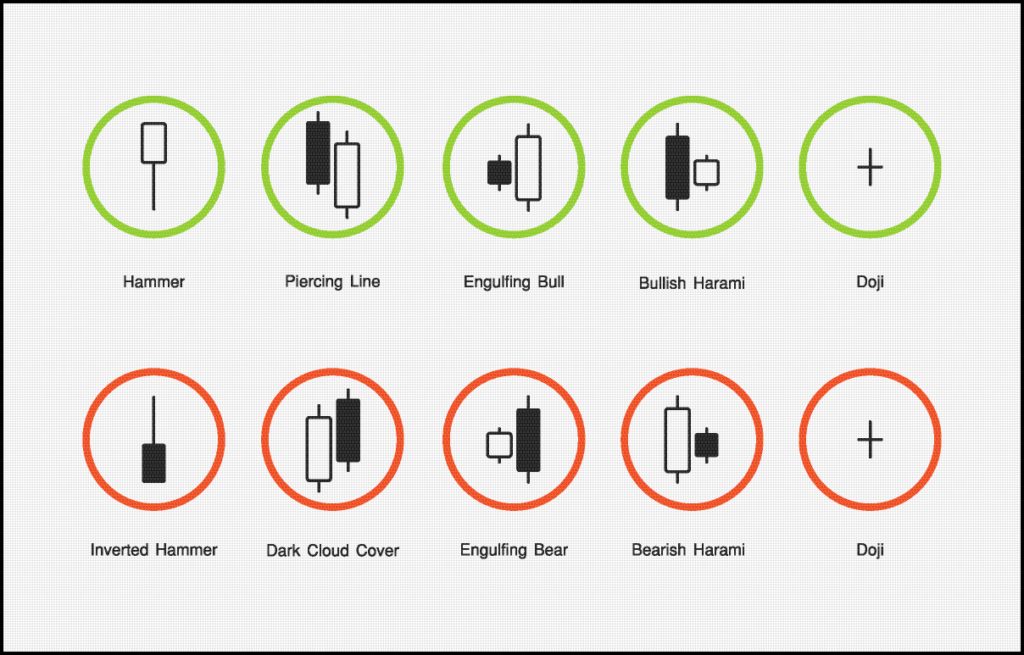

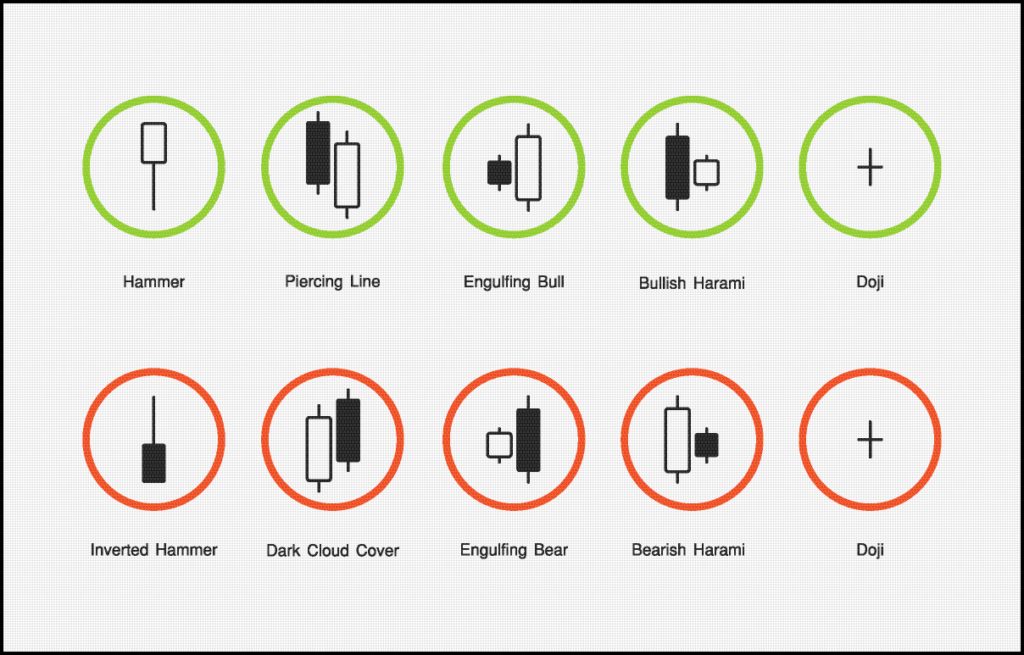

Ten Candlesticks Signals

The FED is on deck today. Hopefully, the market will this the news and start a long bullish move on the overhand the market might not care for the FED news. Yesterday the SPY gapped down, finding our $300.00 support line, and the crawled back as much as it could still leaving a gap. Any bullish strength today or tomorrow would have to carry the SPY over $301.45, a show of weakness below $300.00 would set us up for a test of the July 19 low.

The VIX closed well showing a bit of fear in the crowd, a close over $14.50 would spark a bit more fear, maybe enough to start a fire. Over $14.50 would also be over the 50-SMA. The T2122 chart has moved back up and above it’s 34-EMA closing yesterday at 74.90

✅ No closed trades yesterday nor any buys. CPB (Option) is up 6.12%m CVS is up 8.19% (Option), GE is down 4.5% (Option), KO is up 4.2% (Option), KSS is up 23% (Option), VXX is down .02 (Option), WBA is up 4.42% (Option) X is down -6.9% (Option), XLF is down 2.5% (Option) If you are interested in trading simple directional options, risking less money and BIGGER rewards send me an email, at contact us Attn: Rick

😊 Have a great trading day – Rick

✅ For your consideration: Here are a few charts I thought should go on the watch-List, remember to trade your trade. Trade smart and wait for the QEP → (QEP) Quality Entry Patterns). ARWR, OXY, X, SHAK, GE, BX, GS, CVS, YELP Check Earnings!

🎯Dick Carp: the scanner paid for the year with HES-thank you

🎯Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Although we have more than 350 companies reporting, all eyes will be on the FOMC rate decision at 2:00 PM Eastern today. In anticipation of a rate cut, the Dow and SP-500 have rallied more than 10% since the discussion began in early June. One has to wonder after such a huge anticipation run what might occur if the FOMC disappoints the market. One thing for sure is that the entire world is watching and we should expect considerable volatility as a result. Trade negotiations with China ended very sharply after just half a day of conversation, but that’s likely to get lost in the shadow of the FOMC today.

Overnight, Asian market closed in the red across the board, but European markets trade mixed, however, mostly higher ahead of the FOMC decision. US Futures are pointing to a bullish open fueled by the earnings that have come in largely better than expected this quarter. Expect a flurry of price volatility during the morning rush as the market reacts to a big round of earnings reports but don’t be surprised if that quickly fades into choppy light action as we wait for the Fed. Fasten your seat-belt and prepare for a wild news-driven day.

On the Wednesday Earnings calendar, we reach the half-way point for this season. We have more than 350 companies stepping up to report. Among the notable today are, ABC, mt, ADM, AVP, CC, CI, CLX, ED, CROC, DVA, DISH, DNKN, DD, ETSY, EXC, FSLR, GM, GPRO, HBI, HFC, IRM, K, LM, NNN, PINS, RMAX, RDFN, SHOP, SQ, STOR, X, VZ, W, WU, WING, WYNN, XYL, YETI, and YUM.

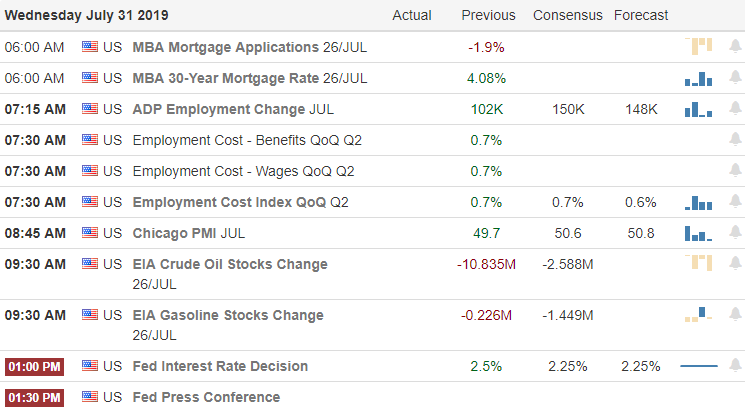

After a choppy day of price action that left the DIA, SPY, and QQQ slightly lower on the day the big round of earnings after the bell seems to have lifted the spirit fo the bulls this morning. AAPL beat analysts estimates and guided positively forward although iPhone sales slumped. Today at 2 PM Eastern we will finally get the decision from the FOMC on interest rates. However, before that occurs, we will get word on the ADP Employment numbers, Employment Cost Index, and the Petroleum Statis Report along with a very large group of earnings reports.

It’s going to be a very busy day of data, but as of now, the Futures are pointing to a bullish open. Expect volatility to during the morning rush as trader react to earnings reports but don’t be surprised if price action becomes very light and choppy leading into the rate decision. There has been so much news spin around this rate decision that the entire world is waiting in anticipation so expect an explosion of the volatility after the release and during the Chairmans press conference. Buckle up it may prove to be a very bumpy ride today.

Trade Wisely,

Doug

I don’t really expect much market activity today, just more of yesterday. Right, now the market is waiting for the Fed’s announcement “Wednesday.” Yesterday’s candle traded narrow and closed with an inside day. With yesterdays close the SPY is still bullish. Price still above the trend and the past six days, there are more higher lows and higher highs than the other way around. SPY above $300 remains bullish, below $300 could put pressure on $297. If the market is happy and the SPY breaks out $302.60 and $303.20 are in the cards.

The VIX-X closed with a bullish engulf and a 3 bar pattern we call a fig Newton, a close above $13.05 could really wake the VIX up and a close above $13.30 would put a bit of pressure on the market. The 2122 chart has now turned back down headed for the lower end, closed yesterday at 46.35

✅ We closed LYFT yesterday for a loss and bought CVS with a Directional Call Option. Nice Morning Star signal on the 2-day chart. CPB is finally working its way up. GE continues to march sideways in a wedge. Pretty quick it’s going to run out of the wedge. KO up 15% took a little rest yesterday but nothing serious. KSS is in our famous RBB Rounded Bottom Breakout setup! We are up 26.8% and looking good. WBA is just humming along going nowhere. And X gave us a little Hammer yesterday; let’s see if something comes out of it. Click Here and choose Trading Room #1 Password 8020👈

😊 Have a great trading day – Rick

✅ For your consideration: Here are a few charts I thought should go on the watch-List, remember to trade your trade. Trade smart and wait for the QEP → (QEP) Quality Entry Patterns). ANF, CONN, CAKE, BERY, CVS, EL, BKI, EXAS Check Earnings!

🎯Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

As the market waits for the FOMC rate decision, fed fund futures seem to display wavering confidence on the possible outcome. Currently, it suggests a 73% chance of a 25 basis cut with a 50 basis cut slipping back to just 27%. Clouding the water just a bit more a CNBC story suggests there could be up to 3 members voting against a rate cut due to stronger than expected economic indicators. One thing for sure all we can do as traders is to wait for their decision and manage the price volatility it creates the best we can or stand aside.

Asian markets saw green across the board at the close of trading last night after the Bank of Japan decided to hold rates steady. European, markets are currently mixed but mostly lower as they deal with some disappointing earnings results this morning. US Futures currently point to a slightly bearish open this morning ahead of a big round of earnings reports and a busy economic calendar. With another round of market-moving reports after the bell, today prepare for the possibility of a substantial gap Wednesday morning.

On the Tuesday Earnings Calendar, we have more than 290 companies expected to report results today. Some of the notable earnings include, AAPL, AMD, AOS, AKAM, MO, ARCC, BIDU, BYD, CINF, COP, GLW, CMI, DLR, DHI, ETN, ECL, EA, LLY, EXR, FEYE, GILD, GRUB, IR, LDOS, MA, MRK, MDLZ, OKE, PAYC, PFE, PG, PAS, RL, SIRI, SNE, STAG, UAA, YUM, and XRX.

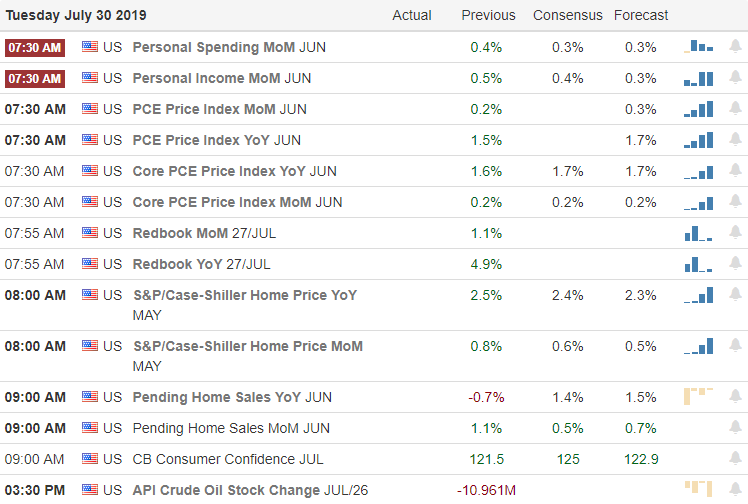

Another very big day of earnings and economic data for the market to digest today as we wait for the FOMC rate decision Wednesday at 2 PM Eastern. Today there is even more uncertainty about what the Fed might do with a story released on CNBC that there could be as many as three members voting in decent of cutting rates. Fed fund futures now suggest a 73% chance of a 25 basis point cut and just a 27% chance of a 50 basis rate reduction.

Futures currently suggest a slightly bearish open as earnings begin to roll out and ahead of the Personal Income, S&P Corelogic, Consumer Confidence, and Pending Home Sales economic reports. After the bell today we have some big reports from the likes of AAPL, AMD, and many other possible market-moving events. As a result, there is a possibility of a substantial market gap Wednesday morning. Plan your risk carefully and expect the challenging price volatility to continue. Although we saw a small dose of selling pressure yesterday morning, index trends remain bullish.

Trade Wisely,

Doug

If I had to pick one word to describe this week of trading, it would be anticipation. With the FOMC expected to cut rates on Wednesday. The question is, will it be enough after a 10% market rally in anticipation of an aggressive FOMC move? The market will also have to focus on over 1200 earnings reports this week and the resumption of US/China trade negotiations. If that’s not enough for the market to digest, let’s toss in a very busy week of market-moving economic reports such as the Friday Employment Situation number to continue to stir the volatility.

During the night, Asian markets closed modestly lower across the board ahead of the pending trade talks. This morning European markets are also pensive currently trading mixed but mostly lower. US Futures are also starting the day timidly, pointing to flat open. Although the index trends are bullish and new record highs were made on Friday this morning’s uncertainty is palpable. I’m expecting price action this week to challenge even the most experienced traders. Plan your risk carefully.

We have a huge number of earnings this week with more than 120 companies reporting today. Notable reports include AKS, BAH, BTND, CTB, TACO, RE, ILMN, LEG, NBR, SNY, TXRH, RIG, and VNO.

This week has the potential of being a very challenging trading week full of uncertainty and price volatility. We have more than 1200 companies expected to report this week, a busy economic calendar that includes the FOMC rate decision Wednesday afternoon as well as the Employment Situation Report Friday, and for good measure, let’s toss in the resumption of China Trade talks. With the SP-500 at new record highs and up more than 10% in just the last 2-months, there is a lot at stake.

The NASDAQ also closing at new record highs on Friday index trends are bullish, and there is very little fear with the VIX hovering just above 12. As I write this report, US Futures are flat ahead of today’s earnings reports, and its possible trading could remain choppy and indecisive until the FOMC decision where is largely expected a rate cut is forthcoming. The question is, will it be enough to please the market after running up so hard in anticipation? I expect this to be a very challenging week, even for every experienced trader’s.

Trade Wisely,

Doug

Trading earnings can be a very dangerous business. In this E-Leaning session we covered option strategies that may help you mitigate the risk of trading earnings events should you choose to do so.

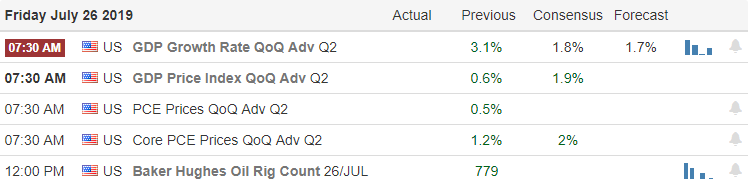

A better than expected Durable Goods number yesterday elevated concerns that the FOMC might be less aggressive or even skip cutting rates at their meeting next week. Adding to the concern, the ECB signaled a future rate cut, but the market largely expected the cut to occur yesterday. The better than expected company earnings results this quarter would seem to confirm the overall strength of the US economy. Keep an eye on the results the GDP number at 8:30 AM, as it’s results could be a critical factor to sway the FOMC for or against a rate cut next week.

Asian markets struggled overnight, closing mostly lower due to worries of a less aggressive Fed. However, European markets don’t seem to share the same concern seeing green across the board this morning. US Futures point to a bullish open as better than expected earnings continue to inspire the bulls ahead of the GDP number. With a huge number of earnings, next week plan your risk carefully heading into the weekend and plan for the challenging price volatility to continue.

On the Friday earnings calendar, we get a little break with just over 80 companies reporting. However, next week earnings ramp up again with more than 1000 companies expected to report. Notable earnings today include but are not limited to ABBV, COG, CHTR, CL, GT, MCD, PSX, TWTR, WY, WETF, and YNDX.

Another good round of earnings after the bell looks to energize the bulls even as the strong, durable goods numbers raises concerns about Fed cuts. The ECB signaled a coming rate cut but also seemed to surprise markets that were largely expecting a cut yesterday. The GDP number at 8:30 AM Eastern could help to restore rate cut hopes if it comes in lower than expected. However, if the number were to come in, strong markets could become worried that the FOMC will also skip cutting rates this month. Certainly, current economic indicators have been strong, and the better than expected earnings results would seem to confirm that strength.

Although yesterday’s price action snapped a 3-day rally, index trends remain bullish. US Futures have remained bullish all night and have only strengthened this morning ahead of earnings and the very important GDP number. With both Iran and North Korea raising the stakes for military confrontation, there is some uncertainty as we head into the weekend so plan your risk carefully. Challenging price volatility is likely to continue today and stick with us all next week, so remember to consider taking some profits to the bank.

Trade Wisely,

Doug

The SPY closed below Thursdays high with an inside day candle; the range continues to get tighter and tighter, suggesting a breakup or down is coming very soon. With yesterdays close still in the T-Band channel and the channels are still rising we remain cautiously bullish. Below $297.10 (last weeks lows) would turn us bearish. Below $297.10 would also be below the T-Band Channels.

The VIX-X is seriously trying to construct a bottom around $12.25. If the VIX-X chart pushed the price over $14.50 we could be talking about a ton of fear, below the $12.25 area we have the same old thing, market grinding higher. The 4wk New High/Low Ratio chart (T2122) is coming off the overbought area trying to get to the oversold area. (T2108) % of stocks above 40 Day Pma is sitting at 60 and under the 20-SMA on the 130 min chart. Conclusion: The SPY remains in a slow bullish grind with intraday boredom and chop.

✅ On Thursday (yesterday) we closed OXY for a small loss and closed 💲BABA for an 11.4% gain. AMD still hanging in the T-Band channel and really needs to get above $34.55. CPB closed with a Doji yesterday still above our support line. WBA has tested support now we need buyers, above $55.20 would suggest the buyers are back. X is having a tough time getting above the $15.00 area into the $16.00 area but seems to behold in place. XLF is in the T-Band trend, above $28.10 we are still bullish. 👉For more detail and the full list join us in the HRC trading room #1 Click Here and choose Trading Room #1 Password 8020👈

😊 Have a great trading day – Rick

✅ On Fridays we do not post trade ideas. Think about profits and getting rid of the dead wood. 🌞 Hope you all have a great weekend!

🎯Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service