More delays of reopening

With coronavirus surging around in many US states, the business remains under tremendous pressure with additional closures and further delays of reopening of the economy. The huge back to the school shopping season is also in question as school districts and parents grapple with the difficult decisions of reopening and child safety. Yesterday’s mild selloff left more questions with bearish candle patterns appearing on the index charts at possible highs or near resistance levels. With the VIX rising in yesterday’s close expect price volatility to remain high and extreme sensitivity to news events.

Asian markets closed mixed but mostly higher, with Shanghai rising 1.74%. European markets are seeing modest declines across the board this morning as the surge in pandemic infections worries investors. US Futures chop around the flat-line this morning with a light day of earnings and economic news.

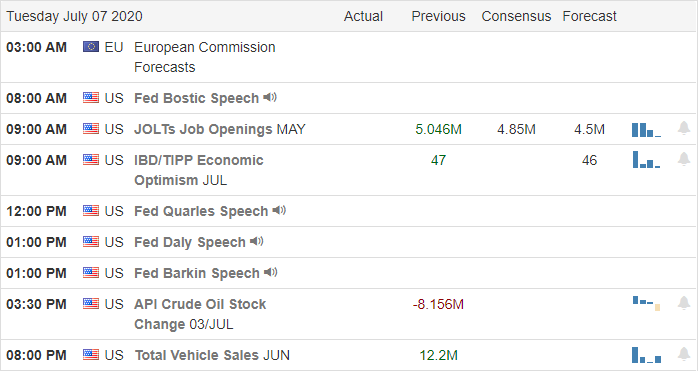

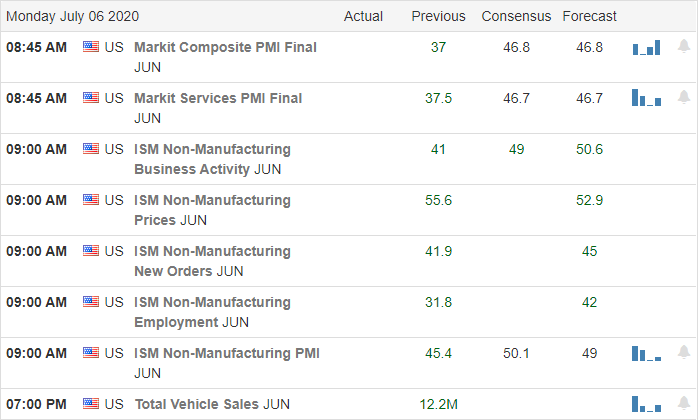

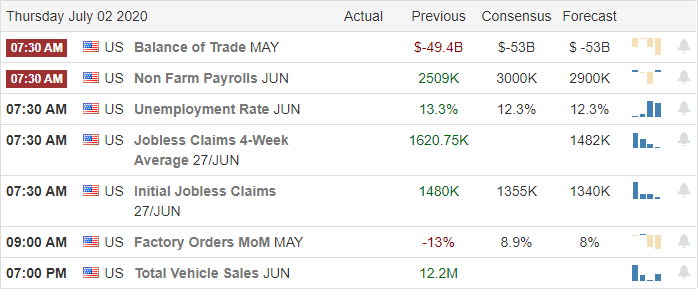

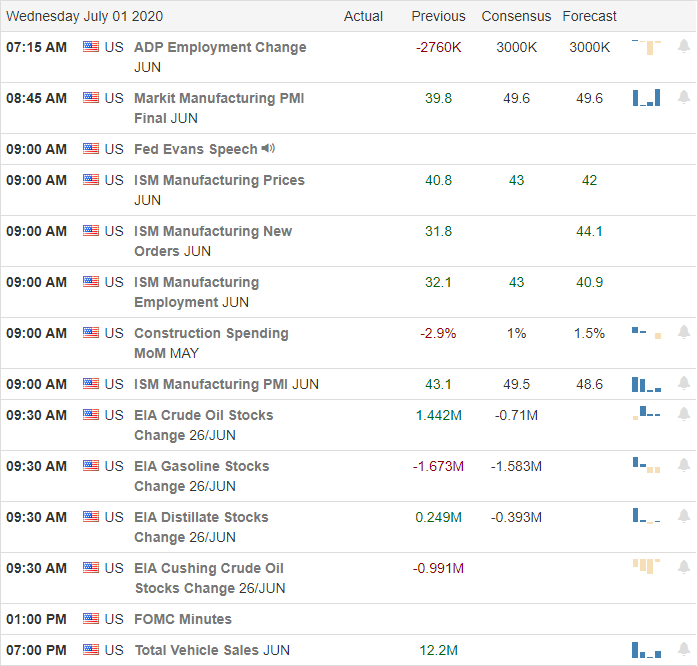

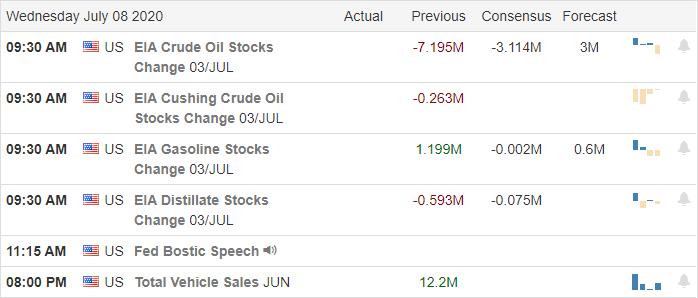

Economic Calendar

Earnings Calendar

On the Hump day earnings calendar, we have just 14 companies expected to report quarterly results. Notable reports include BBBY, MSM & SMPL.

News and Technical’s

US coronavirus infections have topped 3-million cases with states reporting more than 55,000 instances yesterday and 993 deaths. Arizona has seen a 26% increase in infections with the WHO suggesting just a 5% increase is troubling. In response to rapidly rising cases and hospitalizations, Texas canceled the state fair while San Francisco delays reopening indoor dining. It’s no wonder that parents have concerns about sending their children back to school this fall, and retailers worry about the back to the school shopping season. The President is suggesting he will do all he can to pressure schools to reopen. Tensions between the US and Chiana continue to grow after the FBI Director slammed their government for the use of espionage and cyberattacks against the United States. He said the stakes could not be higher, and the potential economic harm to American business as a whole almost defies calculation. These comments come on the heels of the Secretary of State threatening to ban Chinese social media apps.

After a gap down open, the bulls once again attempted a rally to test resistance levels but found resistance and ultimately selling off by the close. Potential bearish candle patterns such as an abandoned baby pattern or evening star patterns were left behind on the DIA, SPY. The QQQ left behind the uncertainty of a shooting star pattern, and the VIX rose above a 29 handle. Declining issues far outpaced advancing issues after the Schwab pointed out that 90% of the current market rally is attributed to just the top 10% of companies. This colossal imbalance raises the question, what happens to the market should these tech giants begin to selloff? An interesting question to ponder as we head for a relatively flat open with a light day of earnings and economic news.

Trade Wisely,

Doug