Earnings Hot And So Are China Relations

The bulls kept their foot on the gas Friday with a half percent gap higher and then follow-through all morning. The afternoon turned into a sideways grind, but the SPY and QQQ closed very near the highs and the DIA ended up as a white-bodied Spinning Top candle. On the day, SPY gained 1.03% (new all-time high close), DIA gained 0.66% (new all-time high close), and QQQ gained 1.17% (new all-time high close). The VXX fell half of a percent to 30.33 and T2122 rose back to near the overbought territory at 76.24. 10-year bond yields rose to 1.281% and Oil (WTI) rose a third of a percent to $72.17.

GM filed a lawsuit against F on Saturday. The suit was filed on behalf of GM’s “Cruise” driverless taxi subsidiary and is intended to block F from using the name “BlueCruise” for their “hands-free driving technology.” In other stock news, PM told the British press that it plans to stop selling cigarettes in the UK within 10 years as the company attempts to pivot its business. This falls in line with the company’s recent acquisitions in the Pharma space.

A US-Chinese meeting ended in a tense manner early today. The Chinese characterize the relationship as “now at a stalemate and facing serious difficulties.” As a backdrop, the Biden Administration has taken steps against US companies doing business in the Chinese province where it is alleged that an entire minority population of Uighurs are being and otherwise abused. At the same time, China has cracked down on Chinese businesses that have been listed in US capital markets. Apparently, the Chinese submitted 2 lists (one of “errors” that must be corrected immediately and one of the issues Beijing sees as very important) and the Americans “raised concerns” as well. This shifting and tense relationship is taking shape in the new “near-peer” world as China ascends on the back of decades of strong economic growth.

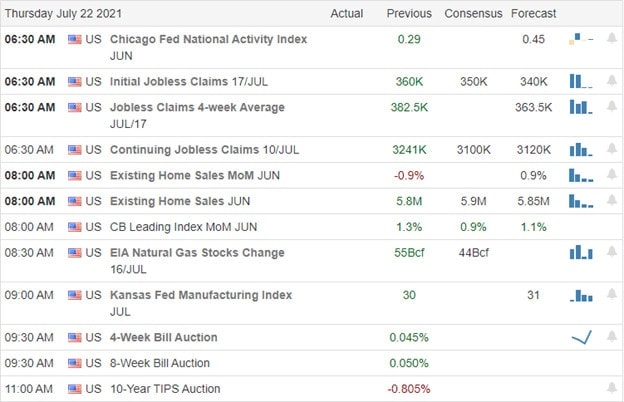

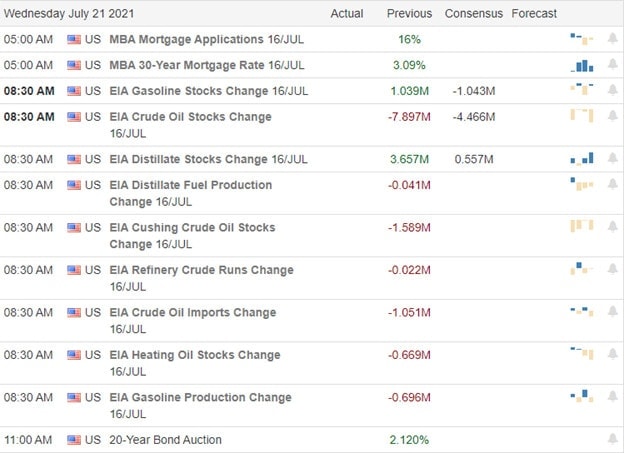

As we start the week, here are some of the major data points that will drop. Tuesday, we see June Durable Goods Orders and Conf. Board Consumer Confidence. Then on Wednesday we get June Trade Balance, June Retail Inventories, Crude Oil Inventories and crucially the Fed decisions, statement and presser. On Thursday we see Q2 GDP, Jobless Claims, and June Pending Home Sales. Finally, Friday brings the PCE Price Index, Q2 Employment Costs, June Personal Spending, Chicago PMI, and Michigan Consumer Sentiment.

Overnight, Asian markets were mostly down, especially the Chinese exchanges. This came amidst a Chinese crackdown on Hong Kong-listed and US-listed companies including in the paid education, eCommerce, and social media spaces. Hong Kong (-4.13%), Shenzhen (-2.65%), and Shanghai (-2.34%) paced the losses. Japan (+1.04%) was the lone gainer. In Europe, markets are a little more reticent but are mostly lower in modest trading so far today. The FTSE (-0.24%), DAX (-0.43%), and CAC (-0.29%) are typical, but there are half a dozen modestly green exchanges across the continent. As of 7:30 am, US Futures are pointing to a mildly lower open. The DIA is implying a -0.36% open, the SPY is implying a -0.23% open, and the QQQ is implying a -0.11% open.

The only major economic news scheduled for release on Monday is June New Home Sales (10 am). The major earnings reports scheduled for the day include CHKP, HAS, LII, LMT, OTIS, PETS, and RPM before the open. Then after the close, AMP, AMKR, AXTA, BRO, CDNS, CLS, CR, FFIV, LOGI, PKG, RRC, TSLA, TFII, TBI, and UHS reports.

Despite the tense atmosphere between China and the US, there was little headline news to move markets. That said, stocks that do large parts of their business in China or that are Chinese and listed here are at risk today. With that said, earnings continue to be very strong, and most eyes will be watching the Fed tea leaves for later this week. Also bear in mind that we sit at all-time highs, coming off a strong 4-day run to end last week. So, a little pause or pullback is due soon.

Manage your current positions first and take your time early. Do not chase, stick with your trading rules, and maintain discipline. Success comes from your consistency. This means focusing on the process and managing what you can control. Limiting your losses and taking profits when we get them is the key. Remember, trading success is not made in one trade, one day, one week, or one month.

Ed

Swing Trade Ideas for your consideration and watchlist: SOS, JYNT, LCI, DHI, FSR, ARKK, BMBL, CVS, FLGT, TLIS. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service