Bulls Look to Try Again At Open

Markets gapped about one percent higher on Friday, but this was a Bull Trap. Right after the open, the selling started and the selloff continued until about 3 pm. However, a massive rally (options expiration pinning) took us out well over halfway up those candles. This gave us a black, Bearish Engulfing candle (barely) in the QQQ and just black indecisive candles with huge lower wicks in the SPY and DIA. The late-day rally saved the SPY from joining the QQQ in Bear Market territory (down more than 20% from the high). It also capped off the seventh consecutive week of declines across the market. So, the bears may want to retest that Bear Market level this week. And with that said, markets are still well oversold, giving the bulls some ammunition. So, the Bulls may want to try a little relief rally as well. On the day, SPY gained 0.04%, DIA lost 0.24%, and QQQ lost 0.31%. The VXX fell a little over a percent to 25.05 and T2122 “climbed” to 8.28. 10-year bond yields fell to 2.79% as traders bought up bonds during the first 6 hours of the day and Oil (WTI) was up marginally to $112.70/barrel.

Last week, TSLA had a terrible streak losing 14%. However, you have to bear in mind, that the stock has lost 34% since it was revealed (well after the fact) that Musk had been selling off TSLA stock to raise money for his TWTR bid. Among the problems facing the company are the lockdowns in China stalling production, the Chinese economic downturn hurting demand, massively increased competition from actual major carmakers, and, of course, the 3-ring circus of notoriety for the sake of itself that Musk feels the need to maintain at any cost. On the Chinese front, TLSA has said it wants all staff to continue living in its Chinese factory until mid-June to minimize the risks of more shutdowns. In other stock news, Sunday night Bloomberg reported that AVGO is in talks to acquire VMW.

Recently, there has been considerable talk in the trading rooms about whether or not we’ve yet seen a bottom in the selloff. On Sunday, the WSJ suggested the answer is no for now. They reported that BAC says that 63% of their private client’s portfolios are still in stocks, much higher than when prior bottoms have been reached. In addition, the VIX is currently at 29 and has reached a maximum of 34.75 in the last month. Again, this is well below the 40+ it reached in the 2008, 2011, and March 2020 selloffs. Finally, while most selloffs end in capitulation (extreme volume on at least one big down day), we have not seen any such action yet. So, at the moment, both the chart and anecdotal evidence point to the bears still being in control.

SNAP Case Study | Actual Trade

Bloomberg reported over the weekend that Fed members have been telling them that a market selloff is exactly what they need. The basic idea is that as the market falls, the normally “long-only” public loses money or at least feels worse. In turn, this will cause the public (on average) to spend less and that lower demand helps to reduce inflation. So, while the Fed increasing rates works on the supply side (making spending more expensive), a bear market works on the demand side, slowing the consumer’s urge to buy. For that reason, Bloomberg says several anonymous Fed members have told them that any sort of Fed Put is the last thing they want to see. Simply stated, any market bullishness would make their “job number one” (taming inflation) twice as hard. KC Fed President George is expected to confirm this evening.

In climate-related news, the North Americans Electric Reliability Corporation (a non-profit regulatory authority) has warned that the entire Western US, most of the Upper Midwest, and parts of the East Coast are at high risk of blackouts this summer. This is the result of the long-term drought in the West (now reducing hydroelectric production) and a newly forecast summer heatwave (worse than normal). This electricity shortage may affect essentially every industry over at least the next 1-2 Quarters. Climate has also put another hit on the Ag industry as unprecedented rain for months has caused the deterioration (flooding) of Canadian croplands as well as the inability to plant. The Insurance Journal reports that only 4% of Manitoba croplands are planted, while the 5-year average at this point of the year would be over 50% planted. Canola and wheat are the crops most impacted, which coincidentally are exactly the crops whose supply is also most impacted by the Russian invasion of Ukraine and the blockading of Odesa. As a result, all companies that use wheat and canola are at great risk of both supply problems and much higher input costs six months down the road. Of course, consumers will also have to pay much higher prices for staple items like bread, pasta, cereals, battered food, etc.

On the Russian invasion story, Russia cut the flow of natural gas to Finland Saturday (after Finland refused to pay in Rubles). Lithuania also stopped buying electricity from Russia. On Sunday, Russian Trans. Minister Savelyev told state media that Western sanctions have effectively broken logistics within Russia. On the ground, things are looking tough for the Ukrainians in the Luhansk region as Russia made gains around the town of Popasna and blew up the last resupply/retreat bridge for the Ukrainian Army in Severodonetsk / Lysychansk (a large petrochemical industry metroplex). With no major new Western arms shipments expected until July and Russia getting tens of thousands of additional troops (freed up from Mariupol and returning from their Syrian drawdown), it is looking dire for Ukraine holding onto the Donbass. Finally, much of the talk at Davos has been about implementing and offsetting Russian Oil sanctions. This included a speech from Ukrainian President Zelensky.

Overnight, Asian markets were mixed on modest moves. Japan (+0.98%), Thailand (+0.76%), and New Zealand (+0.44%) led the gainers. Meanwhile, Hong Kong (-1.19%), Singapore (-0.83%), and Malaysia (-0.43%) paced the losses. This is despite a rally that came when President Biden told the Asian Economic meeting that he was going to revisit the former President’s Chinese tariffs. (The President also misspoke, saying that the US Military would intervene to defend Taiwan from a Chinese attack.) In Europe, stocks lean heavily to the green side on Biden’s comments as well as more certainty from the ECB as ECB President Lagarde said they are likely to raise rates this summer and be out of negative rates by September. At mid-day, the FTSE (+1.04%), DAX (+0.75%), and CAC (+0.35%) lead the way and are fairly typical of the continent. Only Russia (-1.91%) and the FTSE MIB (-0.64%) are in the red in early afternoon trading. As of 7:30 am, US Futures are pointing to another gap higher to start the day. The DIA implies a +1.11% open, the SPY is implying a +1.21% open, and the QQQ implies a +1.05% open at this hour. 10-year bond yields are back up to 2.835% and Oil (WTI) is up 1% to $111.36/barrel in early trading.

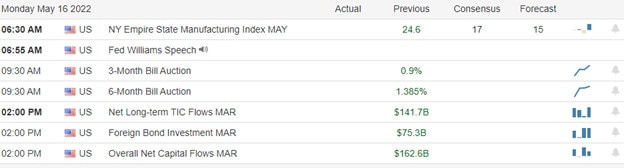

The only major economic news scheduled for release Monday is a Fed speaker (George at 7 pm). There are no major earnings reports scheduled before the open. However, AAP, HEI, NDSN, SKY, and ZM report after the close.

The major economic news coming later this week includes Mfg. PMI, Services PMI, and April New Home Sales on Tuesday. Then on Wednesday, we get April Durable Goods Orders, Crude Oil Inventories, and the May FOMC Minutes. On Thursday we see Q1 GDP, Weekly Initial Jobless Claims, and April Pending Home Sales. Finally, on Friday we get a Fed speaker (Bullard, twice), April Trade Goods Balance, April PCE Price Index, April Retail Inventories, April Personal Spending, and Michigan Consumer Sentiment.

Major earnings reports coming later this week include ANF, AZO, BBY, CSIQ, DOLE, ESLT, NTES, WOOF, and RL on Tuesday. Then Wednesday we get BMO, BNS, BAX, DKS, DY, UHAL, CHNG, DXC, ENS, GES, NVDA, SPLK, and WSM. On Thursday, we hear from BABA, AMWD, BIDU, BURL, CM, DG, DLTR, GCO, IQ, M, MDT, AEO, ADSK, COST, DELL, FTCH, GPS, MRVL, ULTA, VMW, and WDAY. Finally, Friday he see BIG, PDD, and SAFM.

The bulls look to be trying to leverage the late-day rally on Friday into a gap higher this morning. News that the US is reconsidering tariffs on Chinese goods is helping buoy spirits despite the head of the IMF saying they may need to reduce the 2022 global economic growth forecast again. In short, after seven weeks of losses and sitting in a very oversold state, the bulls feel the need to stretch their legs. As traders, we need to keep in mind that despite this fact, the trend is down and the probability of volatility is high. So, continue to be very careful about chasing gaps. Remember that Friday’s gap was a Bull Trap. Either way, that “bear market level” (down 20% from highs) in the area is close below in the S&P. So, remain nimble and hedged. Above all, don’t give in to FOMO and feel the need to chase a move or predict a reversal either way.

Trading is a job, not a lottery ticket. So, work the process. Stick with your trading rules and manage the things that you can control while trying not to worry about the things you have no control over at all. Trade with the trend, don’t chase, keep consistently taking profits when you have them, and move your stops in your favor. Also, remember that the first rule of making big money in the market is to not lose big money in the market. So, don’t be stubborn, and protect yourself from yourself. Keep in mind that nobody is right all the time. When you’re wrong, just admit it and take your loss. As they say, the best time to have taken a $500 loss is when you are now staring at a $1,500 loss.

Ed

Swing Trade Ideas for your consideration and watchlist: No Trade Ideas Yet (Rick has Internet issues). You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service