Trade war uncertainty, growing tensions with Iran and more than 400 companies reporting earnings; When it rains it pours! Markets hate uncertainty and we sure have a pot full of it this week giving the indexes as well as traders and investors a case of indigestion trying to digest it all. Asian market closed in the red across the board last night in reaction to the tariff fears and surprises in Chinese trade data. European indexes are currently modestly lower across the board as well this morning.

The sharp selloff yesterday broke US index supports creating some significant technical damage in the charts. Currently the US futures are suggesting a lower open of more than 100 Dow points but that has been fluctuating substantially and could be very different by market open as earnings reports roll in at a furious pace this morning. Expect very high volatility with fast price action to challenge all traders. Buckle up the bumpy ride continues down a very uncertain path.

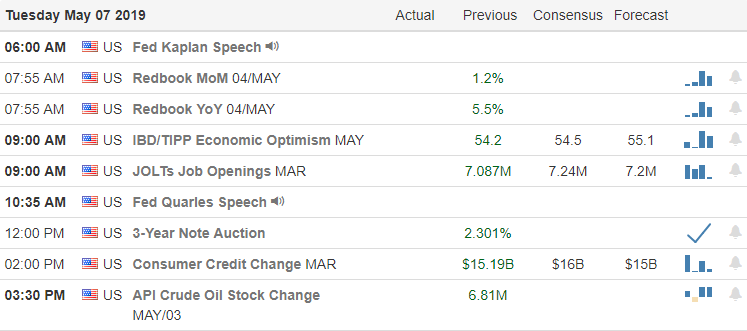

On the Calendar

We have a huge day on the earnings calendar with more than 400 company’s reporting. Some of the notable today include, DIS, ETSY, ACM, ALB, APLE, GOLD, CVNA, FUN, CTL, CHK, CXW, COTY, BREW, FOSL, FOXA, GDOT, HMC, TWNK, IAC, MCK, NYT, ODP, PAAS, PRGO, ROKU, SBRA, SRPT, STMP, SWCH, TM, VER, VIS & WEN.

Action Plan

Futures that were positive most of the night turned sharply lower at about 4 AM Eastern time this morning. According to CNBC a diplomatic cable for Beijing arrived in the oval office late last Friday evening with edits that removed most the China concessions and destroyed months of negotiations. The president’s Sunday decision raise tariffs on Friday was the result of this action. Here is the link to the full story https://cnb.cx/304DBGc.

Iran has issued new threats suggesting they no longer want to live by the nuclear agreement they signed just a couple years ago raising tensions with the US. As the old saying goes, When it rains it pours! Toss in more than 400 earnings reports today and the market has more than enough fodder to continue with volatile price action. Yesterday’s steep selloff may have put us in a short-term oversold condition but having broken through important supports more lows are certainly possible. However, we should also be on the lookout for the possibility of a short covering relief rally so be careful not to chase the morning gap.

Trade Wisely,

Doug

Comments are closed.