Success: Planning, Stops, Management

Tuesday 12-29-20 e-Learning

Tuesday 12-29-20 e-Learning

Members E-Learning and I think the title says it all.

The bears decided to make an appearance yesterday, raising some concern in the IWM as it slipped below its uptrend. Although printing some bearish candles, the DIA, SPY, and QQQ uptrend remain intact as the bulls fight back in the premarket, suggesting a bullish open. Consider your risk carefully, as the volume could quickly diminish today, making it difficult for the bulls to sustain the opening pop. Plan your risk carefully as we slide into the holiday shutdown.

Overnight Asian markets traded mostly lower as China revised 2019 GDP growth lower. European markets trade flat to modestly lower this morning despite the positive vaccine news with stocks lacking momentum. The U.S futures bucking the trend point to a higher open as the bulls fight to regain record territory once again. Momentum could be a problem today, so stay focused and be careful not to get caught up in fear of missing out.

There are no confirmed earnings reports today.

Vaccine is back in the news today, with the Oxford-AstraZeneca gaining approval in the U.K. McConnell blocks the $2000 direct payments approved just yesterday by the U.S. House. Then tied the bill to other legislation that includes election security as well as tech. McConnell also asked the Senate to approve the military spending bill that was vetoed by the President. Colorado has confirmed the first case of the new, more infectious strain of COVID discovered in the U.K. One of the newly elected Congress died yesterday in a Louisiana hospital from COVID-19 just days before being sworn in and taking his seat. He was only in his 40’s.

Although the bears came out to play yesterday, leaving behind some concerning daily candle patterns, yet three indexes remain in bullish trends. The very extended IWM index is of most concern following the Tuesday bearish engulfing candle to slip below its current uptrend. However, we once again see the futures pointing to a bullish open as the familiar morning pump begins. Yesterday’s selling relieved the pressure of overextended condition in the T2122 indicator, but the Absolute Breadth Index continues to decline, providing a reason for caution. Keep in mind volume is likely to drop quickly today, and the early pop higher may have trouble finding the momentum to sustain.

Trade Wisely,

Doug

Markets gapped higher about half a percent again Tuesday. However, after the gap, the rest of the day saw a roller coaster selloff. This caused large black Bearish Engulfing candles in the large-cap indices and a Black Spinning-Top type candle in the QQQ. However, it is worth noting the QQQ also closed at yet another all-time high. Part of the reason behind the post-gap selloff might be that Tuesday was the last day to sell (or buy) and have the trade settled before year-end. On the day QQQ led at almost flat +0.09%, while the SPY (-0.19%) and DIA (-0.18%) were down slightly on the day. The VXX rose over 3.6% to 17.43 and T2122 fell to the low side of the midrange at 45.35. 10-year bond yields rose to 0.938% and Oil (WTI) also gained a percent plus to $48.23/barrel.

During the day, Senate Democrats moved for unanimous consent to the increase in direct payments to Americans to $2,000. However, that was showdown by Senate Majority Leader McConnell. The “consensus view” is that McConnell will block all attempts for a Senate vote on the direct payments until after the GA Senate runoff elections end next week. So, the only vote expected in the Senate this week will be a vote on overriding the President’s veto of the $740 billion Defense Spending bill.

Related to the virus itself, US infections continue the winter surge. The totals have risen to 19,977,704 confirmed cases and 346,579 deaths. The expected post-holiday surge is still a couple of weeks away. However, the 7-day daily average remains high at 184,221 new cases and the average number of deaths was raised by a record number of new deaths that brought the average to 2,250 deaths per day. Overnight, a LA Congressman-elect died of Covid. In CA, Governor Newsome extended the stay-at-home order for two regions of the state Tuesday and the new order will stay in place until those regions’ “available ICU bed capacity” rises to at least 15%. Elsewhere, CO has genetically verified the first case of the new strain of the virus (first seen in the UK) that appears much more contagious, but also has no worse a rate of hospitalizations and is no more deadly than the original strain. The more concerning point was that the case was found in a man who had no history of travel. This implies the case was locally transmitted.

Globally, the numbers rose to 82,446,401 confirmed cases and the confirmed deaths are now at 1,799,505 deaths. As a reference, the world is averaging about 563,575 new cases and 10,321 new deaths per day. In the UK, they approved the Oxford-AZN vaccine today. The AZN vaccine is less effective (70%), but also requires much less stringent storage temperatures. In Asia, countries continue to retighten their borders due to the new strain of virus. Taiwan and Hong Kong joined the list of countries prohibiting or tightening requirements for International travelers entering the country. In China, the state-owned pharma company Sinopharm announced data showing their own vaccine is 79.34% effective based on two doses.

Overnight, Asian markets were mixed yet again, but this time leaned to the green side. Hong Kong (+2.18%), South Korea (+1.88%), and Taiwan (+1.49%) led the gainers. The losses came from smaller exchanges like Indonesia (-0.95%), Thailand (-0.86%), and the larger Japan (-0.45%). There is a similar story in Europe so far today, but on much more moderate moves. Among the big 3 bourses, the FTSE (-0.06%) and CAC (-0.02%) are on the red side of flat, while the DAX (+0.08%) is just on the green side of flat. As of 7:30 am, US futures are pointing to a positive open. The DIA is implying a gain of +0.29%, the SPY implying a gain of +0.34%, and the QQQ implying a gain of +0.33%.

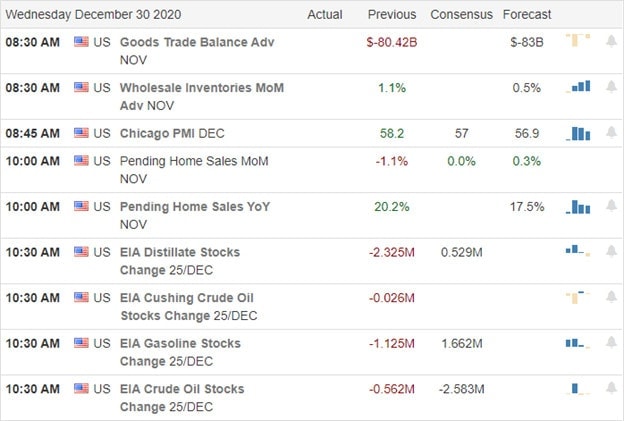

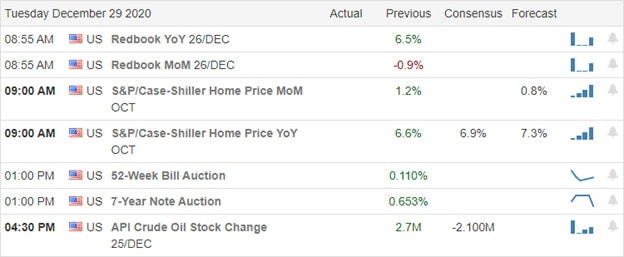

The major economic news for Wednesday is limited to Nov. Trade Balance and Nov. Retail Inventories (both at 8:30 am), Dec. Chicago PMI (9:45 am), Nov. Pending Home Sales (10 am), and Crude Oil Inventories (10:30 am). There are no major earnings reports on the day.

With the last day to sell (and get the sale settled before year-end) behind us, the Bulls should have a tailwind today. However, with no earnings and no major recent economic news catalyst, it may not be a strong wind. Also, keep in mind that volume is expected to remain on the light side.

Focus on working your process and keep your eye on the chart. Lock in those base hit profits and maintain your discipline. Follow the trend, respect support and resistance, and don’t chase the moves you have missed. Remember that trading is a marathon, not a sprint. So, don’t try to get rich quick. Do it in the long-run by hitting goals over and over again.

Ed

Swing Trade Ideas for your consideration and watchlist: MKC, HWM, NIO, RIOT. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Another record-setting day as the market celebrates the passage of the stimulus bill. With a very light day of earnings and economic news, you might want to keep an eye on the Senate today as they deliberate on the $2000 direct payments bill passed by the House yesterday. It could make for some interesting political drama, and their decision could have significant market ramifications.

Overnight Asian markets were mixed but mostly higher as the NIKKEI surged to price levels not seen since the early 1990s. European markets are green across the board this morning, and the U.S. futures point to more new record highs as the bulls continue to march higher. Remember, volume and momentum can quickly diminish as we approach the holiday shutdown plan your risk accordingly.

On the last trading Tuesday of 2020, we have a light day of earnings with just one verified report coming from JRJC.

After a record-setting day, futures continue to push higher in reaction to the stimulus bill’s passage. Yesterday the U.S. House passed a bill to raise direct payments to $2000, and they easily gained the 2/3 vote required to override the President’s veto of the defense bill. The focus will now turn to the Senate as the legislative year draws to a close. Treasury yields continue to rise this morning and may well react depending on the Senate vote on stimulus checks. The Boeing 737 Max returns to the air here in the U.S., which may be good timing with investors seeing a bright near-term future for airlines anticipating a significant return to air travel post-pandemic environment.

Although the market remains in rally mode, it’s a bit difficult for me to be excited about the rally, with volume likely to shrink heading toward the New Year’s shutdown. The Absolute Breadth Index continued to decline yesterday, indicating fewer and fewer stocks are holding the market up. The T2122 indicator also supports that thought showing a modest decline yesterday as the market rallied. The tech giants AAPL, AMZN, GOOG, MSFT, did most of the work yesterday, enjoying strong buy-side pressure. Plan your trading carefully as volume and momentum can quickly fade as we approach the holiday.

Trade Wisely,

Doug

Markets gapped up Monday on the signing of the Stimulus package. However, stocks then roller-coastered sideways the rest of the day. This left all 3 major averages with some soft of a gap-up Doji candle. The worst of those was the DIA which printed a high-wick Shooting Star tyle candle. On the day, SPY was up 0.86%, DIA up 0.66%, and QQQ up 1.01%. VXX was flat at 16.82 and T2122 fell just outside of overbought territory to 78.15. 10-year bond yields fell slightly to 0.923% and Oil (WTI) dropped a percent to $47.69/barrel.

After hours the House passed a bill (with 73% voting for the measure) calling for the $2,000 direct payments President Trump said he wanted. This will force the Senate Republicans to publicly vote for/against the matter that the President knows most GOP members oppose. The other vote of note was that the House overrode the President’s veto of the $740 billion Defense Spending bill. Again, this pushes the bill to the Senate where an override vote will be held today.

Related to the Chinese economy, a survey of Chinese executives done by China Beige Book said they do not expect their companies to return to 2019 profitability until after the first quarter of 2021. In related news, the IMF reports that the Chinese economy now has more purchasing power than the US economy and that Chinese GDP should pass that of the US within the next 6-7 years. Assuming the projections are correct, that would be the first time since the 1920s that the US did not have the largest GDP on the planet.

Related to the virus itself, US infections continue to rage as the US. The totals have risen to 19,781,718 confirmed cases and 343,182 deaths. As expected, there was a significant falloff in reported new cases and deaths over the long holiday weekend (as state and hospital offices were closed). However, the 7-day daily average remains 184,692 new cases and the average number of deaths are 2,247 deaths per day. The number of Covid-19 hospitalizations reached an all-time high of over 121,200 Monday. In Los Angeles, one hospital system CEO reports they will need to begin rationing care with the expected Christmas wave of new cases.

Globally, the numbers rose to 81,769,157 confirmed cases and the confirmed deaths are now at 1,784,070 deaths. As a reference, the world is averaging about 559,998 new cases and 10,143 new deaths per day. In Asia, travel bans are ticking up again due to the newest strain of the virus. Indonesia and the Philippines are banning foreigners from entering their countries as of January 1. In Europe, the Netherlands will demand a negative PCR test within 72 hours of all arrivals. In follow-up news, Chinese CDC researchers say a study of 34,000 people in Wuhan show a 4.43% prevalence of antibodies. This implies the number of cases in Wuhan was 10 times higher than officially reported. However, outside that city of 11 million, he rate is only 0.44%, which falls more or less in-line with Beijing totals.

Overnight, Asian markets were mixed again. Japan (+2.66%) again far out-paced other gainers with Hong Kong (+0.96%) next in line. Among losers, Indonesia (-0.94%), Shenzhen (-0.64%), and Shanghai (-0.54%) paced the losses. In Europe, markets are green across the board. The FTSE (+2.12%) made significant catch-up gains while the DAX (+0.28%) and CAC (+0.44%) are more typical as of this point in the day. As of 7:30 am, US futures are pointing to a positive open. The DIA is implying a gain of +0.45%, the SPY implying a gain of +0.48%, and the QQQ implying a gain of +0.44%.

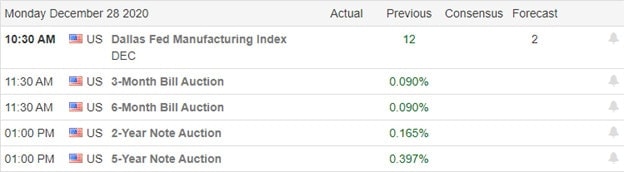

The only major economic news for Tuesday is Conf. Board Consumer Confidence (10 am). There are no major earnings reports on the day.

Once again, with no economic or earnings data and still being in the holidays, the bulls may be able to keep prices drifting higher. However, beware of the possibility of year-end profit-taking and portfolio rebalancing that could lead to selling and rotation. Also, keep in mind that volume is expected to be light. The other potential driver would be the Senate vote on additional direct payments. While expected to be rejected, if passed that extra $1,400 in American pockets could help the bulls.

As usual, focus on the process and chart, keep locking in profits and maintain your discipline. Follow the trend, respect support and resistance, and don’t chase the moves you have missed. Remember that trading is a marathon, not a sprint. Don’t try to get rich quick. Do it in the long-run by hitting goals over and over again.

Ed

Swing Trade Ideas for your consideration and watchlist: LYFT, TJX, SBUX, AAOI, YUM, MGM. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

With the signing of the stimulus bill, the bulls are bidding up the futures market this morning, suggesting a gap up open with the possibility of some new record highs as a result. However, there is a reason for some caution, with a significantly elevated T2122 indicator and the Absolute Breadth Index remaining in decline. Plan carefully and stay alert for the traditionally low volume that often accompanies the days between Christmas and New Year’s.

Asian markets closed mixed but mostly higher, with Hong Kong declining as Alibaba shares plunge nearly 8%. European markets are green across the board this morning, celebrating a Brexit trade deal and, in reaction, the $900 Billion stimulus spending. Here in the U.S., futures point to a bullish open and possible index records as we kick off the last 4-trading days of 2020.

We have only four verified earnings this Monday. Notable reports include FDS and HEI.

After hinting that he may not sign the stimulus bill, President Trump finally signed it into law while still supporting the idea of $2000 direct payments rather than the $600 the bill provides. That news is inspiring European markets and U.S. futures markets higher at the open. Treasury yields trade higher this morning as well relieved by the avoidance of a government shutdown heading into the end of the year. With air travel hitting new post-pandemic highs over the Christmas Holiday, Whitehouse advisor Dr. Fauci warns of a likely surge in infection rates coming in the weeks ahead.

With the overnight surge of bullishness after news of the stimulus bill came out, the indexes point to gap up open and possible new record highs. However, traders will have to stay on their toes as the trading days between Christmas and New Year’s traditionally suffer from a lack of volume, meaning momentum may quickly fade. With a light day on the economic calendar and very little in the way of earnings, the market could be quite sensitive to political news. Stay focused and plan your risk carefully, as price action could quickly become light and choppy.

Trade Wisely,

Doug

Thursday saw a flat open in the Market. Then after a sideways grind most of the day, a late-day “here comes a day off” rally in the afternoon saw an early close near the highs. The large-caps printed inside days and the QQQ printed a Bullish Harami on the day. At the close, SPYA was up 0.39%, QQQ up 0.44%, and DIA up 0.25%. The VXX was down almost 3% to 16.88 and T2122 (4-week new High/Low ratio) fell, but remains well inside overbought territory at 89.69. 10-year bond yields rose slightly to 0.926% and Oil (WTI) rose to $48.30/barrel.

In another bad sign for BA, one of its just-recertified 737 Max planed had to divert for an emergency landing during its delivery flight to Air Canada (from the Arizona storage facility where 737 Max have been moth-balled during the 18-month flight ban). The problem seemed to be an engine hydraulic warning, which forced the shutdown of the engine shortly after takeoff. In other corporate news, FB is shutting down the Irish holding companies that allowed it to shift billions of dollars to Ireland to avoid higher taxes in the US and other countries. Finally, Sunday BABA announced it is increasing its share buyback plan from $6 billion to $10 billion, but this has not helped the stock as Chinese regulators pressure the company o come in line with Chinese law.

The other major story of the weekend was President Trump’s continued calls for a more generous $2,000 per person direct payment and his not signing the stimulus bill which contains a $600 direct payment (and a lot of pork and unrelated spending). The net effect is that the unemployment and loan programs expired Saturday. However, on Sunday night, after strong-arming Republican Senators into agreeing to votes on an increase in the direct payments, his unfounded allegations of election fraud, and his desire to punish Social Media companies by repealing Section 230, he did sign the bill.

Related to the virus itself, US infections continue to rage as the US. The totals have risen to 19,573,847 confirmed cases and 341,138 deaths. As expected, there was a significant falloff in reported new cases and deaths over the long holiday weekend (as state and hospital offices were closed). However, the 7-day daily average remains 183,773 new cases and the average number of deaths fell to 2,238 deaths per day. The expectation is that cases will soar again in a couple weeks after holiday travel and gathering spread has incubated.

Globally, the numbers rose to 81,217,556 confirmed cases and the confirmed deaths are now at 1,773,724 deaths. As a reference, the world is averaging about 559,998 new cases and almost 10,128 new deaths per day. Over the weekend the EU began vaccinations with the PFE-BNTX vaccine. They are also expected to approve the AZN vaccine this week.

Overnight, Asian markets were mixed in modest trading moves. Among the exchanges, Japan (+0.74%) was the clear leader to the upside, while Thailand (-2.26%) was far and away the biggest loser. However, in Europe markets are green across the board so far today. Among the 3 major bourses, The DAX up 1.52%, the CAC up 1.15%, and the FTSE lags at a flat +0.10%. This was aided by an unexpected (and not yet ratified) Brexit trade deal. The UK Economic Minister reported that instead of a -6% GDP in 2021, the deal likely means only a -4% GDP. As of 7:30 am, US futures are pointing to a gap higher. The DIA is implying a gain of +0.52%, the SPY implying a gain of +0.68%, and the QQQ implying a gain of +0.73%.

There is no major economic news for Monday. The only major earnings report on the day will be WB before the open.

With no economic or earnings data and still being in the holidays, the bulls may be able to keep prices drifting higher. However, beware of the possibility of year-end profit-taking and portfolio rebalancing that could lead to selling and rotation. The resumption of the expired stimulus programs may help, but this came at the cost of more political theatre to come. Democrats plan to put the $2,000 direct payment to a vote today and the Republicans oppose the idea. (Many see this as a GOP power struggle between outgoing President Trump and rest of his party led by Senate Majority Leader McConnell.)

It looks like a strong open today. You will be very tempted to chase, but consider where markets are in general (near all-time highs) with political theatre ahead and expecting more bad virus news soon. As usual, my advice is to focus on the process and chart, keep locking in profits and maintain your discipline. Follow the trend, respect support and resistance, and don’t chase the moves you have missed.

Ed

Swing Trade Ideas for your consideration and watchlist: No Trade Ideas Today. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

The bill is now on the president’s desk, but he calls the stimulus bill unacceptable. He calls on Congress to raise the direct payments to $2000 from the approved $600 and cut the laundry list of wasteful pork belly spending. An interesting turn of events is likely to keep the media hopping and the market unsettled with the uncertainty. The NASDAQ printed its 54th new record high in 2020 yesterday, a remarkable feat considering the economy’s actual state. Keep in mind volume typically declines as we head into the holiday shutdown. Plan your risk accordingly.

Overnight Asian markets rallied in response to the Congressional passage of the stimulus bill. Across the pond, European are mostly higher on hopes that a Brexit trade deal is on the verge of completion. U.S. Futures recovered overnight loss and currently point to a bullish open ahead of a busy economic calendar with potentially market-moving effects. Right Way Options will be closed on Christmas Eve and Christmas day, so there will be no blog or Morning Prep Video. On behalf of my family, I want to wish you and yours a safe, Very Merry Christmas.

It should not be a big surprise that there are very few earnings as we head toward the Christmas shut down. There is only one notable report, PAYX. We have no notable reports on Thursday and, of course, Friday.

After weeks of wrangling, both Congress bodies finally passed the stimulus bill, but now that’s it’s on the President’s desk, he says it’s unacceptable. Although he has not said he will veto the bill, he has asked Congress to increase the direct payments to $2000 per citizen and up to $4000 per couple. He also listed a disgraceful laundry list of wasteful pork belly spending in the bill he wants cut before signing the spending plan. A movie script on the last few week’s politicals in the U.S. would have been trashed as too unbelievable just a few years ago. According to reports, the U.K. and E.U. may be near a Brexit trade deal, good news, as they quickly approach the deadline. With the new virus, strain brings up worries of more business restrictions; the Dow lost ground yesterday, but the resilient NASDAQ inked its 54th new record of 2020. A remarkable and honestly unbelievable feat considering the state of the economy and rapidly pandemic having many hospitals near capacity.

We have a very bid day on the Economic Calendar today, and the bulls remain very feisty, recovering from overnight losses pointing to a bullish open. Index trends remain bullish, but with the Absolute Breadth Index continuing to decline and the holidays just around the corner, there is a reason for caution. Plan your risk carefully. Right Way Options will be closed on Christmas Eve and Christmas day, so there will be no blog or Morning Prep Video. On behalf of my family, I want to wish you and yours a safe, Very Merry Christmas.

Trade Wisely,

Doug

Tuesday brought us a small gap down in the large-caps and a small gap up in the QQQ. After the open, the DIA slowly ground lower, the SPY and QQQ undulated more sideways. The DIA printed a Bearish Harami and the QQQ printed a long-legged Doji, while the SPY printed a run-of-the-mill black-bodied candle. On the day, QQQ gained 0.27%, SPY lost 0.17%, and DIA lost 0.69%. The VXX fell a little under 2% to 18.11 and T2122 rose near, but just outside of the overbought territory at 77.03. 10-year bond yields fell to 0.921% and Oil (WTI) fell almost 2.5% to $46.80/barrel.

President Trump felt the need to lash out again overnight. This time his tweet called the Stimulus bill a disgrace and demanded Congress change the $900 Billion bill to add bigger direct payments to Americans. He did not overtly threaten a veto, but the threat was implied. This came out of the blue, especially since his own Treasury Sec. (Mnuchin) was one of the lead negotiators. The President’s demand for larger direct payments also flies in direct opposition to the Senate GOP position that there should have been no additional direct payments (which was then negotiated up to the final agreed number of $600). If vetoed, the move would also kill the $1.4 trillion omnibus spending bill, which would close the government. Treasury yields climbed and futures moved down on the news.

In other after-hours Tuesday news, the NYSE announced that most of their trading floor personnel will go back to remote work as of December 28. This includes all the market makers. This follows the same rules as the historic floor operations shutdown back in March and is based on a new level of outbreak in the New York City area.

Related to the virus itself, US infections continue to rage as the US. The totals have risen to 18,684,628 confirmed cases and 330,824 deaths. The weekend saw another small reduction in new cases and deaths Monday, but the 7-day daily average remains 219,171 new cases and the average number of deaths rose to 2,781 deaths per day. This comes after we reported the second-highest number of daily deaths on Tuesday.

Globally, the numbers rose to 78,476,586 confirmed cases and the confirmed deaths are now at 1,726,558 deaths. As a reference, the world is averaging about 648,000 new cases and almost 11,700 new deaths per day. In Europe, France agreed to reopen border crossing with the UK, but only for people who can present a negative test that had been taken within 72-hours of the crossing. However, with a queue that has already grown for 48 hours, it will take time to get drivers the test and clear the backlog. In the meantime, German airline Lufthansa has begun flying special cargo flights of fresh produce to the UK. (Sort of the opposite of the Western airlift into Berlin during the Berlin Blockade.) That said, Germany reported its highest daily death toll since the beginning of the virus.

Overnight, Asian markets were mostly in the green. Among the major exchanges, South Korea (+0.96%) and Hong Kong (+0.86%) led the way. The only losses were in smaller exchanges like Thailand (-0.59%) and Indonesia (-0.24%). Europe is also mixed, but leans to the green side so far today. Among the big 3 bourses, the FTSE (-0.09%) is on the red side of flat, but the DAX (+0.52%) and CAC (+0.46%) are green and more typical of the continent. As of 7:30 am, US futures are pointing to a flat, but mixed open. The DIA is implying a slight gain of +0.15%, the SPY also implying a slight gain of +0.16%, and the QQQ implying a small loss of -0.09%.

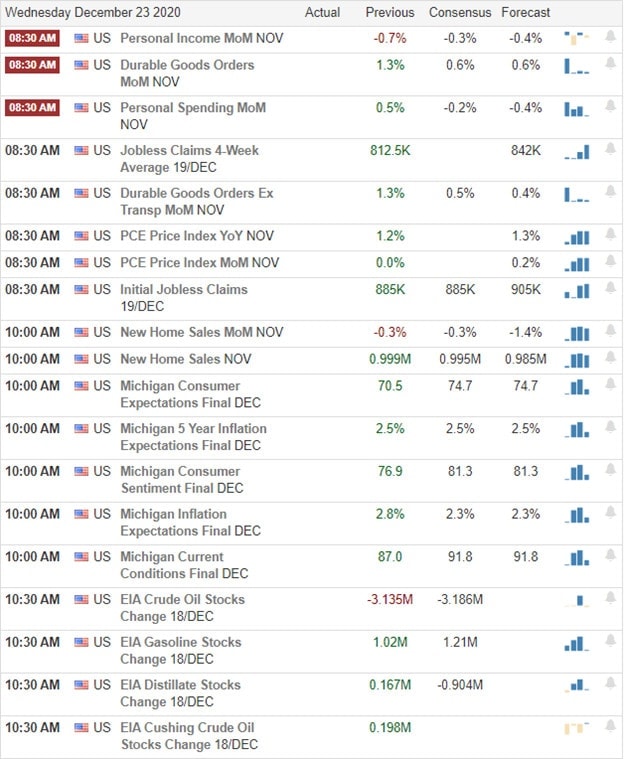

The major economic news on Wednesday includes Nov. Core PCE, Nov. PCE Price Index, Nov. Personal Spending, and Weekly Jobless Claims (all at 8:30 am), Univ. of Michigan Cons. Sentiment and Nov. New Home Sales (bot hat 10 am), and Crude Oil Inventories (10:30 am). The only major earnings report on the day will be PAYX before the open.

With the holiday fast approaching, more and more traders will be away from the market. The President’s ojection to the stimulus deal and fear over the virus (and almost inevitable new wave after people ignore the advice and congregate for Christmas and New Year’s Day) are fighting against holiday cheer for the mind of th market. Remember that the bulls are extremely resilient. So, be careful, but don’t take any rash actions. Stick to the chart.

Respect the trend, support and resistance, and price action. Focus on maintaining your trading rules. Keep booking those profits (and especially goals) when you have them…its all about base hits. Don’t let greed get in the way of you achieving goals. Success is built one trade at a time, not by trying to hit the lottery. In short, get rich slowly…one trade at a time, just consistently achieving goals.

Ed

Swing Trade Ideas for your consideration and watchlist: WRAP, PINS, NKE, CCOI, FVRR, GTHX Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service