You can’t make this stuff up! While the market consolidates at record highs, the House votes to impeach the president while he takes the stage at a packed out campaign rally. Thus far, the market seems to have taken the vote in stride as the bullish trend remains intact. With several earnings and economic reports this morning, perhaps the market can find some inspiration to break out of the consolidation that began after the Monday morning rally. However, with the Holiday’s just around the corner volume is likely to remain light after the morning burst of energy.

Asian markets closed mixed but mostly lower overnight, with the central bank holding rates steady. European indexes trade mixed but slightly lower this morning after the Bank of England announces no rate changes. US Futures have bounced around the flat-line this morning with an ever so slight bullish lean ahead of an economic calendar data dump.

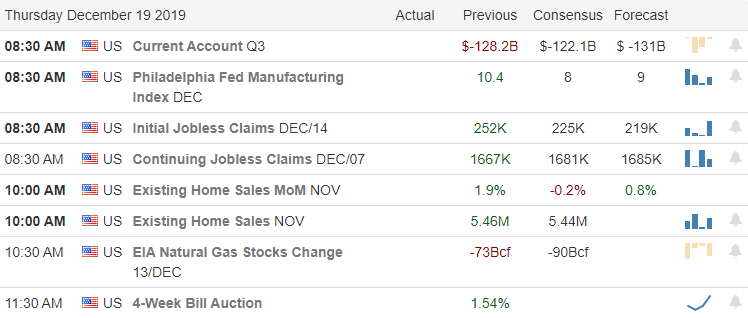

On the Calendar

On the Thursday Earnings Calendar, we have our biggest day this week, with 26 companies reporting. Among the notable reports are RAD, ACN, CAG, DRI, SAFM, FDS & NKE.

Action Plan

As expected, the market wandered sideways in consolidation, waiting for some inspiration. During the evening, the full House voted to impeach President Trump. The tally showed that not one of the President’s party voted in favor of the impeachment with just a few from the opposing party not voting to impeach. So far, the overall market has seen no reaction to the vote. Overall the bullish trends remain intact and the bulls have the upper hand although there was a tiny hint fear with the VIX rising ever so slightly at the close yesterday.

After the bell yesterday MU reported better than expected earnings lifting the stock and this morning, we have a few reports that may help the market find some inspiration. However, it’s more likey it will be the economic reports, Jobless Claims, Philly Fed Survey, & Existing Home Sales that will fuel the bulls or bears this morning. With the Holiday’s rapidly approaching, don’t be too surprised if a morning burst of energy quickly fades into light and choppy price action.

Trade Wisely,

Doug

Comments are closed.