At the Highs, But With Fed/Earnings Ahead

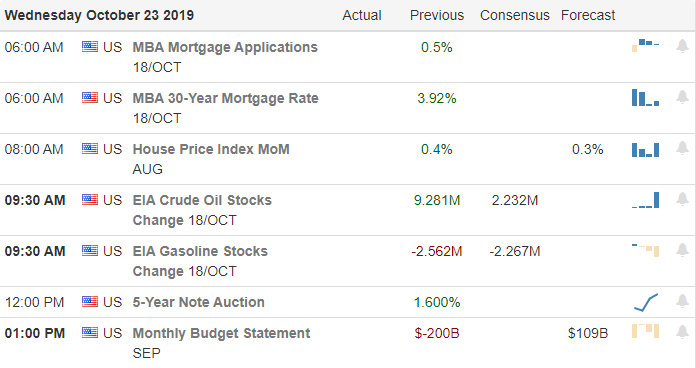

Overall, markets are giddy to be at or near the all-time highs again. However, there is also some fear from recent misses and uncertainty with the FOMC meeting just a couple of days ahead. Earnings and FOMC should be the lead stories with another heavy reporting list again this week and the Fed meeting on Tuesday and Wednesday. On Monday, among the major names reporting before the Open are: T, CHKP, DTE, L, NLSN, and WBA. The major economic news is limited to Sept. Trade Balance and Sept. Retail Inventories (both at 8:30 am).

Friday saw a rally with the QQQ closing at all-time highs and the SPY testing all-time high resistance. The DIA and IWM both printed a Bullish Engulfing Signals, with the DAI bouncing up off the recent support level again and the IWM testing its resistance again as well.

The EU has decided on giving the UK a 3-month extension, (France folded from its support of Boris Johnson where they were pushing for an extension of only a few days.) However, as a middle-ground, Brexit can happen before January 31…if the UK can get their act together to be ready early.

Overnight, Asian and European markets were green and European markets are mixed, but mostly green. As of 7:30 am, U.S. futures were indicating a gap up of 0.3% in the SPY, 0.5% in the QQQ and the DIA lagging with a gap-up of 0.2%.

Bulls are thrilled to be at the highs again. However, with many more earnings and the FOMC still ahead of us, don’t be surprised by lighter volumes and we see a slow market Monday. Be cautious, and remember to take profits along the way.

Ed

Trade ideas for your consideration. Long – KSS, HOME, PM, CNC, PNC, TSM, JBHT, AFL, COG, BERY, SNBR, JEC, JWN. Short – CINF, GD, KO, NOC. Trade smart, take profits along the way and trade your trade. Also, do not forget to check for upcoming earnings. Stocks we mention and talk about are not recommendations to buy or sell.

✅ SMS text alerts and reminders?👈

✅ Check out our newest YouTube videos👈

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service