Another day, and another news-driven whipsaw, revealing that President Biden will propose doubling the capital gains tax. Proposal or not, the fact remains that the wild price swings this week have elevated the risk and uncertainty for retail traders. Next week we ramp up earnings reports that include several tech giants, so it’s likely the rollercoaster ride of whipsaws and morning gaps will continue for the near future.

Asian markets had mixed results as the HIS surged 1.12% and NIKKEI fell 0.57% in a volatile session to close the trading week. European markets see modest declines across the board this morning even as data suggests their recovery gains strength. Trying to shake off tax-raising proposals, U.S. futures point to a modestly bullish open ahead of earnings, PMI, and New Home Sales numbers.

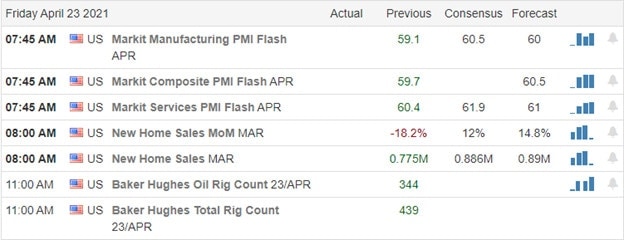

Economic Calendar

Earnings Calendar

Today, we get a little break on the earnings calendar with just over 30 companies planning to reveal quarterly results. Notable reports include AXP, HON, KMB, RF,& SLB.

News & Technicals’

Yesterday’s turbulent whipsaw came after a Bloomberg story revealing that President Biden will propose doubling the capital gains tax to fund education and child care. Not surprisingly, the market quickly reacted negatively. Treasury yields are creeping up this morning to 1.558% on the 10-year, with the 30-year rising to 2.245%. Sadly the pandemic issues in India continue to grow, setting a new world record daily infection rate of more than 332,000, topping yesterday’s record. There are also growing concerns around new strains of the virus that are potentially more contagious. Tesla faces pressure in China after customer protests, and the Chinese state media branded the company’s response as arrogant, with regulators increasing their scrutiny of the company.

It’s been a wild week of emotional whipsaws fueled by data and news with another daily reversal as investors try and sort out all the implications. The question to answer is which way will the wind blow today? Will it be a rush back in to chase moving issues, or will there be a run for the day as we head into the weekend? One thing for sure the price action risks have grown due to the large daily price swings. Though we have a lighter day on the earnings calendar, keep in mind next week’s reports ramp up dramatically with big tech in focus. Consequently, the wild ride is likely to continue so plan your risk carefully.

Trade Wisely,

Doug

Comments are closed.