After a late-day surge, the market closed inking the most robust quarterly rally since 1987 fuled by trillion upon trillion of stimulus and historic central bank operations. However, immediately after the cash close, the futures began selling off and now point to a substantial gap down at the open, taking back most of yesterday’s rally. With a long weekend beckoning traders to extend vacations, look for volumes to decline over the next couple days after the morning reaction to earnings and economic news.

Asian markets closed mixed but mostly higher after June manufacturing activity beat expectations. European markets are decidedly bearish this morning with indexes declining by as much a 1.50%. US Futures point to a gap down open ahead of a big morning of economic data and worries of rising virus infections weigh on the market.

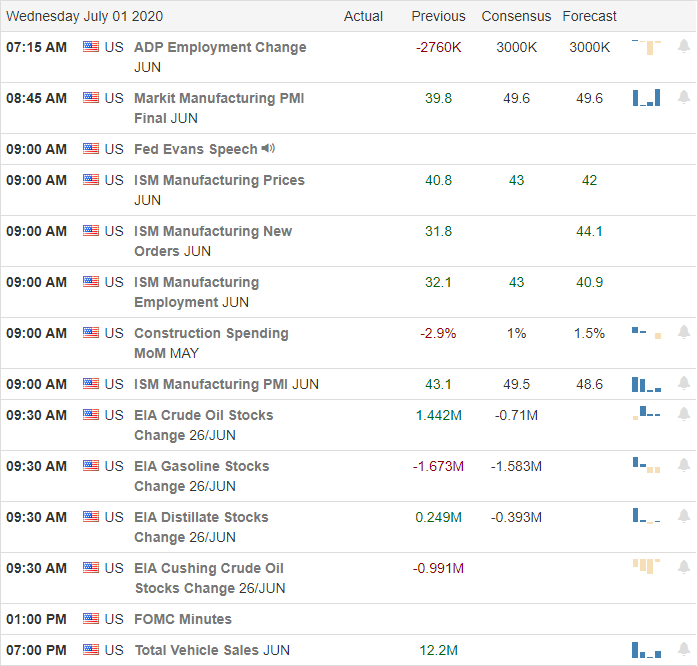

Economic Calendar

Earnings Calendar

On the 1st day of the 3rd quarter, we have 13 companies stepping up to report quarterly results. Notable reports include M, STZ, CPRI, & GIS.

News and Technicals

The last day of the 2nd quarter spent most of the morning session chopping in a narrow range, but in the afternoon, the bulls seized control, pushing the index up into the close. Thanks to the trillion upon trillion in central bank operations and governmental stimulus, we had the most robust quarterly rally since 1987. Interestingly enough, as the market surged higher into the close, the Absolute Breadth Index declined, and the VIX held above a 30 handle. Gold and silver also sharply rallied often considered a safe-haven trade. During testimony to congress, Dr. Fauci, the White-House health advisor, said the coronavirus outbreak is going to be very deturbing and may top 100,000 new cases per day. Yesterday the US reported just over 46,000 new infections and more than 750 further deaths. As the death toll approaches 130,000, Goldman Sachs called for a national mask-wearing requirement in public to save the economy. During the night, the Senate voted to extend the small business coronavirus relief program called the Paycheck Protection Program through August 8th. Also during the night, Hong Kong makes its first arrests just one day after China’s new so-called national security law. The law says that any person that acts to undermine national unification faces punishment up to a lifetime in prison.

Yesterday’s rally pushed the DIA up to test its 500-day moving average, but by the close was unable to muster the energy to break above. The SPY comfortably held above its 200-day while the IWM remained substantially below. The DIA, SPY, and IWM are still within a short-term downtrend while the QQQ continues to dominate the market with MSFT and AAPL doing the majority of the lifting yesterday. Immediately after the cash close yesterday, the futures began to selloff and now point to a significant gap down this morning. With a busy economic calendar, the next 2-days and rising concerns on the impacts of the rising pandemic, anything is possible as we approach the 4th of July market shutdown. Expect volume to begin to decline as traders take off early to extend their vacation time.

Trade Wisely,

Doug

Comments are closed.