Fear of Virus Resurgence in the Markets

Markets gapped up just under a percent on Tuesday and then proceeded to chop sideways until reaching the highs at 2pm. From there we saw a steady selloff into the close. For the day, SPY was up 0.44%, DIA up 0.45%, and QQQ up 0.85%. However, none of the index candles looked particularly bullish at the close. The large-caps both had black bodies and the QQQ put in a Shooting Star type candle. VXX was down again to 34.45 and T2122 fell back to mid-range at 55.32. The 10-year bond yield rose slightly to 0.713% and Oil (WTI) fell to $40.24/barrel. However, the story of the day was that AAPL and AMZN (and FB to a lesser extent) held markets up, particularly the QQQ by themselves for most of the day. All 3 companies printed record-high closes on the day.

During the day, President Trump told reporters Tuesday that he is open to more stimulus, specifically more checks for individuals. Treasury Sec. Mnuchin also said he hoped Congress would pass such a plan by the end of July. Senate Republicans have opposed such plans to this point. However, the Administration backing may change their political calculus on this issue.

On the Virus front, the global headline numbers are 9,381,389 confirmed cases and 480,401 deaths. The German meat-packing plant outbreak has expanded past 1,500 cases and another such plant has found 23 cases so far. The government has been quick to lockdown a second district of the country. However, the UK is headed the other direction, announcing broad reopening and even a reduction of social-distancing distance to 1 meter to help restaurants and pubs increase capacity, all to begin July 4. Ironically, the EU is now debating a measure to ban travelers from the US even as its countries open more. They are citing the haphazard rules and response in the US as the cause for concern. In Asia, Tokyo’s Governor said they found a new workplace cluster and are now expecting “quite a large number” of new cases as test results come back.

In the US, we now have had 2,424,493 confirmed cases and 123,476 deaths. 25 of the states saw an increase in the rate of new cases with a national total of 35,600 new cases on the day. CA, TX, FL, and AZ all saw a record number of new cases. TX Gov. Abbott told state residents “the safest place for you is at home.” Meanwhile, FL saw more areas make masks mandatory. However, it is worth noting that even though both the R-naught (spread rate) and hospitalizations are rising in lock-step with new cases, the national daily death rate trend (which lags) continues to fall. So, as mentioned, reopening continues with examples like NY, which has reopened its beaches ahead of the July 4 holiday.

Overnight, Asian markets were mixed and generally closer to flat. The exceptions were South Korea with a 1.42% gain, New Zealand with a 1.15% gain, and India with a 1.58% loss. In Europe, we see red across the board as virus resurgence has sparked fear. The big 3 bourses (CAC, DAX, and FTSE) are all down about 2% so far today. As of 7:30 am, US futures are pointing to a gap lower of about 0.8% in the large-caps and 0.4% in the QQQ.

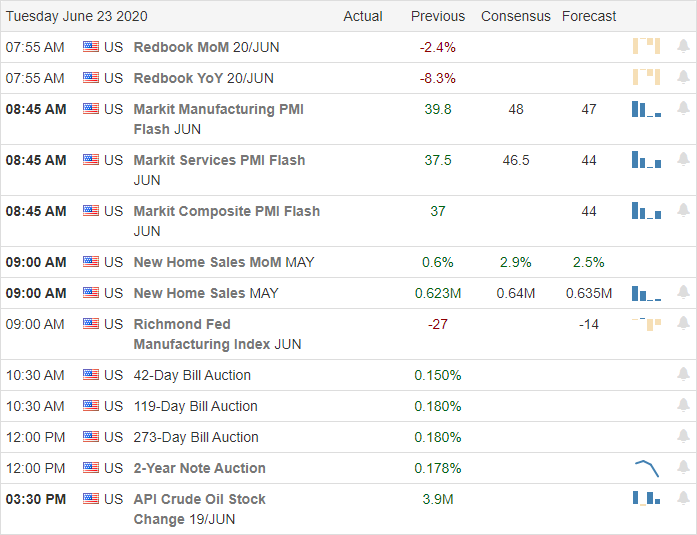

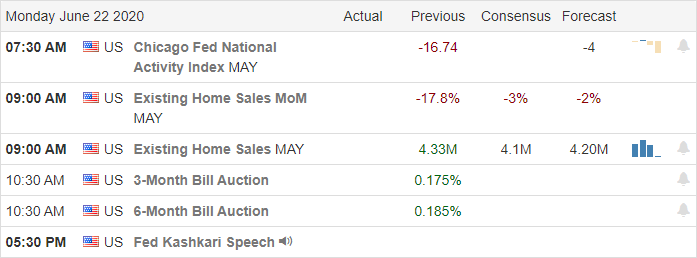

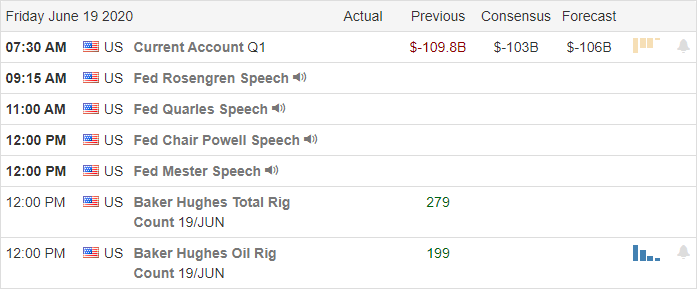

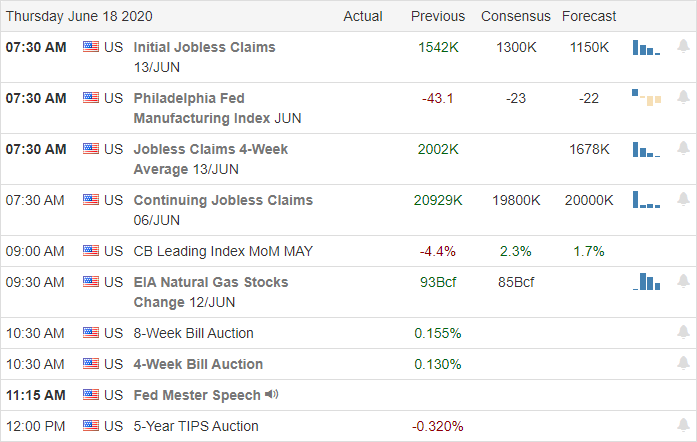

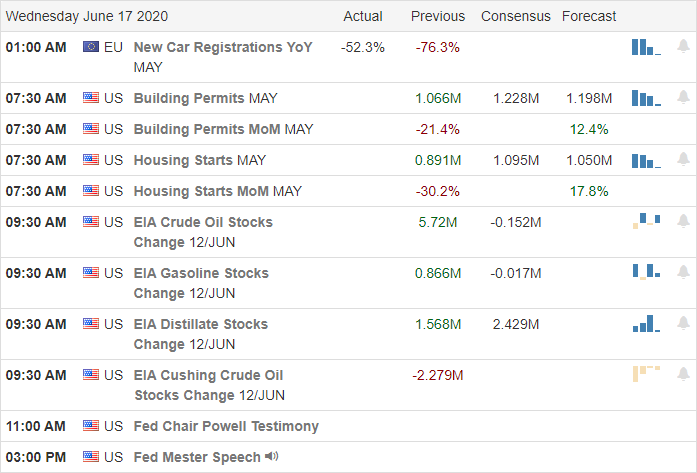

The only major economic news for Wednesday is Crude Oil Inventories (10:30 am) and an FOMC Speaker (Bullard at 3 pm). It might be worth noting that Bullard is an opponent of the idea (reported under strong consideration) of the Fed pinning bond interest rates by buying/selling whatever it takes to keep rates at a target. The only major earnings reports on the day are PDCO and WGO before the open and FUL and KBH after the close.

It’s early, but it looks like markets (at least the large-caps) are having trouble getting through resistance at recent highs. This morning we look to be following Europe on the daily gap open. With no major news scheduled today and Quarter-end rebalancing coming, we may see the bears push a little on the drift. Watch the short-term chart and be ready for the whipsaw that has been the norm. As always, don’t chase, don’t predict, and don’t be greedy (take profits and move your stops as you go).

Ed

Daily trade ideas have been moved to the trading room and the Members-Only Phone App. Trade your plan, take profits along the way, and smart. Also, don’t forget to check for upcoming earnings. Finally, remember that the stocks/ETFs we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service