The NASDAQ lept higher yesterday, setting new records while the Dow, SP-500, and Russell struggled to find follow-through to break price resistance levels. In a pattern that’s becoming all too familiar of late, the big morning gap struggled to find buyers or sellers as it chopped sideways the majority of the day. This morning with the EU forecasting an 8.3% economic slump and the US states beginning more business shutdowns, it looks as if the big gap this morning will be down trapping those that chased in yesterday.

Asian markets closed mixed but mostly lower overnight. European markets fall on concerning economic data with the DAX, FTSE, and CAC down 1% or more this morning. US Futures in reaction to virus-related business uncertainty suggest a substantial gap down at the open ahead of a light day of earnings and economic reports.

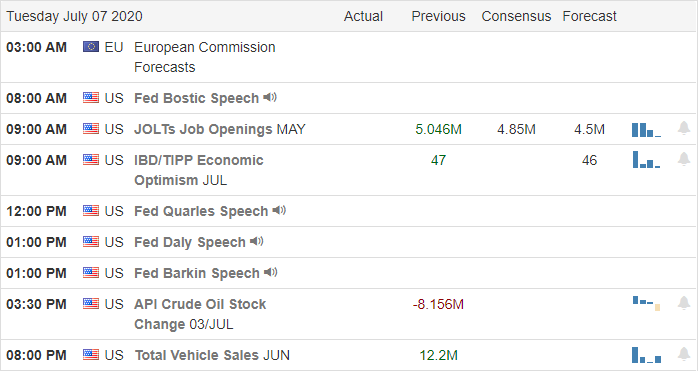

Economic Calendar

Earnings Calendar

On the Tuesday earnings calendar, we have 10-companies fessing up to quarterly earnings. Notable reports include LEVI and PAYX.

News and Technical’s

We have reached nearly 3 million coronavirus cases in the United States, with several states doubling infection rates in just two weeks. Florida is once again closing restaurants, health clubs, and group party venues, and some areas in Texas are reaching hospital capacity. Australia closed interstate borders in an attempt to slow the spread of the pandemic, and the Governor of California asks indoor business to close. With more and more states adding to shutdown orders and mulling future restrictions, it would seem the economic recovery continues to face considerable challenges. As tensions grow with China, the US is conducting war games in the South China Sea and, at the same time, looking at banning social media apps such as TikTok. During the night, the EU cut its economic forecasts for the region and is now projecting an 8.3% decline in the economy this year.

Yesterday’s big morning gap struggled to find follow-through buyers spending most of the day chopping sideways. The DIA, on a last-minute surge at the end of the day, breached the resistance of its 200-day average. Although the SPY tried hard to break the resistance of the early June island reversal pattern, it closed the day, failing to breakthrough. The QQQ lept higher with the tech giants leading the way while the IWM closed the day lower once again, unable to reach its 200- day average. With a light day of earnings and economic news, the market seems to have turned its attention to the impacts of the viral surge that is prompting business shutdowns in several states. As of now, the US futures are pointing to a gap down open that has the potential to create abandoned baby patterns at resistance in the DIA and SPY. With the VIX remaining elevated, expect the wild price volatility to continue today.

Trade Wisely,

Doug

Comments are closed.