Earnings Season Begins

Although there seems to be swirling political uncertainty everywhere the market will not turn its primary focus to the beginning of the 4th quarter earnings season results. JPM has already let the way this morning with a solid beat gaping the stock higher and emboldening the bulls in the futures market. Let’s hope the other big banks can do as well this week as earnings ramp-up in the weeks ahead.

Overnight Asian markets closed mixed as traders remain cautious on the proposed Phase 1 deal that many are now calling a temporary cease-fire. European markets are mixed but mostly higher as EU negotiator gives hope of Brexit deal this week. US Futures are currently green across the board as big bank earnings roll in this morning. As of now, futures point to gap up of more than 100 Dow points, but that could easily improve or sharply diminish so expect volatility and stay focused on price action for clues forward.

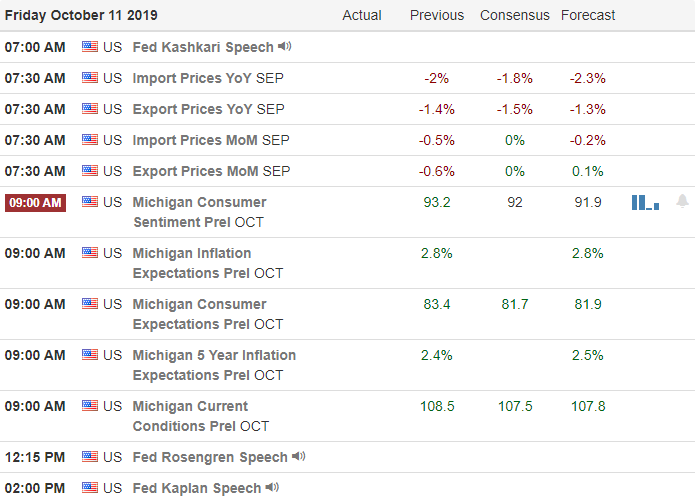

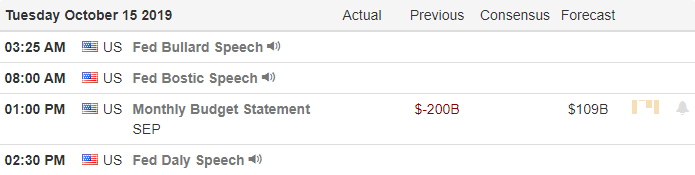

On the Calendar

Today begins 4th Quarter earnings with 42 companies on the Earnings Calendar expected to report. Among the notable reports are C, JPM, KEY, BLK, SCHW, TACO, GS, JBHT, JNJ, PGR, PLD, SNBR, UAL, UNH, WFC & WIT.

Action Plan

How we deal with today depends very much on how the market responds to the early morning earnings reports. Futures seem to have considerable confidence that the results from the big banks this morning pointing to more than a 100 point gap up open. According to reports very early this morning, one of the Brexit negotiators says a deal is still possible this week, creating a rally in the sterling. We, of course, will have to watch closely for developments in the Phase 1 deal is being renamed by some as merely a temporary cease-fire in the trade war. Tariffs on China will increase to 30% in December if the deal fails. Attempting to punish Turkey for its Syrian invasion the President has raised steel tariffs on the country to 50% and cleared the administration to pursue all available economic sanctions.

Though all this political uncertainty has made for very challenging price action focus will likely turn to earnings results as 4th quarter reports ramp up this week. With the DIA, SPY, and QQQ holding above their 50-day averages with significant gaps below, we will need some sold results to prevent prices from sliding into the gap. As I write this, JPM has reported positive earnings results and is gaping higher. Let’s hope the other big banks can do the same settling frayed trader’s nerves and put some structure back into the chart technical’s without all daily reversals and whip.

Trade Wisely,

Doug