Great Retail Earnings Reports Continue

Markets opened flat Tuesday and rallied slowly until 2 pm on strong economic news. At that point, they slowly sold off into the close. This left us with Bullish Engulfing candles in the SPY and QQQ, both with upper wicks, and a Gravestone Doji-type candle in the DIA. On the day, SPY gained 0.39%, DIA gained 0.19%, and QQQ gained 0.73%. The VXX gained slightly to 20.19 and T2122 remains in the mid-range at 59.66. 10-year bond yields rose again to 1.644% and Oil (WTI) was flat at $80.78/barrel.

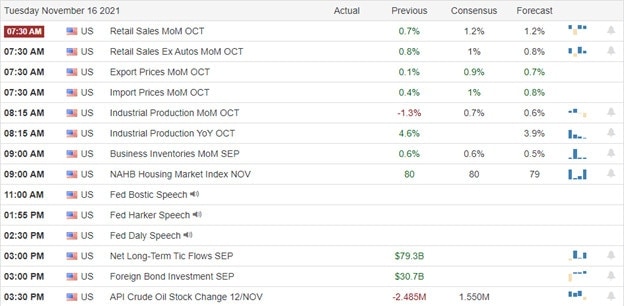

As mentioned, before the open, October Retail Sales and Exports came in much stronger than expected. Industrial Production also came in strong with only a slightly higher than expected increase in September Business Inventories. Socks rallied on this news. In related news, the retail sector got off to a good start on Q3 earnings as HD and WMT (both before the open) and then LZB (after close) all easily beat on both the revenue and earnings lines. The good news in retail reports has continued this morning with easy beats on both lines from BIDU, LOW, TGT, and TJX so far. (TGT beat revenue estimates by $2 billion for Q3.) LOW has also increased estimates for Q4 after posting 2.2% same-store sales growth (analysts had expected a 1.4% decline). The story seems to be that the consumer is in a “buy, buy, buy” mode.

During the day Tuesday, the electric vehicle industry made news as recent listing LCID passed F and GM in market capitalization. This resulted from a gain of almost 24% on the day. (LCID went public through a reverse merger and the stock has been parabolic since mid-October.) While not as ridiculously high as TSLA (over $1.2 trillion), the $89 billion market value tops rival NIO ($71 billion). LCID announced Monday evening a sizable increase in purchase reservations (17,000 now vs. 13,000 in Q3). They also announced it has a 20,000-vehicle production target for 2022, which would amount to approximately $2.2 billion in revenue.

Tuesday evening Treasury Sec. Yellen sent a letter to Speaker of the House Pelosi saying that she now estimates the US will hit its debt limit on Dec. 15. This is nearly two weeks later than the forecast made in October (Dec. 3), when the decision to suspend the debt ceiling was pushed back to December. The reason cited for the change of date is that the $1 trillion Infrastructure Law has funded some programs at a lower level than originally expected and slightly reduced spending. The increase in the debt limit has been tied to President Biden’s (and Democrats) Social Spending bill. The House is expected to vote on the Social Spending Bill this week and the Senate will take up the bill after returning from the Thanksgiving recess (about Nov. 29).

Overnight, Asian markets were mixed. South Korea (-1.16%) was an outlier as Australia (-0.68%), India (-0.56%), and Japan (-0.40%) were really the leaders to the downside. Meanwhile, Shenzhen (+0.67%), Shanghai (+0.44%), and Taiwan (+0.40%) led to the upside. In Europe, markets are also mixed, but on smaller moves as of mid-day. The FTSE (-0.33%), DAX (+0.12%), and CAC (+0.07%) are typical of the continent in early afternoon trading. As of 7:30 am, US Futures are pointing toward a mixed and flat open. The DIA is implying a -0.06% open, the SPY is implying an unchanged open, and the QQQ implies a +0.14% open at this hour. 10-year bond rates are unchanged and Oil (WTI) is down seven-tenths of a percent in early trading.

The major economic news scheduled for release Wednesday includes Oct. Building Permits and Oct. Housing Starts (both at 8:30 am), Crude Oil Inventories (10:30 am), and a slew of Fed speakers (Williams at 9:10 am, Bowman at 11 am, Waller at 12:40 pm, Daly at 12:40 pm, and Bostic at 4:10 pm). Major earnings reports scheduled for the day include BIDU, BILI, BV, IQ, LOW, MTOR, TGT, TJX, and ZIM before the open. Then after the close, BBWI, CSCO, CPRT, HI, YY, NVDA, TTEK, VSCO, and ZTO report.

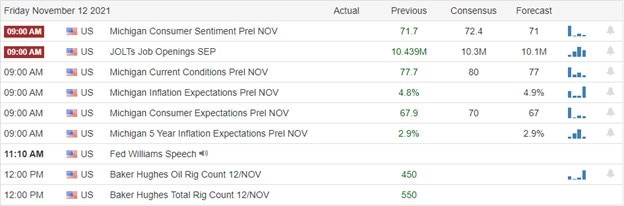

Mortgage rates have continued to spike in the last week and as a result, refinance demand was down again, this time down 5% on the week. The less rate-sensitive new home purchase mortgage applications rose 2% week-on-week. Still, the great earnings out of the Retail Industry is likely to be the driver for markets early. Remember that the short-term trend is now bullish in the SPY and QQQ and the pullback trend is being challenged in the DIA. However, that longer-term strong bullish trend remains in place and we sit near all-time highs.

Watch your current positions before looking to add any new trades. Focus on your trade rules and on managing the things you can control. That should include consistently taking profits when you have them and moving your stops in your favor. Trade carefully and continue to think twice before holding through earnings…especially without a hedge.

Ed

Swing Trade Ideas for your consideration and watchlist: RMO, PLUG, NCTY, AEM, BA, CHPT. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service