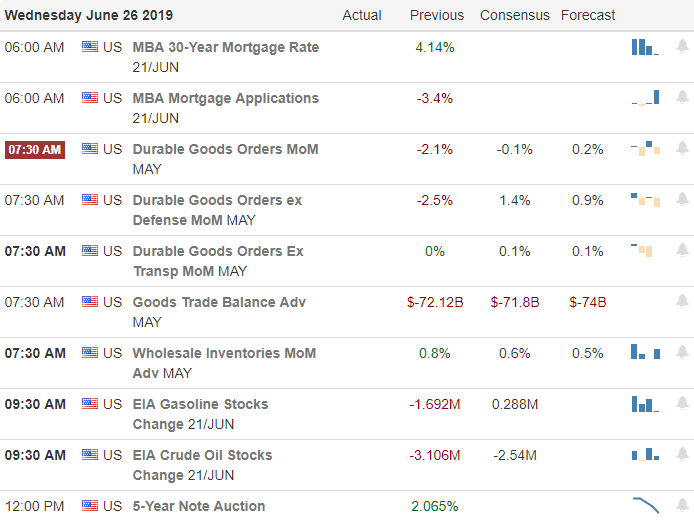

On the Calendar

On the hump day Earnings Calendar we have 18 companies reporting quarterly results today. Notable reports today include KBH, BB, GIS & PAYX.

Action Plan

After learning that the FOMC plan to move much more cautiously than the somewhat exuberant market has expected the short-term price action turned decidedly bearish yesterday afternoon. No doubt many likely entered short positions yesterday expecting at a modest pullback at a minimum. However, during the night we get a statement from Treasury Secretary Mnuchin that the trade deal is 90% complete and markets around the world reacted bullishly.

Had they gone beyond the headline they would have also seen the statement that he hoped a completed deal by the end of the year. If it’s going to take another 6-months to work out the final 10%, I think it’s safe to say the devil is in the details and we may still have a long bumpy road ahead. US Futures are pointing to a gap up of around 100 Dow points. Truly a glass half full kind of market. Those caught short will be squeezed hard this morning and could propel the indexes higher. On the other hand the morning pop could set up a pop and drop pattern so be patient to see if buyers will support the gap.

Trade wisely,

Doug

Comments are closed.