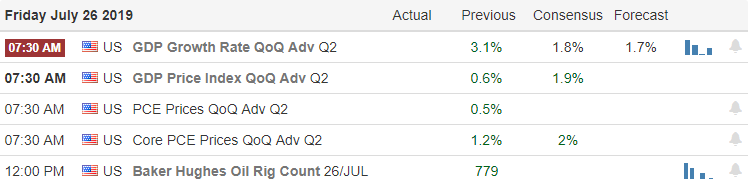

A better than expected Durable Goods number yesterday elevated concerns that the FOMC might be less aggressive or even skip cutting rates at their meeting next week. Adding to the concern, the ECB signaled a future rate cut, but the market largely expected the cut to occur yesterday. The better than expected company earnings results this quarter would seem to confirm the overall strength of the US economy. Keep an eye on the results the GDP number at 8:30 AM, as it’s results could be a critical factor to sway the FOMC for or against a rate cut next week.

Asian markets struggled overnight, closing mostly lower due to worries of a less aggressive Fed. However, European markets don’t seem to share the same concern seeing green across the board this morning. US Futures point to a bullish open as better than expected earnings continue to inspire the bulls ahead of the GDP number. With a huge number of earnings, next week plan your risk carefully heading into the weekend and plan for the challenging price volatility to continue.

On the Calendar

On the Friday earnings calendar, we get a little break with just over 80 companies reporting. However, next week earnings ramp up again with more than 1000 companies expected to report. Notable earnings today include but are not limited to ABBV, COG, CHTR, CL, GT, MCD, PSX, TWTR, WY, WETF, and YNDX.

Action Plan

Another good round of earnings after the bell looks to energize the bulls even as the strong, durable goods numbers raises concerns about Fed cuts. The ECB signaled a coming rate cut but also seemed to surprise markets that were largely expecting a cut yesterday. The GDP number at 8:30 AM Eastern could help to restore rate cut hopes if it comes in lower than expected. However, if the number were to come in, strong markets could become worried that the FOMC will also skip cutting rates this month. Certainly, current economic indicators have been strong, and the better than expected earnings results would seem to confirm that strength.

Although yesterday’s price action snapped a 3-day rally, index trends remain bullish. US Futures have remained bullish all night and have only strengthened this morning ahead of earnings and the very important GDP number. With both Iran and North Korea raising the stakes for military confrontation, there is some uncertainty as we head into the weekend so plan your risk carefully. Challenging price volatility is likely to continue today and stick with us all next week, so remember to consider taking some profits to the bank.

Trade Wisely,

Doug

Comments are closed.