The NASDAQ soars to new record highs, as does the number of coronavirus infections across the country. As business once again close and state rollback reopening plans, the market appears to have no concerns whatsoever, pointing to a substantial gap ahead of the holiday shutdown. Bad news has become good news, and the good news is now seen as excellent news, and no price is apparently too high for the bulls. Today is all about the jobs, then expect volume to drop off quickly as we head into an early market close for the holiday.

Asian markets closed higher across the board even as hundreds of protesters were arrested in Hong Kong under the new security laws. European markets trade sharply higher this morning boosted by vaccine hopes with banks up as much as 4%. Ahead of employment data and jobless claims, the US Future point a gap open even as virus numbers surge to a new daily record high.

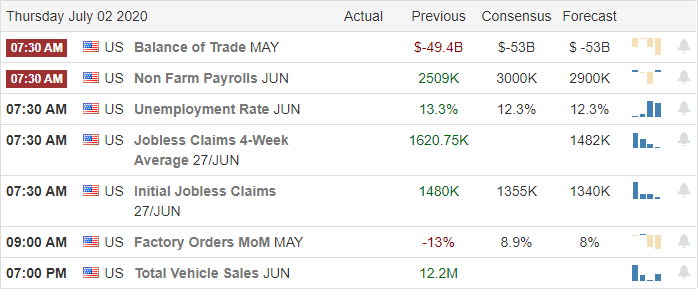

Economic Calendar

Earnings Calendar

On the Thursday earnings calendar, we have just seven companies reporting results. The only somewhat notable report is that from KFY.

News and Technical’s

As we hit a new daily record high of coronavirus infections and states rollback reopening plans, the US Futures point to new record highs. California has once again closed all indoor operations for about 70% of the States population due to rising numbers. New York has also announced to rollbacks, and Apple said it would close 30 more stores across the country in response. Congress extended the paycheck protection program, and it looks as if Congress is moving forward with another round of direct payments to taxpayers that could be as much as $6000 per household. With MSFT and AMZN leading the way, the QQQ set new record highs yesterday with the DIA and IWM closing the day slightly lower.

Today we get both the Employment Situation number and the weekly Jobless Claims. If the consensus estimates are correct, the rehiring last month is likely a new record since the numbers have been tracked all the way back to 1939. Looking at the market, the millions that remain unemployed and the current round of further state shutdowns don’t seem to matter. Bad news is good news, and good news is excellent news as there appears to be no price too high as stocks continue this historic rally. One has to wonder if the upcoming earnings can support current market prices. Only time will tell. Keep in mind that we have an early market close today, and volume is likely to fall off quickly after the morning reports as traders head out for the 3-day weekend. Have a safe and fantastic 4th of July, everyone!

Trade Wisely,

Doug

Comments are closed.