Bullish Piercing Candle

Friday Update: (SPY) The Bullish Piercing Candle from yesterday did not get follow-through. Today we bought INTC, LYFT, OXY, and VXX. INTC ended about where we bought it, LYFT up 1.57%, OXY up 16.9% and VXX is up 16.9%.

Have a great weekend everyone!

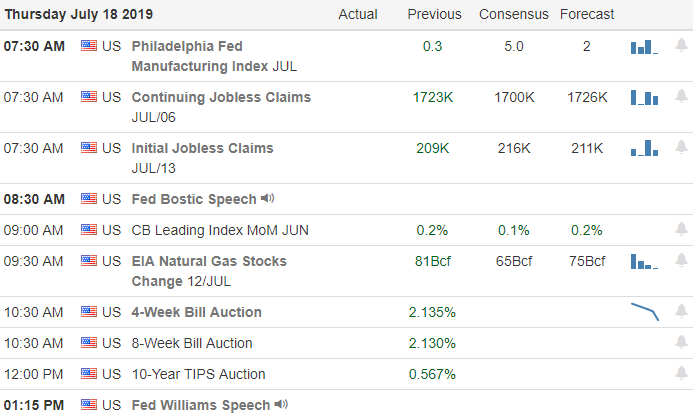

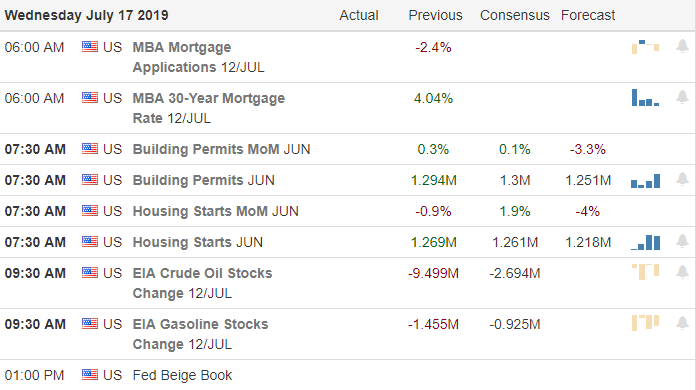

MSFT is gapping on earnings! Yesterday July 18, we closed VXX for a small loss and made no other trades. Due to market chop and condition. BABA is still set up in the Bands, over $178.10 we would look for a challenge of $184. Still holding F and will add over $10.30 (earnings on Wednesday). CPB is acting well pattern breakout and riding the trend. A close below the Red T-Band and I will close QCOM. We have added a couple of new scans to the scanner and will hold a clinic this Friday at 2: pm in room #3.

👉 Full disclosure, we are actively trading all stocks mentioned in the above. We may close or add more at anytime. To learn more about us or join in the live trading room consider an HRC membership or trial Rick and the HRC Members kick off the trading room starting at 9:10 Eastern We review the market and today’s trade ideas.

Pre-Market Thoughts

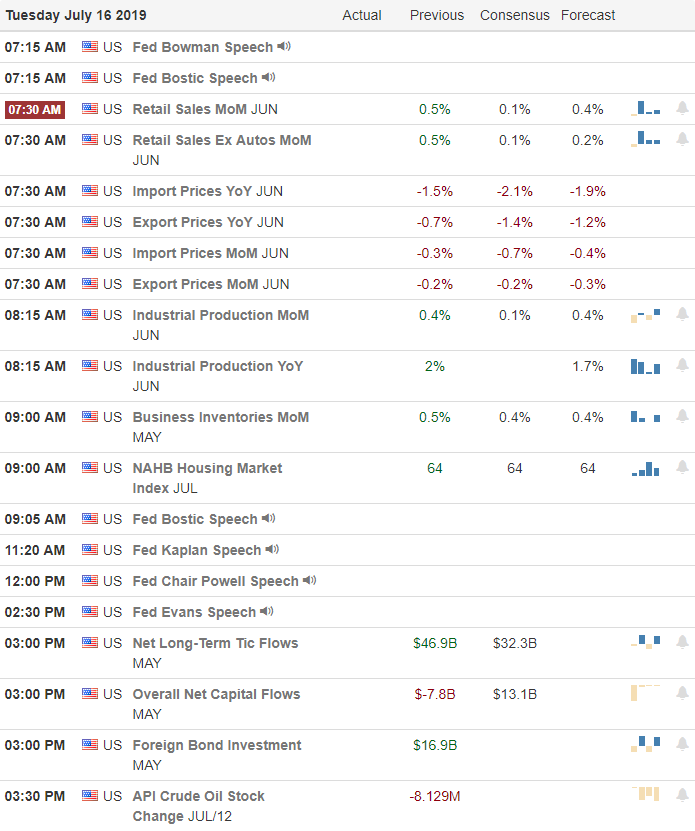

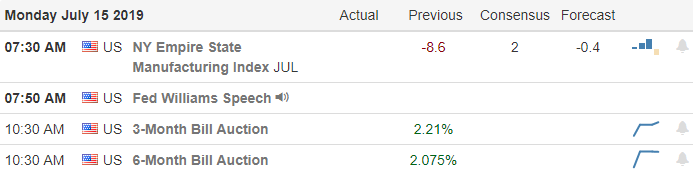

The SPY made four lower lows then yesterday on a FED comment the bulls stepped in. The SPY closed with a Bullish Piercing Candle from the $296. Key support line. Like all Candlesticks signals, confirmation is required, for yesterday’s rally to be confirmed we need to see positive trading above $298.90. With minimal overhead resistance, a Bullish J-Hook continuation pattern is setting up. At one point yesterday it looked as if the VXX chart was going to make a run for it, then pulled back closing with a Doji. The VXX is still trending down. A close above $24. Could rally a few more points. Stay safe and cautious with this market.

😊 Have a great trading day – Rick

🎯Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Trade-Ideas

✅ It’s Friday, no trade Ideas today. Trade smart and wait for for the QEP → (QEP) Quality Entry Patterns). Check Earnings!

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service