News that Beijing is once again instituting coronavirus isolation measures and the resurgence of hospitalizations here in the US have the bears on the prowl this morning. As of Friday, longer-term trends and major price support areas, as well as 50-day averages, remain bullish. However, the substantial spike in the VIX could make the days ahead very challenging for traders, and those bullish technical s could quickly turn bearish. With the Fed step up their operations, will the Congress approve more stimulus, will it be enough to keep the economy afloat if the feared second wave of infections begins to inflate? Tough questions to answer, making the path forward very uncertain.

Asian markets closed lower across the board, with the NIKKEI falling nearly 3.5% overnight. European indexes are decidedly bearish this morning as the threat of virus rebounds. US futures point to a rather grim gap down with the Dow expected to fall more than 500 at the open. It would appear the wild ride of 2020 is far from over, and the complexity of the recovery will be far more challenging than the recent rally would suggest.

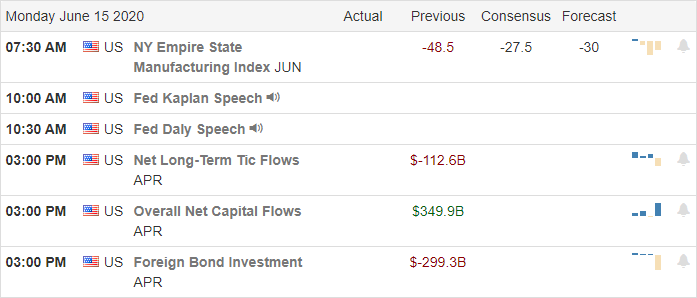

Economic Calendar

Earnings Calendar

On the Monday earnings calendar, we have a relatively light day. Notable reports included JKS & TTM.

Technically Speaking

The Friday’s bounce after the Thursday rout was a nice break in the selling, but the news over the weekend has the bears charging again this morning. We learned during the night that Beijing as reinstated isolation measures in some areas, established checkpoints and closed some schools due to a resurgence of the Coronavirus. Here in the US, even as the States try to reopen their economy’s infection rates and hospitalizations are accelerating. Planet Fitness has filed for bankruptcy and said they would close about 1000 locations as it attempts to reorganize. I suspect we will begin to hear of many more bankruptcies in the coming months as the full measure of business impacts is realized. According to reports, protesters have taken over a small area of Capitol Hill in Seattle, forcing a police station to close for the safety of the officers. The President has theathend to mobilize the national guard to restore order, but the idea does not have support by the governor.

As bad as the Thursday sell was, the longer-term bullish trends and major price supports have so far held in the DIA, SPY, and QQQ. They all remain above their respective 50-averages, and the QQQ thus now is merely testing the breakout as support. Unfortunately, the spike volatility could quickly shift those bullish technicals as the uncertainty about the path ahead with the resurgence of the virus. There are those once again predicting a market calamity, and those that believe the virus news has blown everything out of proportion, and the recovery will resume. The fact is no one knows the futures and the best we can do as traders; avoid the prediction and stay focused on price action for our trade queues or stand aside if you fell the risk of uncertainty is too high. Remember, there is no shame in protecting your trading capital; in fact, that is one of the primary jobs in this wild business of trading.

Trade Wisely,

Doug

Comments are closed.