The China Story Two-Step

China deal optimism led Markets to gap higher Thursday. However, there was no follow-through as the sideways grind set in for the rest of the morning. Then about 2:30 pm, rumors had the White House pushing back against tariff reductions. Markets sold off on this report. The selloff subsided at the end of the day as markets ended in the green, but printing Shooting Star type candles in the SPY, DIA and QQQ, while the IWM had sold off all day printing an ugly black candle.

After-hours, ATVI, BIDU, BKNG, MTD, MNST, NLOK, DIS reported beats. Meanwhile, AMCR, MATX, NWS, and TTWO reported misses. However, after-hours Larry Kudlow (Dir. of the Council of Economic Advisors to the President) told Bloomberg that afternoon rumors were false and that if a first-phase trade deal is signed with China, it will indeed include the tariff reductions China was insisting upon. Unfortunately, later more reports of opposition to tariff rollbacks came. Obviously, the administration has two splinter groups at odds over this issue.

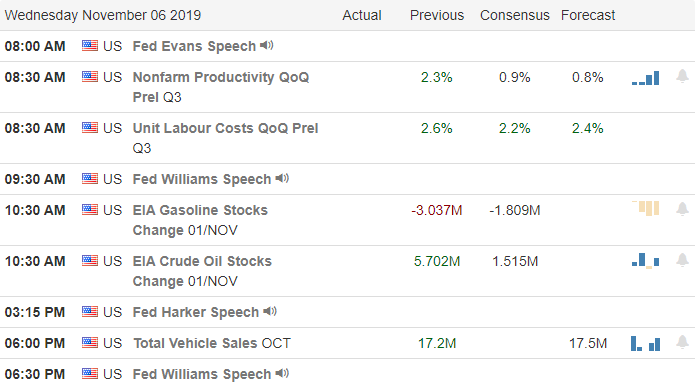

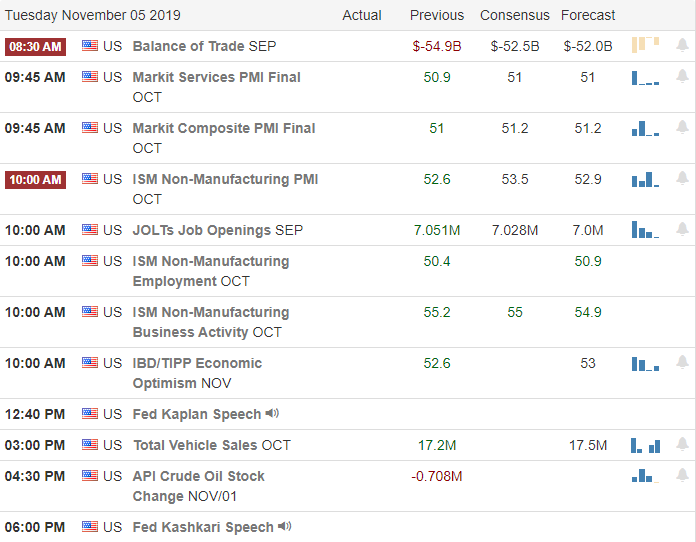

Friday’s economic calendar is limited to Michigan Consumer Sentiment (10 am). In addition, earnings will hold little sway as only AEE and DUK report before the bell.

Overnight, Asian markets were mixed, but mostly in the red. In Europe, markets are also mixed at this point, with the FTSE and DAX red and the CAC and others in the green. As of 7:30 am, U.S. futures were on the green side of flat.

With the bulk of earnings and the Fed direction out of the way, it seems the China Trade War is the big story driving market moves. However, it sure seems that two competing groups inside the Trump Administration are using leaks (and stock Market gyrations) to gain points in their fight. So, beware of chasing any such news. It may well be countered in short order. Remember to be cautious and continue to take profits and move stops. We have a long weekend news cycle ahead and no chance to trade against that news before the Open Monday.

Ed

Normally, we don’t put out trade ideas on Friday. However, with two groups in the trading room, I’ll make an exception. Swing-Trade Trade ideas for your consideration. Long – AIZ, MAS, K, CMI, AMD, PCAR, STX, SYY, CELG, VLO, ROL, CTXS, OLLI. Short – EFX, KO, CF, MLM, F, SBUX, STZ, WEC. Trade smart, take profits along the way and trade your plan. Also, do not forget to check for upcoming earnings. Stocks we mention and talk about are not recommendations to buy or sell.

✅ SMS text alerts and reminders?👈

✅ Check out our newest YouTube videos👈

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service