Bear Signals and Virus Fear

Markets took some profits on Friday as the US followed the pattern of Asia and Europe for the day. The QQQ and SPY ended the day as Doji candles after some volatility, but the DIA printed a large-body black candle to print an Evening Star signal. The SPY was down 0.53%, the DOA down 0.87%, and the QQQ down 0.43%. As a result, the VXX climbed slightly to 14.38 while the T2122 fell again to 33.94 (still not oversold).

The big story on the day seemed to be a complete reversal by the Fed from what was told to the financial press just two days earlier. On Friday, the Fed reported to Congress that the coronavirus presents a new risk to the US economic outlook and they warned of disruptions to global markets. Specifically, the Fed reported, “Because of the size of the Chinese economy, significant distress in China could spill over to U.S. and global markets through a retrenchment of risk appetite, U.S. dollar appreciation, and declines in trade and commodity prices.”

On Tuesday and Wednesday, both Fed speakers and the President’s Chief Economic Advisor Larry Kudlow had said the virus would not have a significant impact on the US economy. This reversal may help explain the profit-taking on Friday.

Over the weekend, the virus has continued to spread and has surpassed the SARS outbreak of 2003 in terms of impact. The number of confirmed cases has now reached over 40,000 and deaths now exceed 900. One of those deaths was in the US. In terms of impacts, there is serious scrambling going on throughout the Auto and Electronics industries as the vast majority of those supply chains run through China. In other words, you can’t make a car in Detroit, Berlin, Japan or Mexico if the parts have not arrived from China.

Overnight, Asian markets were in the red. Europe is mixed at this point, but most of the major bourses are red…the FTSE being the striking exception. As of 7:45 am, U.S. futures are flat, sitting on either side of the break-even line.

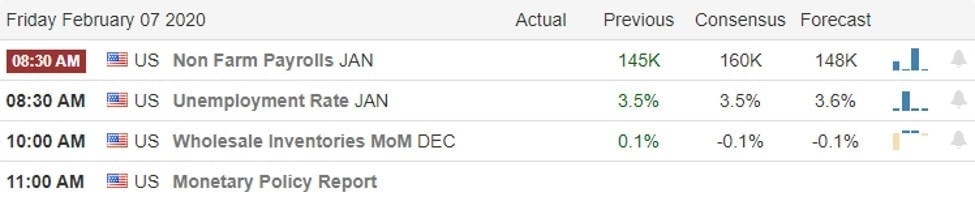

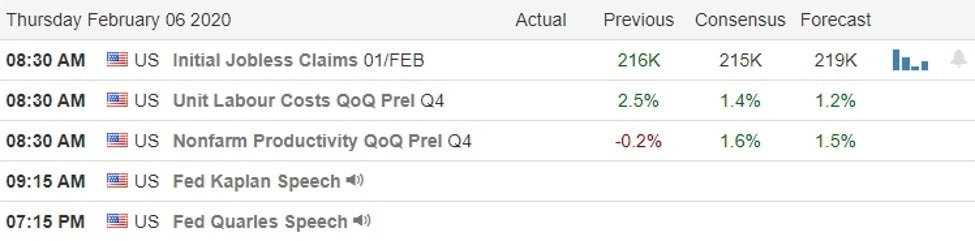

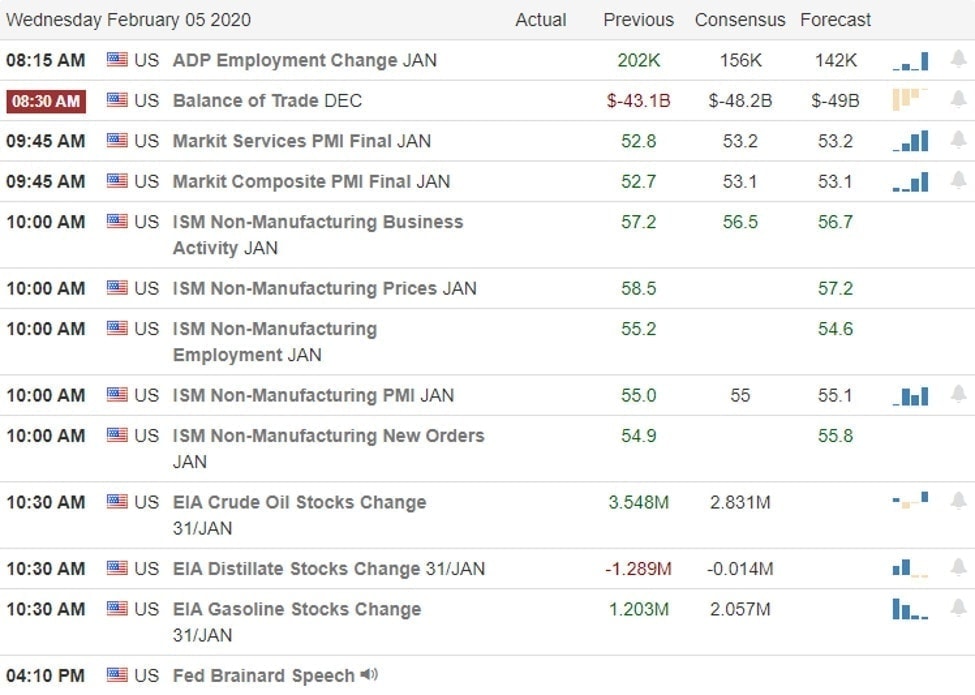

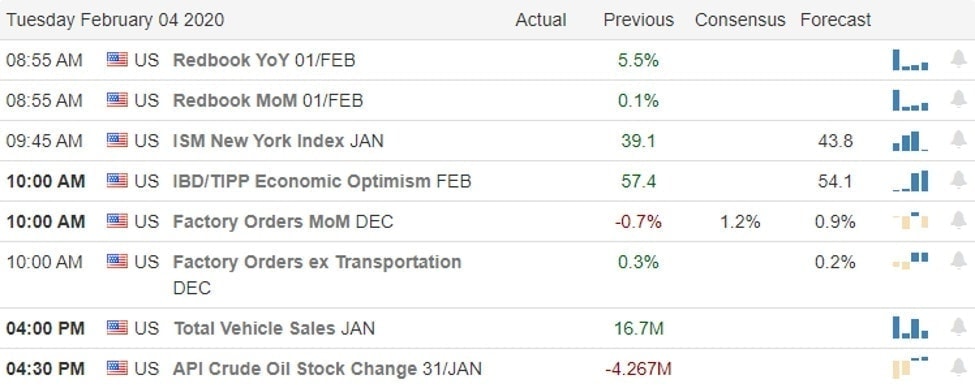

There is no major economic news for Monday. However, there are a couple of Fed speakers during the day. Earnings are also light for the day, but AGN, QSR, L, DO, IVC, and AVYA report before the Open. After Monday’s close, CHGG, MELI, RNG, XPO, APPS, ELY, MESA, MOH, IIVI, JCOM, RE, RPD, VRNS, DVA, BLKB, VOYA, FLDM, FRT, ICMB, and PYX all report.

Markets took some profits Friday, but the bulls have been resilient and relentless for a long time now. The trend remains clearly bullish, but we are still a bit extended and there is no new impetus with light earnings and no planned economic news Monday. Perhaps the rumors of President Trump’s election-year budget (apparently going to expand tax cuts) will be the driver today.

Again, the bias is on the long side, but the candle patterns are on the bearish side. I think we need to remain cautious. At the very least take a look at bearish setups or hedges. I know I sound like a broken record on the topic, but nobody ever went broke taking profits and reducing risk. Plan the trade, make the trade come to you and then trade the plan.

Ed

Swing Trade Ideas for your consideration and watchlist: PLCE, FTK, SLCA, SLM, KSU,DKS, CROX, KLAC, SWKS, QRVO, ZM. Trade smart, take profits along the way and trade your plan. Also, don’t forget to check for upcoming earnings. Finally, remember that the stocks/etfs we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service