All about the Jobs Number.

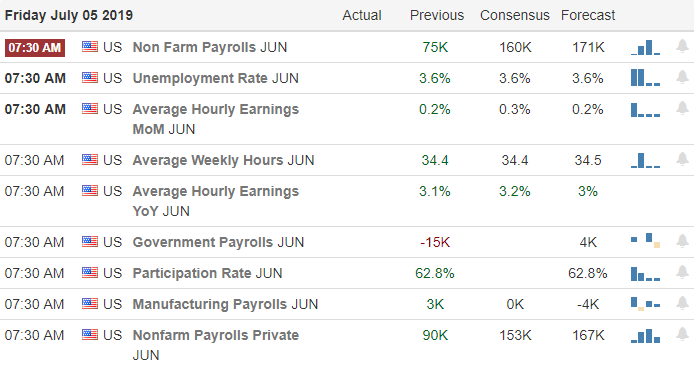

At 8:30 AM Eastern we will get a very importing reading of the condition on the strength of our economy and the number of jobs it did or didn’t create. If the Employment Situation number comes in weak it could provide the FOMC hammer to drive down interest rates in July. A strong number could make an interest rate cut difficult if the US Economy continues to show resiliency in the face of a slowing global economy. One thing for sure is that the number is likely to receive a significant price action response upon its release and may well set the direction to today’s market.

Asian markets were a bit subdued last night closing mixed up mostly higher. European markets are currently lower across the board and US Futures point to a modestly lower open ahead of the jobs number. The trends are bullish with DIA, SPY and QQQ breaking out to new all-time highs on Wednesday. The task ahead for the bulls is now to prove they defend this new price level with a worrisome earnings season beginning in 10-days.

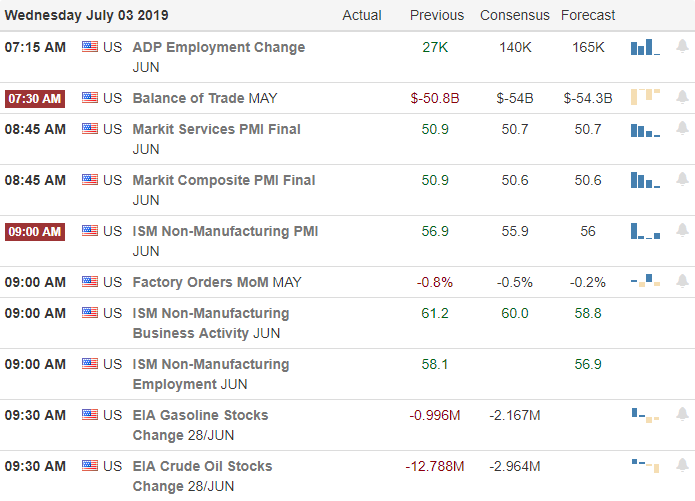

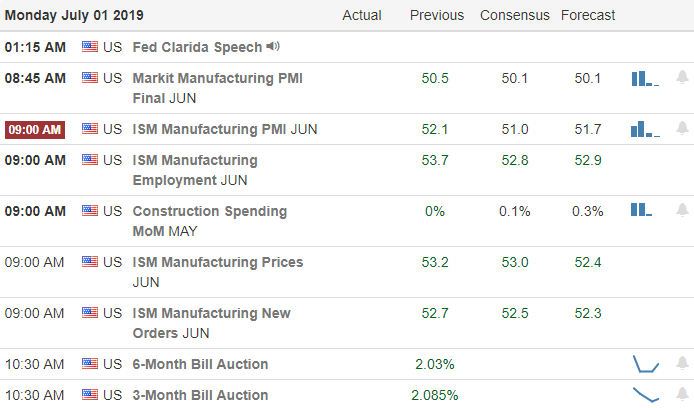

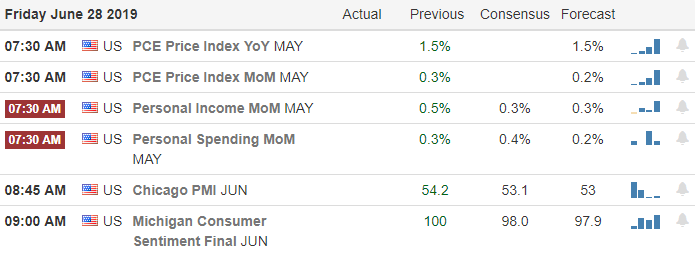

On the Calendar

On the Friday Earnings Calendar we have 16 companies stepping up to report quarterly results. None of the reports today are particularly notable unless you happen to own them.

Action Plan

The key focus this morning will be the Employment Situation number at 8:30 AM Eastern. If the number comes in weak it would seemingly provide the FOMC with the cover needed to lower the interest rate next month. However, the consensus estimate is suggesting that the number could come in strong with nearly double the jobs creation from last month. No matter how the number comes in it’s how the market reacts to the data that important.

At the close on Wednesday the bulls were in full control setting new all-time high records in the DIA, SPY and QQQ in a show of force rather remarkable considering the holiday-shortened trading day. Now that we have the breakout it will be important for the bulls to hold these new levels as price support. That may be a difficult task with so many companies warning they will miss analysts estimates when earnings season kicks off in about 10-days.

Trade Wisely,

Doug