World markets are watching and wondering, will they or won’t they cut interest rates in June or will the FOMC wait until July. Recent strong economic numbers seemed to have lowered the odds of a June rate cut but the odds of a July cut seem to be rising. One thing for sure is we all have to wait for there decision and forecast on Wednesday at 2:00 PM Eastern time.

As we wait it would not be surprising to light and choppy consolidating price action. With the DIA and SPY hold above their 50-day averages and the QQQ and IWM remain below the directional uncertainty of market is palpable. Futures are pointing to a modestly bullish open ahead of today’s economic reports so be careful not to chase. Baring some surprise news or a presidential Tweet Storm I would expect anemic and pensive price action until the FOMC Announcement.

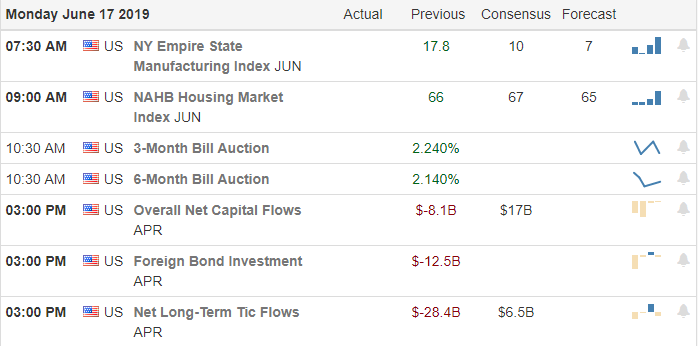

On the Calendar

On the Monday Earnings Calendar we have only 11 companies reporting quarterly results but none are notable very unlikely to move the market today.

Action Plan

The FOMC will be the predominant focus of the market until their rate announcement and committee forecasts on Wednesday at 2:00 PM Eastern. Strong economic numbers last week seems to have lower the odds of a June rate cut but most are expecting the Fed will make its move in July. I think the bigger question is will the FOMC forecast suggest one, two or even more possible rate cuts this year? Other questions to ponder, What if there is a US/China trade deal at the G20 meeting? If so, will there be any need for the FOMC to cut rates?

With so many big questions it would not be out of the question to see pensive price action as the world waits for the FOMC decision. US futures currently point to a modestly bullish open ahead of the 8:30 AM Eastern Empire State Mfg. Survey and Housing Market Index report later this morning. Unless we have some big breaking news or a Tweet Storm expect a relatively quiet market until Wednesday afternoon.

Trade Wisely,

Doug

Comments are closed.