Fear of the rising virus hospitalizations, debit, bankruptcies, and growing tensions with China & North Korea are apparently no match for an FOMC with an unlimited checkbook. From Monday open to Tuesday, a swing of 1000 points just in the morning gap after the Fed adds another 750 billion in direct company bond purchases. This morning the indexes will challenge the huge June 11th gap as the massive price volatility continues.

Asian markets roared back overnight with Japan rising nearly 5%, and European markets reverse to bullishness with the DAX up over 3% on in reaction to the Fed spending. Ahead of the Retail Sales numbers and the Chairman’s congressional testimony US Futures are decidedly bullish, suggesting a considerable gap in the indexes.

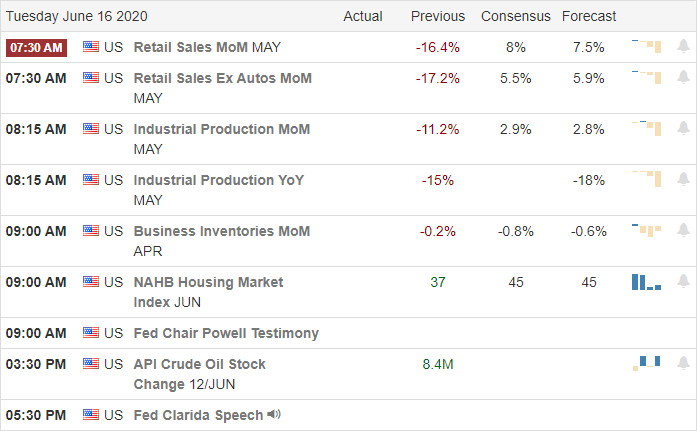

Economic Calendar

Earnings Calendar

On the Tuesday earnings calendar, we have just over 20 companies reporting their quarterly results. Notable reports include LEN, ORCL, GRPN, HRB, & MFA.

Technically Speaking

With slow and steady pressure, the bulls recovered from the substantial morning gap down as the incredible price volatility continues. Yesterday we heard the Planet Fitness declared bankruptcy, but the stock rallied during the day. Today 24 Hour Fitness joined them in declaring bankruptcy. United Airlines burrowed 5 billion against its frequent flyer program, and Hertz announced a new stock sale with the suggestion that investors will lose their money. However, none of that seems to matter these days, including rising coronavirus, unemployment, and the soaring national debt. That said, the market celebrated the news that the FOMC will add another 750 billion to buy bonds directly from companies. The President announced a plan to spend Trillion on infrastructure and will sign an executive order on police reform later today.

This morning ahead of the Jerome Powell’s testimony on the hill and several economic reports, we are once again expecting a 500 point gap at the open. Yesterday, bearish, today bullish. Count it up; that’s a 1000 point swing in just the morning gap! Amazingly that seems to have become the new normal. Today’s gap will test the 200-day average on the DIA and IWM as resistance and move us to back up into the vast gap down created on June 11th. The SPY quickly recovered its 200-day average yesterday, and the QQQ rally regained the breakout high of last February with the big internet tech companies leading the way. With the market tossing around 500 point gaps, what happens next is anyone’s guess, so prepare for another wildly volatile day.

Trade Wisely,

Doug

Comments are closed.