NFLX Beats, China Adds Stimulus, Fed Speakers

Markets gapped and then ground on Thursday. SPY gapped 0.64% higher, DIA gapped up 0.41%, and QQQ gapped up 1.11% at the open. From there, SPY and QQQ sold off until just after 11 a.m., recross the opening gap in SPY and recrossing 85% of its gap by then. At that point, those two major index ETFs ground sideways inside the gap. For its part, DIA chopped sideways along its open all day. This action gave us gap-up, black-bodied candles in all three major index ETFs. The SPY and QQQ printed large, black, Marubozu candles that ended the day little-changed from Wednesday. Meanwhile, DIA gave us a gap-up, black-bodied, Doji type candle that also printed a new all-time high and closed at a new all-time high close. This all happened on below-average volume in the SPY and QQQ as well as slightly above-average volume in DIA.

On the day, five of the 10 sectors were in the green and the other half in the red with Utilities (-0.90%) well out in front leading the losers lower. At the same time, on the other side, Financial Services (+0.40%) led a more tightly-grouped pack of gainers. Meanwhile, SPY gained 0.01%, DIA gained 0.40%, and QQQ gained 0.07%. VXX fell 1.65% to close at 52.45 and T2122 dropped back to just inside the bottom edge of its overbought territory to close at 80.72. At the same time, 10-Year bond yields spiked again to close at 4.098% while Oil (WTI) gained 0.45% to close at $70.71 per barrel. So, the Bulls gapped markets higher on strong earnings and raised guidance from the world’s largest chipmaker, TSM (+9.77%), which had countered the previous day’s fear over that crucial sector sewn by ASML (+2.50%).

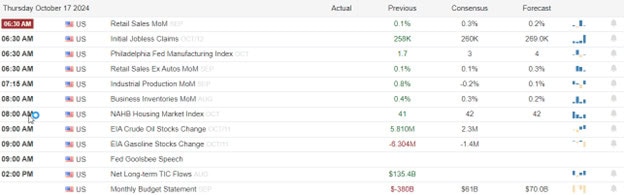

The major economic news scheduled for Thursday included Weekly Initial Jobless Claims, which were down as expected at 241k (compared to a 241k forecast and the prior week’s 260k number). In terms of on-going claims, Weekly Continuing Jobless Claims were up, but not as much as feared at 1,867k (versus a 1,870k forecast and the prior week’s 1,858k reading). At the same time, September Core Retail Sales were much stronger than expected at +0.5% (compared to a +0.1% forecast and August’s +0.2% value). On the manufacturing front, the Philly Fed Mfg. Index was also much stronger than predicted at 10.3 (versus a 4.2 forecast and well up from September’s 1.7 reading). This was done with less labor as the Philly Fed Mfg. Employment Index was down to -2.2 (compared to a September value of 10.7). At the same time, the September Retail Sales (month-on-month) were up to +0.4% (versus the +0.3% forecast and well above August’s +0.1% value). Later, September Industrial Production fell 0.3% (compared to a projected fall of 0.1% and well below August’s 0.3% climb). Later, August Business Inventories remained steady at 0.3% (versus a forecast and July reading of 0.3%). However, August Retail Inventories climbed a tick to 0.5% (compared to a forecast and July value of 0.4%). Later, the Weekly EIA Crude Oil Inventories showed a drawdown of 2.191 million barrels (versus a forecasted inventory build of 1.800 million barrels and the previous week’s 5.810-million-barrel build). At the close, the TIC Net Long-Term Transactions for August showed a decline to $111.40 billion (compared to the July $137.90 billion value). Then, after the close, the Fed Balance Sheet showed another reduction for the week at $7.039 trillion (versus last week’s $7.047 trillion).

In other news, on Thursday the Treasury Dept. released data that showed foreign holdings of US Treasury bonds surged to an all-time high in August after four straight months of increases. The Treasury reported that foreigners owned $8.503 trillion US bonds in August, up 11.5% from one year earlier. Japan remained the largest foreign holder of bonds at $1.129 trillion while China’s holdings fell to $774.6 billion.

After the close, OZK, CCK, ISRG, and NFLX all reported beats on both the revenue and earnings lines. Meanwhile, WAL beat on revenue while missing on earnings. However, WDFC missed on both the top and bottom lines.

In stock news, on Thursday SBGSY announced it had acquired controlling interest in private firm Motivair for $850 million. (Motivair makes liquid cooling technologies for data centers.) At the same time, the Financial Time reported that UBER has explored the idea of making a $20 billion offer to acquire EXPE. Later, NBRNF was acquired by private firm Bidco for $248.5 million. At the same time, META announced it partnered with private studio Blumhouse Productions to test its generative AI for video creation. At the same time, AMZN announced it was dipping a toe into the news market for Prime Video as it has hired NBC anchor Brian Williams to lead its coverage of the US election day. (This is noteworthy because Prime already offers a number of news channels such as CMCSA’s NBC, DIS’s ABC, and CNN.) Later, Reuters reported that BP is considering selling a minority stake in its offshore wind business. (This is reportedly another move by CEO Auchincloss to reduce the company’s renewables exposure as he was brought in to refocus on fossil fuels.)

Elsewhere, TSLA tried to rebound from the embarrassment of last week’s Optimus robot prototype show (which was later acknowledged to just be radio-controlled robots). Thursday, TSLA released a less than 90 second video (with numerous jump cuts) purporting to show an Optimus prototype navigating by itself on a simulated simplistic factory environment. Later, ZUO announced it had agreed to be acquired by the Singapore Wealth Fund and buyout form Silver Lake in a deal valued at $1.7 billion ($10/share). At the same time, PPG announced it will lay off 1,800 employees across the US and Europe as well as close some plants. PPG said this was part of reducing structural costs in Europe. Meanwhile, the Financial Times reported that META has fired around two dozen employees from its Los Angeles office for misusing their company meal allowances for items like laundry detergent and acne treatment pads.

In stock legal and governmental news, on Thursday the Federal Energy Regulatory Commission (FERC) issued an order allowing LNG to move liquified natural gas from its Corpus Christi storage facilities onto tankers. (Having cleared this key hurdle, LNG expects to have the plant producing export gas by year end.) Later, and somewhat oddly, GM announced it “fully supports” the Mexican government’s plans to strengthen supply chains by bringing production to Mexico rather than importing components. GM did not comment when asked to comment on speculation about its future plans in Mexico. At the same time, the FCC proposed a $147k fine for DIS’s ESPN network for violating broadcast rules by broadcasting emergency alert tones during promotional segments in the 2023-2024 NBA basketball season. Later, two consumer groups and two labor unions urged the FCC to block the acquisition of CTLC by NVO in a $16.5 billion deal. (The groups claim that deal would threaten competition in the weight loss drugs and cutting-edge gene therapies markets.)

Elsewhere, the US Dept. of Energy approved a total of nearly $3 billion in conditional loan guarantees for two sustainable aviation fuel projects from CLMT and GEVO. Later, Reuters reported exclusively that President Biden had directed the Commerce Dept., Dept. of Defense, and State Dept. will ease export restrictions on some satellite and spacecraft-related products to US allies. This includes technologies made by LMT, LHX, and BA. At the same time, a suit has been filed against ADM alleging the company failed to maintain and test safety systems on grain equipment for years, resulting in an explosion and the immolation of a worker last year. Later, the FTC has opened an investigation into DE over the company’s repair policies and restrictions the company puts on hardware and software to prevent customers from repairing their purchased products. (DE already faces antitrust lawsuits over the same issue in multiple states.)

In miscellaneous news, NOAA released an updated forecast calling for a warmer and drier-than-normal winter in the south and central Great Plains. This effect of La Nina is expected to worsen the drought across the plains, hitting the US’s top wheat-producing area and impacting wheat yields. (52% of US wheat-producing areas are currently in a drought condition, compared to 44% just two weeks ago.) However, a wetter than normal condition is forecast for the Great Lakes and Ohio River Valley regions this winter. Elsewhere, the CA state Dept. of Food and Ag reported that cattle are dying from bird flu as they are being stressed by heat (at least six days of 95-plus-degree temperatures so far in October). CA reported that herds are now seeing 15%-20% mortality rates (compared to 2% in other states).

In Middle East news, on Thursday, Israeli attacks in Gaza and Lebanon continued. The Israeli government also confirmed that it had, in fact, killed the Hamas military leader Yahya Sinwar on Wednesday. (An IDF unit was operating in Gaza when it stumbled into a 3-man Hamas ground unit. In the firefight that resulted, Israel killed the other two Hamas militants and seeing the severely injured Sinwar was still alive, fired another tank shell, which killed him. After the attack, they recognized Sinwar and collected his body for identification. He was identified by dental records, which Israel had because he had previously spent 23 years in Israeli prison before being released in a prisoner exchange in 2011.) Sinwar had been the subject or a ton of intelligence work and targeted attacks for over a year and had always been thought to be in tunnels hiding with hostages. However, it turns out he had actually been fighting as a regular Hamas fighter all along. While many hope this offers an opportunity to end the Israeli bombing and invasion of Gaza, Israeli PM Netanyahu said the fighting will continue. In addition, Hamas has already named a replacement for Sinwar. Elsewhere, the US confirmed B2 bombing of five weapon storage targets in areas controlled by Houthi rebels in Yemen.

Overnight, Asian markets were mostly green with just three of 12 exchanges below break-even. Shenzhen (+4.71%), Hong Kong (+3.61%), Shanghai (+2.91%), and Taiwan (+1.88%) paced the gains. Australian (-0.87%) and South Korea (-0.59%) led the losses. In Europe, we see a more mixed picture with five of 14 bourses in the red at midday. The CAC (+0.58%), DAX (+0.29%), and FTSE (-0.27%) lead the region and are typical of the early afternoon trade. In the US, as of 7:30 a.m., Futures are pointing toward a mixed but generally green start to the day. The DIA implies a -0.05% open, the SPY is implying a +0.21% open, and the QQQ implies a +0.49% open at this hour. At the same time, 10-Year bond yields are up to 4.108% and Oil (WTI) is down four-tenths of a percent to $70.40 per barrel in early trading.

The major economic news scheduled for Friday is limited to Preliminary September Building Permits and Preliminary September Housing Starts (both at 8:30 a.m.). We also hear from Fed member Bostic (9:30 a.m.), Fed member Kashkari (10 a.m.), Fed Governor Waller (12:10 p.m.), and Fed member Bostic again (12:30 p.m.). The major earnings reports scheduled for before the open include ALLY, AXP, ALV, CMA, FITB, PG, RF, and SLB. Then, after the close, there are not reports scheduled.

So far this morning, VLVLY (Volvo), ALLY, CMA, FITB, and RF all reported beats on both the revenue and earnings lines. Meanwhile, AXP, PG, and SLB missed on revenue while beating on earnings. However, ALV missed on both the top and bottom lines.

In late-breaking news, GOOGL announced they had replaced the head of their search and ads unit leader (Raghaven) with longtime Google employee Nick Fox. GOOGL’s statement said that Raghaven will move to the role of Chief Technologist. (It was unclear if this was a new position or if he was replacing someone else.) Elsewhere, CVS replaced their CEO Lynch with longtime executive David Joyner, effective immediately. Meanwhile, the Chinese rally may be explained by its release of “better-than-expected” GDP growth of 4.6% year-on-year for Q3, where the consensus analyst estimate had been 4.5%. (Still, this was still the slowest growth in six quarters.) The tell may be that Beijing almost immediately announced new stimulus that propped up the Chinese markets.

With that background, it looks like the Bulls are in charge again in the SPY and QQQ as they both gapped higher to start the premarket and have followed-through with white-body candles. For its part, DIA is down a bit after opening the early session higher and then trading indecisively but lower. All three remain above their T-line (8ema). So, the short-term trend remains bullish. The mid-term and longer-term trends are also strongly Bullish in all three. With regard to extension, none of the major index ETFs are too far extended from its T-line (8ema). However, the T2122 indicator is still at the lower edge of its overbought territory. So, markets have room to run either direction, but the Bears have more slack to work with again today. With regard to those 10 big dog tickers, nine of the 10 are in the green this morning. NFLX (+6.74%) leads on price move after blow-out earnings last night. The biggest dog, NVDA (+0.93%) has traded a bit more than twice the next closest ticker in terms of dollar-volume traded. Finally, remember its Friday and options expiration Friday at that. So prepare your account for the day and weekend.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the Man in the Green Bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby, it’s a job. The gains are real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Member e-Learning 10-17-24 – John

Member e-Learning 10-17-24 – Doug

TSM Crushes Raises Guidance More Banks Beat

On Wednesday markets diverged at the opening bell. SPY opened flat, DIA opened 0.06% lower, and QQQ opened 0.08% higher. From there, SPY and DIA rallied in a slow and steady manner all day. Meanwhile, QQQ sold off at the open, chopping sideways until noon and then began a slow, steady rally the rest of the day. All three modestly pulled back at the end of the session. This action printed a white-bodied, Bull Harami with small wicks on both ends in the SPY. At the same time, DIA gave us a Bull Engulfing candle that bounced up off its T-line (8ema). It should also be noted that DIA ended within 15 cents of another all-time high close. For its part, QQQ printed a Doji that retested its T-line and closed just a few pennies below that average. This all happened on below-average volume in the DIA and well-below-average volume in the SPY and QQQ.

On the day, all 10 sectors were in the green with Utilities (+2.01%) and Healthcare (+1.93%) way out in front leading the market higher. On the other side, Consumer Defensive (+0.03%) and Technology (+0.16%) lagged behind the other sectors. At the same time, SPY gained 0.42%, DIA gained 0.73%, and QQQ gained 0.01%. VXX fell 0.97% to close at 53.33 and T2122 spiked back up into the top end of the overbought territory to end the day at 95.22. At the same time, 10-Year bond yields fell again to 4.014% while Oil (WTI) was flat (-0.07%) to close at $70.53 per barrel. So, the Bulls partially bounced back from Tuesday’s down day in the SPY and DIA were in control all day Tuesday. QQQ was the laggard as Technology dragged on the market, but was held up by outlier NVDA (+3.13%) that traded 3.5 times more dollar-volume than any other QQQ ticker.

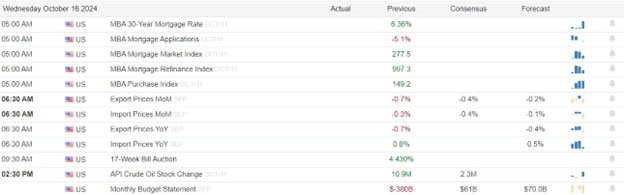

The major economic news scheduled for Wednesday included September Export Price Index, which came in lower than expected at -0.7% (compared to a forecast of -0.4% but not down as much as August’s -0.9%). At the same time, the September Import Index was a tick lower than predicted at -0.4% (versus a -0.3% forecast and down more than August’s -0.2% reading). Then, after the close, API Weekly Crude Stocks showed an unexpected drawdown of 1.580 million barrels (compared to a forecasted 3.200-million-barrel inventory build and far below the prior week’s 10.900-million-barrel drawdown).

In Fed news, on Wednesday, after the close, the Cleveland Fed issued a report saying that rent inflation will continue to put pressure on consumers for some time. The report said, “Our baseline forecast implies that (CPI) rent inflation will remain above its pre-pandemic norm of about 3.5% until mid-2026.” The report went on to cite a “notably wider” gap between new lease inflation and existing lease rollover increases. The report said, “Our estimated rent gap in September 2024 is just under 5.5%, suggesting that there remains a substantial amount of potential rent inflation to be passed through to continuing tenants.” (Prior to the pandemic, that gap stood at 1%.)

After the close, CCI, DFS, EFX, SNV, STLD, and UNB all reported beats on both revenue and earnings. At the same time, AA missed on revenue while beating on earnings. However, CSX, KMI, LBRT, and PPG missed on both the top and bottom lines.

In stock news, on Wednesday, AMZN announced its first color version of its Kindle e-reader after years of development. AMZN priced the device at $280, which is in the $149 – $330 range of similar devices from other manufacturers. At the same time, CZZ Chairman Ometto was quoted in a published interview saying that the company was not looking to sell its stake in VALE in the short-term. (This contradicts a Bloomberg report from late last month, which said the company was interested in selling its VALE stake.) Later, AMZN announced it signed three agreements with private companies for building small modular nuclear reactors to power the AMZN datacenters. (Under the deals, AMZN has the right to buy up to eight 80 MW reactors, which would be enough to power 770k homes.) At the same time, BTAFF announced a new line of synthetic nicotine pouches as a smoking alternative under the existing Velo product line. Later, GM announced it will contribute $625 million to a joint-venture with LAC with a goal of developing lithium mines in Thacker Pass, NV. (The goal is to reduce reliance on Chinese lithium sources.) GM will have 38% ownership of the venture.

Elsewhere, EADSY (Airbus) announced it will cut 2,500 jobs in its Defense and Space division after months of losses. (Negotiations with unions and countries throughout Europe are underway to determine which jobs will be cut and from what locations.) Later, BB told an investor conference that it was exploring options for its Cyclance unit. (Cyclance uses machine learning to preempt cybersecurity breaches.) At the same time, the Wall Street Journal reported that CMCSA-owned NBC Universal will add regional sports broadcasts to tie Peacock streaming service in early 2025. Later, AMX announced it plans to push the rollout of 5G service across Mexico and Latin America in 2025 as the main goal of its $7 billion capital expenditure forecast for the next year. After the close, LCID announced it now anticipates reporting a bigger-than-expected loss for Q3 when the report is released November 11. LCID simultaneously announced a 262 million pubic offering of new shares. In addition, Saudi Arabia’s Public Investment Fund said it would purchase 374.7 million shares, giving it 59% ownership of LCID.

In stock legal and governmental news, on Wednesday, the FDA placed a trial for NVAX’s experimental COVID-19 and influenza combination vaccine on hold. (The hold was due to a report of nerve damage in a patient in an earlier, mid-stage trial.) NVAX closed down 19.44% on the news. At the same time, the Dept. of Energy issued a conditional commitment for a loan of $670.6 million to ASPN for a plant to produce thermal barriers used in electric vehicle batteries. Later, the NHTSA announced that STLA is recalling 54k hybrid crossover SUVs due to a brake pedal that can disengage and stop working. (Just under half those vehicles were sold in North America.) At the same time, the FTC adopted its final rule requiring businesses to make it as easy to cancel subscriptions and memberships as it was to sign up.

Meanwhile, the US Dept. of Transportation tentatively awarded five new daily round-trip flights from Washington Reagan National to AAL, ALK, DAL, UAL, and LUV. The slots are subject to a two-week public comment period and one-week response period prior to the decision becoming final. After hours, Reuters reported that RTX has agreed to pay $959 million to resolve federal charges of defrauding the US Dept. of Defense and bribing a Qatrar official. The company entered into two deferred prosecution agreements (one in Boston and one in Brooklyn) to avoid criminal charges. At the same time, Reuters reported that the US Customs and Border Protection agency has halted the import of some DJI drones from China. (Reportedly, the halt came in response to the Uyghur Forced Labor Prevention Act.) Later, the US Supreme Court declined to put a hold on EPA rules targeting carbon pollution from coal-fired and gas-fired power plants. (The suit seeking to block the EPA rules had been brought by WV and 25, mostly GOP, states.) The suit can continue in lower courts, but the enforcement can proceed at least until that case is decided.

In Middle East news, on Wednesday, Israel defied calls for a cease-fire and pressure to allow humanitarian aid into Gaza and Lebanon by re-intensifying its bombing attacks on Beirut. In the process, the IDF took out a municipal building and aid distribution center killing the entirety of one suburb’s administration (Mayor, three key deputies, and several underlings) which had been meeting to plan the deliveries of a shipment of food aid. (That strike alone killed 16 people and wounded another 60.) This was part of more than 130 IDF attacks on Beirut and southern Lebanon on the day. For its part, the Israel said Hezbollah had fired 90 rockets at northern Israel, but there had been no casualties or significant damage. Meanwhile, and most importantly to markets, CNN reported that multiple sources now tell it that the Israeli response to Iran’s recent 180 missile barrage is ready. (It’s worth noting Iran’s missile attack on Israel did no real damage and caused no casualties.) CNN also says that US officials expect Israel to launch that retaliatory strike (to Iran’s own retaliation for Israeli bombings in Iran) prior to the US election. (This makes sense when you realize what Israeli PM Netanyahu prefers from the US election.)

Overnight, Asian markets were mixed with six exchanges in the green and six in the red. Shanghai (-1.05%), Hong Kong (-1.02%), and India (-0.89%) paced the losses while New Zealand (+1.01%), Singapore (+0.96%), and Australia (+0.86%) led the gainers. However, in Europe, we see green across the board at midday. The CAC (+1.19%), DAX (+0.80%), and FTSE (+0.42%) lead the region higher in early afternoon trade. In the US, as of 7:30 a.m., Futures are pointing toward a move higher to start the day. The laggard DIA implies a +0.14% open, SPY is implying a +0.41% open, and QQQ implies a +0.80% open at this hour. At the same time, 10-Year bond yields are up to 4.036% and Oil (WTI) is up a quarter percent to $70.57 per barrel in early trading.

The major economic news scheduled for Thursday includes Weekly Initial Jobless Claims, Weekly Continuing Jobless Claims, September Core Retail Sales, Philly Fed Mfg. Index, Philly Fed Mfg. Employment, September Retail Control, and September Retail Sales (all at 8:30 a.m.), September Industrial Production (9:15 a.m.), August Business Inventories and August Retail Inventories (bot hat 10 a.m.), Weekly EIA Crude Oil Inventories (11 a.m.), and the Fed Balance Sheet (4:30 p.m.). The major earnings reports scheduled for before the open include BX, CMC, ELV, HBAN, INFY, KEY, MTB, MAN, MMC, SNA, TSM, TRV, TFC, WBS, and WIT. Then, after the close, CCK, ISRG, NFLX, WDFC, and WAL report.

In economic news later this week, on Friday, Preliminary September Building Permits and Preliminary September Housing Starts are reported. We also hear from Fed Governor Waller.

In terms of earnings reports later this week, on Friday, ALLY, AXP, ALV, CMA, FITB, PG, RF, and SLB report.

So far this morning, BX, CBSH, HBAN, INFY, KEY, MTB, MAN, TSM, TVBI, TRV, and TFC all reported beats on both revenue and earnings. (BX crushed on revenue growth by more than 44%. In addition, the worlds largest chipmaker, TSM, crushed with 36% revenue growth and 11.5% earnings growth. Regional bank TCBI reported a whopping 67% beat on earnings.) Meanwhile, MMC, NOK, and SNA missed on revenue while beating on earnings. On the other side, ELV beat on revenue but missed on earnings. However, CMC missed on both the top and bottom lines.

In late-breaking news, TSM crushed in its Q3 report and raised guidance. Since they are the world’s largest, and most cutting-edge chipmaker, this is reassuring markets that the tech market demand has not been hurt. (That dour outlook on chips and by extension tech came from Tuesday’s terrible ASML report.) It is worth noting that TSM’s largest customers are NVDA, AMD, AAPL (phone, tablet, and computer), INTC, and QCOM.

With that background, it looks like the Bulls are in charge again ahead of morning data. SPY and QQQ both gapped higher while DIA opened flat to start the premarket. From there, all three have printed white-body candles so far in the early session, with DIA the smallest of those bodies. SPY is now trading within pennies of another all-time high. All three remain above their T-line (8ema). So, the short-term trend remains bullish. The mid-term and longer-term trends are also strongly Bullish in all three. With regard to extension, none of the major index ETFs are too far extended from its T-line (8ema). However, the T2122 indicator is back in (the top of) its overbought territory. So, markets have room to run either direction, but the Bears have more slack to work with again today. With regard to those 10 big dog tickers, all 10 are in the green this morning. The biggest dog, NVDA (+3.03%) is back to leading that pack in terms of both price move and dollar-volume traded. (It is also worth noting that NVDA has traded 5.5 times as mush stock as the next-closest big dog, TSLA (+0.25%), on the strength of the TSM earnings.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the Man in the Green Bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby, it’s a job. The gains are real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Initial Weekly Jobless Claims

U.S. stock futures edged up slightly on Thursday as investors awaited the release of initial weekly jobless claims data and September retail sales figures at 8:30 a.m. ET. These reports are expected to provide insights into the health of the labor market and consumer spending in the U.S. Additionally, corporate earnings reports are set to continue, with Travelers, Blackstone, and Elevance Health among the major companies reporting Thursday morning. Regional banks, including KeyCorp, M&T Bank, and Truist Financial, are also scheduled to release their earnings, adding to the day’s financial data.

European markets saw an uptick on Thursday morning as traders anticipated the upcoming monetary policy decision from the European Central Bank (ECB). The banking sector led the charge, with the banking index rising nearly 1.3%, while telecom stocks saw a slight decline of 0.5%. The ECB is expected to announce its third interest rate cut of the year, responding to inflation risks in the European Union that are diminishing more rapidly than anticipated. In September, inflation in the euro area cooled to 1.8%, falling below the ECB’s 2% target.

Most Asia-Pacific markets experienced a downturn on Thursday following a lackluster briefing from China’s housing ministry, which failed to meet investor expectations and led to a significant drop in the country’s property stocks. In Japan, exports declined by 1.7% in September compared to the same month last year, while import growth for the same period was 2.1%, falling short of forecasts. Meanwhile, Australia reported a slight decrease in its unemployment rate for September, which came in at 4.1%, marginally lower than the figure predicted by a Reuters poll.

Economic Calendar

Earnings Calendar

Notable reports for Wednesday before the bell include BMI, BX, CMC, ELV, HBAN, IIIN, IRDM, KEY, MTB, MAN, MMC, SNA, TCBI, TRV, TFC, WBS, & WNS. After the bell reports include NFLX, OZK, CCK, ISRG, FNB, WDFC, & WAL.

News & Technicals’

TSMC reported a net income of 325.3 billion Taiwanese dollars ($10.1 billion) for the July-September quarter, exceeding the LSEG estimate of 300.2 billion Taiwanese dollars. The company’s net revenue for the third quarter reached $23.5 billion, marking a 36% increase year-on-year. As the world’s largest producer of advanced chips, TSMC continues to serve major clients like Apple and Nvidia, highlighting its pivotal role in the global semiconductor industry.

Novavax announced that the Food and Drug Administration has placed a hold on its application for a combination shot targeting both Covid-19 and influenza, as well as a stand-alone flu vaccine. This decision, which caused a sharp decline in the company’s shares, stems from a single report of nerve damage in a patient who received the combination shot during a phase two trial completed in July last year. This development represents a setback for Novavax, which is urgently working to introduce new products to the market amid declining global demand for its Covid-19 vaccine.

Shares of Lucid Group declined during after-hours trading following the announcement of a public offering of nearly 262.5 million shares of its common stock. The electric vehicle startup plans to use the proceeds from this offering for general corporate purposes, which may include capital expenditures and working capital. This move aims to bolster the company’s financial position as it continues to expand its operations and market presence.

The Biden administration announced the forgiveness of an additional $4.5 billion in student debt, benefiting over 60,000 borrowers. This latest round of relief stems from the U.S. Department of Education’s improvements to the Public Service Loan Forgiveness program, which has faced challenges in the past. Eligible borrowers can expect to receive notifications about their cancelled debt in the coming weeks, marking a significant step in the administration’s ongoing efforts to address student loan burdens.

With a big round of earnings and economic reports that begin with initial weekly jobless claims, expect some price volatility with the T2122 indicator flashing an overbought warning. We will also have to digest Retail Sales, Philly Fed Mfg., Industrial Production, Business Inventories, Housing Market Index, Natural Gas, Petroleum and more Fed talk from Goolsbee. So, buckle up it could be a wild and woolly day!

Trade Wisely,

Doug

Bank Earnings Strong as ASML Tries to Recover

Markets diverged at the open Tuesday. SPY opened 0.06% higher, DIA gapped down 0.36%, and QQQ opened 0.08% higher. From there, SPY and QQQ ground sideways in a very tight range for 35 minutes before selling off sharply for 30 minutes and then moving sideways again until a little after 1 p.m. From there, those two broader index ETFs sold off again, just much more slowly, for the rest of the day. For its part, after its gap lower, DIA chopped sideways until 12:30 p.m. and then slowly sold off further all afternoon. This action gave us large black-bodied Bearish Engulfing candles in the SPY and QQQ. (QQQ also retested and crossed below its T-line, 8ema.) Meanwhile, DIA gave us a gap down, black-bodied candle with modest lower wick and a bit larger upper wick. This happened on average volume in the DIA, slightly-below-average volume in the QQQ, and below-average volume in the SPY.

On the day, six of the 10 sectors were in the red with Energy (-2.91%) way, way out in front leading the market lower as fears over an Israeli retaliatory strike on Iran faded temporarily. (The thinking is apparently that Israel would wait on a US THAAD missile system to be shipped, installed, and brought on-line by 100 US troops before attacking Iran.) On the other side, Communications Services (+0.60%) held up better than the other sectors. Meanwhile, SPY lost 0.78%, DIA lost 0.78%, and QQQ lost 1.34%. VXX gained 3.26% to close at 53.85 and T2122 fell out of its overbought territory to end in the top of its mid-range, closing at 74.65. At the same time, 10-Year bond yields fell quite a bit to 4.034% while Oil (WTI) plummeted 3.94% to close at $70.92 per barrel. So, the Bears were in control all day Tuesday. An accidental day early publication of earnings by ASML (-16.26%), which beat but missed on key segment growth and significantly lowered forward guidance, caused the stock to plummet. More importantly, that read through into NVDA (-4.69%), AMD (-5.22%), and INTC (-3.33%) among other chipmakers. (NVDA was the big hit to the overall market since it traded almost $50 billion in stock during the day.)

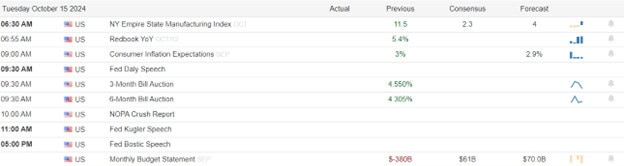

The major economic news scheduled for Tuesday was limited to NY Empire State Mfg. Index, which came in much lower than expected at -11.90 (compared to a +3.40 forecast and a September +11.50 value). Later, September NY Fed 1-Year Inflation Expectations were flat at 3.0% (versus the August 3.0% reading).

In Fed news, on Tuesday, San Francisco Fed President Daly said the FOMC remains on track for more rate cuts this year unless data is unlike than expected. She defended the September half point rate cut, saying that it was “right-sizing.” Daly described it as, “recognizing the progress we’ve made (on inflation) and loosening the policy reins a bit, but not letting go.” She went on, “even with this adjustment, policy remains restrictive, exerting additional downward pressure on inflation to ensure it reaches 2%.” Looking forward, Daly said, “I think one or two [rate cuts] this year would be a reasonable thing.” Regarding quantitative tightening, “Right now, today, I don’t have any signs this is something that needs to change right away.” She concluded saying, “The economy is clearly in a better place (regarding inflation),” … “the risks to our goals are now balanced.” Later, Atlanta Fed President Bostic told an event that he has penciled in just one more (quarter point) cut to rates in 2024 when he updated his “dot” at the September FOMC meeting. Bostic said, “The median was for … 50 basis points more, above and beyond the 50 basis points that was done in September. My dot was 25 basis points more.” However, Bostic said he is open to changing his view and it is not set in stone. Bostic said, “I am keeping my options open.”

After the close, FULT, HWC, and OMC reported beats on both the revenue and earnings lines. At the same time, JBHT and UAL missed on revenue while beating on earnings. On the other side, IBKR beat on revenue while missing on earnings.

In stock news, on Tuesday, BX announced plans to invest $8.2 billion to build data centers in northeastern Spain. Later, WBA announced it was closing 1,200 stores over the next three years (while simultaneously announcing beats on both lines of its earnings report). At the same time, AAPL launched a new version of its iPad mini, which includes AI features. Later, JNJ raised its 2024 sales and profit forecasts on strong cancer drug sales. Meanwhile, BA announced plans to raise $25 billion through the issuance of new stock and another $10 billion through a credit agreement with major lenders. The move comes as the company looks to shore up its balance sheet to avoid a debt rating cut to junk status amidst a strike that has shut down its most-profitable product line’s production and ongoing regulatory and quality problems. (For reference, the strike alone is costing BA more than $1 billion per month.) At the same time, Bloomberg reported that Biden Administration officials “have discussed” capping the sales of advanced AI chips from NVDA, AMD, INTC, etc. on a country specific (read China) basis. (What this does not mention is that China can buy as much access as they want to the computer power via cloud computing from US-located hardware from GOOGL, AMZN, ORCL, MSFT, etc. In other words, unless they also ban cloud sales, the same amount of hardware would be sold…just to different destinations.)

Elsewhere, INTC and AMD announced they have formed an “advisory council” (along with smaller hardware and software firms) for the x86 computer architecture. The aim of the group is to steer both x86 chipmakers toward consistent and compatible functions and features. (This is seen as a way to compete against the ARM and RISC V architectures. However, it is just as important to prevent incompatibilities such have previously been seen in MSFT’s Windows where one company’s CPU do not perform as well or cannot support the same features.) Later. Reuters reported that XOM is looking for a buyer for some of its ND (Bakken formation) shale oil assets. The report said XOM is seeking more than $500 million for 137 active wells, 676 non-active, and 49,000 acres of drilling rights. After the close, NYCB announced it will rename itself “Flagstar Financial” and change its ticker to FLG, effective Oct. 25 as part of the bank’s turnaround efforts.

In stock legal and governmental news, on Tuesday, SCBFF (Standard Chartered bank) won a UK court ruling which allows it to replace the financial benchmark (LIBOR) used to set dividend rates. Despite investor objections, the court ruled it was acceptable for the bank to use a “reasonable alternative rate.” Later, TSLA announced it had received local German approval for the first stage of a plant expansion (a planned doubling of capacity) at its Berlin-area plant. At the same time, DLAKY (Lufthansa) agreed to pay a $4 million penalty for discriminating against Jewish passengers attempting to board a connecting flight in Frankfurt in May 2022. Later, NYT sent a “cease and desist” letter to AI startup Perplexity related to the AI using NYT content. At the same time, the FCC announced it has opened an investigation of broadband internet providers on why data is capped for some customers and not others as well as how the policies impact consumer prices and competition. Later, the US Supreme Court heard a case involving a NY man fired from his commercial truck driver job for failing a drug test after taking CBD product he alleged was falsely marketer by MJNA as not containing the THC component the employment test measured. (The man was seeking permission to sue the maker under the CA state RICO Act.)

Elsewhere, GSK sued MRNA in US federal court, alleging the latter violated the former’s patent rights in the creation of MRNA’s COVID-19 vaccine and RSV vaccine. Later, a CT jury awarded $15 million to a man who alleged the company’s talc had caused the rare form of cancer he contracted as a result of using JNJ talc for decades. After the close, the US Dept. of Energy announced it had closed an $861 million loan guarantee to allows AES and TTE to build two solar farms and battery storage systems in Puerto Rico. At the same time, a US District Judge ruled that META must face lawsuits brought by US states that accuse the company’s products of fueling mental health problems in teens. (30 states are signed onto one such suit while another suit was brought by the state of FL.) The judge also rejected motions by META, GOOLG, SNAP and others asking to dismiss personal injury lawsuits by individual plaintiffs over the same subject. Later, a federal judge ordered BA and the Dept. of Justice to provide details on the impact of company Diversity and Inclusion policies on the selection of an independent monitor prior to his deciding whether or not to accept the BA plea deal for violating the 2021 deferred prosecution agreement.

In miscellaneous news, on Tuesday, the FAA opened an “audit” into runway incursion risks at the 45 busiest US airports after a series of troubling near-miss incidents. (For example, air traffic controllers cleared an ALK flight to take off on a Nashville runway where a LUV plane had been cleared to cross the runway last month.) Elsewhere, the National Retail Federation released its annual holiday sales forecast. The NRF says it expects retail holiday sales to grow 3.5% in 2024 compared to 3.9% last year. The forecast also calls for online sales to grow 9% compared to 2023. (These numbers are partially impacted by a shorter window from Thanksgiving to Christmas this year that is forcing sellers to push holiday sales earlier into non-traditional shopping periods.)

In Middle East news, on Tuesday, US Sec. of State Blinken and Sec. of Defense Austin warned Israel to allow at least 300 trucks of aid into Gaza within the next 30 days or risk losing access to US weapons funding. (Israel has cut humanitarian aid to less than 50% of what it was at its post-Israeli-invasion peak. Even that peak is said by NGO analysts to not be enough to avoid mass deaths from hunger and the lack of medical supplies.) At the same time, the UN called for an investigation into an Israeli attack in a northern Lebanon countryside Christian village which killed two dozen (in pursuit of a single mid-level Hezbollah leader). Meanwhile, US officials leaked to the AP that Israel has promised not to attack Iranian nuclear or oil sites. Elsewhere, 41 new Lebanese were killed in 146 Israeli attacks Tuesday and the total number of Israeli attacks on that country passed 10k since the beginning of the most-recent hostilities one year ago.

Overnight, Asian markets were heavily red. Thailand (+1.36%) printed the only appreciable green while Japan (-1.83%), New Zealand (-1.55%), and Taiwan (-1.21%) paced the losses. In Europe, the bourses also lean toward the red with only four of the 14 showing green at midday. The CAC (-0.52%), DAX (-0.21%), and FTSE (+0.65%) lead the region lower in early afternoon trade. In the US, as of 7:30 a.m., Futures are pointing toward a start just on the green side of flat. The DIA implies a -0.01% open, the SPY is implying a +0.08% open, and the QQQ implies a +0.18% open at this hour. At the same time, 10-Year bond yields are down to 4.01% and Oil (WTI) is off another half percent to $70.20 per barrel in early trading.

The major economic news scheduled for Wednesday includes September Export Price Index and September Import Index (both at 8:30 a.m.), September Federal Budget Balance (2 p.m.), and API Weekly Crude Stocks (4:30 p.m.). The major earnings reports scheduled for before the open include Wednesday, ABT, ASML, CFG, FHN, MS, PLD, SYF, and USB. Then, after the close, AA, CCI, CSX, DFS, EFX, KMI, LBRT, PPG, STLD, and SNV report.

In economic news later this week, on Thursday, we get Weekly Initial Jobless Claims, Weekly Continuing Jobless Claims, September Core Retail Sales, Philly Fed Mfg. Index, Philly Fed Mfg. Employment, September Retail Control, September Retail Sales, September Industrial Production, August Business Inventories, August Retail Inventories, Weekly EIA Crude Oil Inventories, and the Fed Balance Sheet. Finally, on Friday, Preliminary September Building Permits and Preliminary September Housing Starts are reported. We also hear from Fed Governor Waller.

In terms of earnings reports later this week, on Thursday, we hear from, BX, CMC, ELV, HBAN, INFY, KEY, MTB, MAN, MMC, SNA, TSM, TRV, TFC, WBS, WIT, CCK, ISRG, NFLX, WDFC, and WAL. Finally, on Friday, ALLY, AXP, ALV, CMA, FITB, PG, RF, and SLB report.

So far this morning, CFG, FHN, MS, SYF, and USB all reported beats on both the revenue and earnings lines. It is worth noting that MS beat on revenue by 6.7% while crushing earnings by 19%.

With that background, it looks as if all three major index ETFs are very modestly bullish in the premarket. All three have printed small white-body candles inside Tuesday’s black body. QQQ did retest its T-line (and passed so far) from above this morning. The SPY, DIA, and QQQ all remain above their T-line (8ema). So, the short-term trend remains bullish. The mid-term and longer-term trends are also strongly Bull in all three. With regard to extension, none of the major index ETFs are too far extended from its T-line (8ema). In addition, the T2122 indicator is back in (the top of) its mid-range. So, markets have room to run either direction, if traders can find momentum, but the Bears have slightly more slack to work with today. With regard to those 10 big dog tickers, eight of the 10 are in the green this morning. The biggest dog, NVDA (+0.74%) is back to leading that pack in terms of price move and has traded more than three times as much dollar-volume than any other ticker in the early session.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the Man in the Green Bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby, it’s a job. The gains are real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Wait for Directional Signals

Stock futures remained flat as investors wait for directional signals of follow-through up or down. This week’s earnings reports have been a mixed bag, with strong performances from major banks being counterbalanced by weaker outlooks from companies like UnitedHealth Group and Dutch chipmaker ASML. Investors are particularly focused on upcoming reports from Morgan Stanley and Abbott Laboratories, due before the market opens. Bryn Talkington, managing partner of Requisite Capital Management, mentioned on CNBC’s “Closing Bell” that the stock market is expected to be volatile in the coming weeks as investors navigate through earnings season and the presidential election.

European markets saw a decline as global market sentiment deteriorated. However, the FTSE 100 stood out among major regional indices, rising by 0.6% following the release of U.K. data indicating a significant drop in the inflation rate to 1.7% in September. Among individual stocks, LVMH experienced a notable drop of 6.3% at the opening, while British hotel group Whitbread emerged as the best performer, with its shares increasing by 3.7%.

Asia-Pacific markets experienced a downturn as investors remained cautious, anticipating potential stimulus measures aimed at bolstering China’s real estate sector. The upcoming press briefing by China’s housing minister on Thursday is expected to shed light on these measures. Meanwhile, New Zealand reported a 2.2% increase in its consumer prices index for the third quarter, indicating rising inflationary pressures. In South Korea, the seasonally adjusted unemployment rate slightly increased to 2.5% in September from 2.4% in August, reflecting minor fluctuations in the labor market.

Economic Calendar

Earnings Calendar

Notable reports for Wednesday before the bell include ABT, ASML, DFG, FHN, MS, OFG, PLD, SYF, USB, & WAFD. After the bell reports include AA, CNS, CCI, CSX, DFS, EFX, FR, HOMB, KMI, PPG, REXR, SLG, STLD, & SNV.

News & Technicals’

United Airlines reported third-quarter revenue and earnings that exceeded Wall Street expectations, signaling a strong performance. The airline also announced a $1.5 billion share buyback, marking its first repurchase since the onset of the Covid-19 pandemic. Additionally, United’s fourth-quarter earnings estimate surpassed analysts’ forecasts, further highlighting the company’s positive financial outlook.

On Wednesday, Asian and European chip stocks declined following disappointing sales forecasts from Dutch semiconductor equipment maker ASML, which negatively impacted global stocks in the sector. In Asia, Japan’s Tokyo Electron experienced the most significant losses, with its stock plummeting nearly 10%. Meanwhile, in Europe, ASML’s stock fell for the second consecutive day, losing 4% of its value. ASML’s CEO, Christophe Fouquet, highlighted customer caution in the company’s early released results, noting that the recovery is progressing more gradually than previously anticipated.

Boeing announced plans to raise up to $25 billion to strengthen its balance sheet, a move aimed at enhancing its financial stability. In a separate filing, the company disclosed that it has secured a $10 billion credit agreement with banks. Despite these efforts, Boeing is under scrutiny from credit ratings agencies, which have issued warnings that the company could lose its investment-grade rating. This highlights the ongoing financial challenges Boeing faces as it navigates a complex economic landscape.

Venture funding for cloud startups in the U.S., Europe, and Israel is expected to increase by 27% year-over-year, marking the first rise in three years, according to a report from VC firm Accel. Of the $79.2 billion raised by cloud firms, 40% was allocated to generative AI startups. Philippe Botteri, a partner at Accel, highlighted the dominance of AI in the sector, stating that “AI is sucking the air out of the room” in an interview with CNBC. This trend underscores the growing focus and investment in AI technologies within the cloud industry.

Mortgage Apps number came with a substantial disappointment this morning as investors wait for directional signals of what the follow-though will look like today. The ASML early report had bearish effects not only here in the U.S. but also translated into selling around the world last night. Of course, earnings results or the economic numbers are likely to provide the inspiration for the bulls or bears to make that decision. Remember that Thursday is a very big day of economic reports so plan your risk accordingly.

Trade Wisely,

Doug

Record Highs

Stock futures remained relatively stable on Tuesday following record highs for both the Dow Jones Industrial Average (DIA) and the S&P 500 (SPY). Information technology stocks were the standout performers, driving the S&P 500 up by nearly 1.4%, with Nvidia’s 2.4% rally to a record close providing significant upward momentum. The focus now shifts to corporate earnings, with major financial institutions like Goldman Sachs, Citigroup, and Bank of America set to report. Additionally, earnings from United Airlines, Walgreens Boots Alliance, and Johnson & Johnson are anticipated. Investors are also keeping a close watch on manufacturing data and comments from several Federal Reserve speakers, which could influence market sentiment.

European stocks showed a mixed performance on Tuesday as third-quarter earnings reports began to emerge. The market saw a divergence across sectors, with travel stocks rising by 1.3%, while oil and gas stocks fell by 3.15%, mirroring declines in the oil market. Telecom stocks gained 1.39%, largely driven by a significant 8.5% jump in Sweden’s Ericsson, which exceeded earnings expectations despite a 4% drop in year-on-year sales. Meanwhile, the U.K.’s statistics agency reported that average wages excluding bonuses increased by 4.9% year-on-year, though earnings including bonuses fell to a two-year low of 3.8%.

China’s stock markets experienced a significant downturn on Tuesday following the release of disappointing September trade data. Both exports and imports fell short of expectations, with exports rising only 2.4% and imports increasing a mere 0.3% compared to the previous year. This led to a 2.66% drop in the CSI 300 index and a 3.67% decline in Hong Kong’s Hang Seng index. In contrast, South Korea’s Kospi index saw a modest gain of 0.39%, buoyed by revised trade data showing a substantial surplus of $6.7 billion for September. Japan’s Nikkei 225 and Australia’s S&P/ASX 200 also posted gains, rising 0.77% and 0.79%, respectively.

Economic Calendar

Earnings Calendar

Notable reports for Tuesday before the bell include ACI, BAC, C, SCHW, GS, JNJ, PNC, PGR, STT, UNH, & WBA. After the bell reports include FULT, HWC, IBKR, JBHT, OMC, PNFP, SGH, & UAL.

News & Technicals’

Nvidia shares have reached an all-time high, driven by soaring demand for it’s artificial intelligence chips. Major tech companies like Microsoft, Meta, Google, and Amazon are purchasing Nvidia’s graphics processing units (GPUs) in large quantities to build extensive AI computing clusters. This surge in demand has propelled Nvidia’s market valuation to over $3.4 trillion, underscoring its pivotal role in the AI revolution and solidifying its position as a leading player in the tech industry.

A federal appeals court has expedited the Commodity Futures Trading Commission’s (CFTC) case against the Kalshi exchange, which is offering contracts that function as bets on U.S. political elections. These contracts, facilitated by Kalshi and Interactive Brokers, allow bets on outcomes such as the presidential election, U.S. Senate races, and which party will control Congress. Notably, Kalshi has already booked over $7 million in contracts on the presidential race between former President Donald Trump and Vice President Kamala Harris. The court’s decision to fast-track this case underscores the regulatory scrutiny surrounding the legality of such political betting markets.

Ericsson reported adjusted third-quarter earnings of 7.327 billion Swedish crowns ($0.7 billion) on Tuesday, significantly exceeding the analysts’ forecast of 5.75 billion crowns. This impressive performance was largely driven by robust sales growth in North America, which saw a year-on-year increase of over 50%. The company’s strengthened position in the U.S. market, bolstered by securing a major contract with AT&T last year, where it outperformed Finnish competitor Nokia, has been a key factor in this success.

Federal Reserve Governor Christopher Waller indicated on Monday that upcoming interest rate cuts will be more measured compared to the significant reduction in September. He emphasized a gradual approach to lowering the policy rate over the next year, despite short-term uncertainties. Waller’s comments come amid mixed economic data, which the Fed is closely monitoring to guide its policy decisions. This cautious stance reflects the Fed’s aim to balance economic growth with inflation control.

With the DIA and SPY sporting fresh record highs we now face the ramp up of earnings reports likely to inspire significant price volatility. The rising dollar and bond yields continue to be a contradiction to the market’s bullish enthusiasm and the T2122 indicator continues to flag a short-term overbought condition. Stay with the trend but tighten stops as it would only take a minor stumble to trigger a profit taking wave.

Trade Wisely,

Doug

Strong Earnings Continue as Big Banks Crush

Monday saw the bulls in control from the start. SPY gapped up 0.29%, DIA opened 0.10% lower, and QQQ gapped up 0.49%. From there, the Bulls took over in all three major index ETFs. The QQQ rallied sharply for 30 minutes, SPY rallied strongly tor 60 minutes, and DIA rallied more modestly, but steadily all day. After their initial rallies, SPY and QQQ traded mostly sideways with a slight bullish lean the rest of the day. It is worth noting that there was profit-taking across the board in the last 10 minutes. This action gave us large-body, white body candles in the SPY and DIA as well as a white-bodied candle in the QQQ. SPY gapped up and printed a new all-time high and new all-time high close. DIA opened a bit lower but gave us a large white-body candle that also printed a new all-time high and new all-time high close. QQQ gapped up well out of its range going back to late September. It closed as a white Spinning Top with the larger wick at the top and ended 1.25% below its all-time high. This all happened on well-below average volume in all three major index ETFs.

On the day, nine of the 10 sectors were in the green with Utilities (+1.27%) out in front leading the market higher. On the other side, Energy (-0.36%) was by far the laggard. Meanwhile, SPY gained 0.82%, DIA gained 0.50%, and QQQ gained 0.84%. VXX fell another 3.55% to close at 52.15 and T2122 fell but remained in the top half of its overbought territory, closing at 91.78. At the same time, 10-Year bond yields were flat at 4.096% while Oil (WTI) dropped 3.72% to close at $72.75 per barrel. So, the Bulls were again in control from the open. This led to a morning rally and then a drift higher the rest of the day in SPY, QQQ, and DIA. Once again, only a little profit-taking the last few minutes of the day stopped the SPY and DIA from closing on the highs.

There was no major economic news or earnings reports scheduled for Monday.

In Fed news, on Monday, Minneapolis Fed President Kashkari indicated that more rate cuts lie ahead, but guided expectations toward more modest rate cuts. Kashkari said, “As of right now, it appears likely that further modest reductions in our policy rate will be appropriate in the coming quarters to achieve both sides of our mandate.” As usual, he promoted the “data driven” mantra, saying “ultimately, the path ahead for policy will be driven by the actual economic, inflation and labor market data.” He went on to say that the economy is not on the verge of a rapid slowdown, but the Fed is “in the final stages of bringing inflation down to our 2% target.” Later, Fed Governor Waller called for “more caution” (smaller rate cuts) in the interest reductions ahead. Waller said, “Whatever happens in the near term, my baseline still calls for reducing the policy rate gradually over the next year.” While saying that there is “considerable room” to cut rates, he said “We are in the sweet spot right now, we got to keep it there, that’s our job.” He continued, “I view the totality of the data as saying monetary policy should proceed with more caution on the pace of rate cuts than was needed at the September meeting.” Waller concluded, “I will be watching to see whether data, due out before our next meeting, on inflation, the labor market and economic activity confirms or undercuts my inclination to be more cautious about loosening monetary policy.” (When asked what the word “gradually” means, Waller said, “It’s in the eye of the beholder, … That’s for you guys to figure out.”

In stock news, on Monday, ADBE said it has begun rolling out its Firefly AI model that can generate video from text prompts. Later, activist investor Elliott Investment Mgmt. has formally requested a shareholder meeting of LUV. (Elliott plans to put forward its own slate of eight directors against eight existing board members. For reference, LUV has a 12-member board with three open seats.) At the same time, GM and BCS both announced they have signed a long-term credit card partnership. Later, Danish drug maker Lundbeck A/S agreed to acquire LBPH for $2.6 billion ($60/share), which was a 54% premium on Friday’s close price. At the same time, GOOGL announced it had signed an agreement to buy 500 megawatts of electricity from multiple small modular nuclear reactors from Kairos Power. This will help support GOOGL’s AI processing. Later, VNDA rejected a second ($8/share) takeover bid from UK-based Cycle Pharmaceuticals. (VNDA closed a $4.44 prior to the $8/share offer and closed up to $4.81 on the news.)

Elsewhere, TSLA took another hit related to its Robotaxi “unveil” event last week. This came as Bloomberg reporting confirmed that the TSLA Optimus humanoid robots highlighted at the event were actually just radio-control units being controlled by human “driver.” At the same time, HYMTF (Hyundai) sold part of their Indian unit “Hyundai India” via a $989.4 million IPO. BLK, Fidelity, and the government of Singapore each bought $77 million stakes while Indian mutual funds bought $340 million. (At that valuation, the unit represents 40% of the HYMTF market cap.) Later, the Wall Street Journal reported that SBUX will offer fewer discounts and promotions as part of a plan to reposition SBUX as a premium brand and getting customers to pay full price. After the close, PSX announced it will sell 49% of its Coop Mineraloel AG to its Swiss joint venture partner for $1.24 billion. (The joint venture operates 324 petrol stations across Switzerland.)

In stock legal and governmental news, on Monday, acting US Labor Sec. Su flew to Seattle to meet with both sides in the BA strike that is entering its fifth week. (In related news, BA said it will issue “60-day” notices to another tranche of engineering union workers on November 15, with a second wave of 60-day notices going out in December if the strike had not been resolved.) After the close, Blue Cross Blue Shield agreed to pay $2.8 billion to settle class action lawsuits from hospitals, physicians, and other healthcare providers who alleged they had been underpaid for reimbursements. (The deal is still subject to approval by a US District Judge in Alabama.)

In analyst news, heading into earnings season, Bloomberg Intelligence reported that the data they have collected show analysts expect S&P 500 firms to report a 4.2% increase in third-quarter earnings versus a year earlier. However, company guidance, implies a jump of about 16%. This unusually large difference between the forecasts suggest to Bloomberg that companies should easily beat the estimates on average.

In miscellaneous news, on Monday, FEMA reported that over the weekend contractors in NC were forced to cease work and return to their hotels Sunday while security was arranged. This came after some of the lies of the disgraced ex-President and his conspiracy-loving minions came home to roost. On Sunday, active military units that had been deployed to help recovery came across a militia group out “hunting FEMA workers” (based on the militia’s belief of the lies spread by the MAGA fools). Separately, the Sheriff arrested one man armed with a handgun and semi-auto rifle, apparently from the same militia, who was out menacing recovery efforts, but he was later released on bond. Two full days of recovery in Western NC and Eastern TN lost thanks to the right-wing stirring hatred and distrust for the political gain of one man. Elsewhere, in Russia that man’s friend invited fellow BRICS members to join together to create an alternative to the IMF to counter Western political influence throughout the world.

In Middle East news, on Monday, Israel continued strikes in both Gaza and Lebanon. One of the strikes in Gaza hit a Palestinian hospital and refugee camp located beside the medical building. (There was video of patients burning alive in their hospital beds.) more than two dozen were killed including many children. Meanwhile, Israeli PM Netanyahu again demanded that the UN remove peacekeepers and observers from Lebanon, falsely claiming UN troops were shields for Hezbollah. On the other side, Hezbollah made a drone attack on an IDF base, killing four Israeli soldiers and injuring 60.

Overnight, Asian markets were mixed with China out front leading the losers down. Hong Kong (-3.67%), Shenzhen (-2.53%), and Shanghai (-2.53%) saw by far the biggest losses. Meanwhile, Taiwan (+1.38%), Australia (+0.79%), and Japan (+0.77%) paced the six gainers. In Europe, we see a similarly mixed picture that leans toward the red at midday. The CAC (-0.90%), DAX (+0.15%), and FTSE (-0.56%) lead the region with just five green bourses versus nine red ones in early afternoon trade. In the US, as of 7:30 a.m., Futures are pointing to a start just on the red side of flat. The DIA implies a -0.05% open, the SPY is implying a -0.01% open, and the QQQ implies a -0.06% open at this hour. At the same time, 10-Year bonds are down to 4.073% and Oil (WTI) has plummeted another 4.66% to $70.41 per barrel in early trading.

The major economic news scheduled for Tuesday is limited to NY Empire State Mfg. Index (8:30 a.m.), September NY Fed 1-Year Inflation Expectations, and September Federal Budget Balance (2 p.m.). We also hear from Fed members Daly (11:30 a.m.) and Bostic (7 p.m.). The major earnings reports scheduled for before the open include ACI, BAC, SCHW, C, ERIC, GS, JNJ, PNC, PGR, STT, UNH, and WBA. Then, after the close, IBKR, JBHT, OMC, and UAL report.

In economic news later this week, on Wednesday, September Export Price Index, September Import Index, and API Weekly Crude Stocks are reported. On Thursday, we get Weekly Initial Jobless Claims, Weekly Continuing Jobless Claims, September Core Retail Sales, Philly Fed Mfg. Index, Philly Fed Mfg. Employment, September Retail Control, September Retail Sales, September Industrial Production, August Business Inventories, August Retail Inventories, Weekly EIA Crude Oil Inventories, and the Fed Balance Sheet. Finally, on Friday, Preliminary September Building Permits and Preliminary September Housing Starts are reported. We also hear from Fed Governor Waller.

In terms of earnings reports later this week, on Wednesday, ABT, ASML, CFG, FHN, MS, PLD, SYF, USB, AA, CCI, CSX, DFS, EFX, KMI, LBRT, PPG, STLD, and SNV report. On Thursday, we hear from, BX, CMC, ELV, HBAN, INFY, KEY, MTB, MAN, MMC, SNA, TSM, TRV, TFC, WBS, WIT, CCK, ISRG, NFLX, WDFC, and WAL. Finally, on Friday, ALLY, AXP, ALV, CMA, FITB, PG, RF, and SLB report.

So far this morning, BAC, ERIC, GS, JNJ, PNC, STT, UNH, and WBA all reported beats on both the revenue and earnings lines. STT in particular had huge beats (+29.6% on revenue and +8.7% on earnings) while BAC managed +10.0% on revenue and +3.8% on earnings. GS was the king on profit, delivering a 22.6% beat on the earnings line.

With that background, it seems the premarket is undecided with all three major index ETFs basically flat and giving use Doji candles in the early session. The SPY, DIA, and QQQ all remain above their T-line (8ema). So, the short-term trend remains bullish. The mid-term and longer-term trends are also strongly Bull in all three. With regard to extension, none of the major index ETFs are too far extended from its T-line (8ema), although it is worth noting that DIA is getting close to extended. However, the T2122 indicator remains in the upper half of its overbought range. So, markets have room to run either direction, if traders can find momentum, but the Bears have more slack to work with today. With regard to those 10 big dog tickers, six are in the green this morning. AAPL (+0.88%) leads the way in gain while AMD (-1.59%) is the laggard in that regard. That biggest dog, NVDA (-0.62%) is back to leading all other tickers by a factor of three in terms of dollar-volume traded.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the Man in the Green Bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby, it’s a job. The gains are real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service