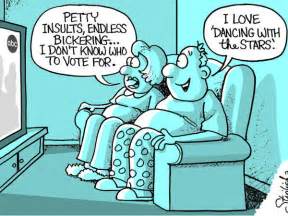

Washington DC Spin

The US Senate is now the top focus of the market as the Tax Reform bill head to the floor for debate. According to reports, a vote could come before the end of business Friday. In my opinion, there is never a more dangerous time in the market then when Politicians, rhetoric and the Washington DC Spin machine is in control. Anything is possible, and high volatility and big intra-day swings can occur. Also, keep in mind that even after the Tax Reform dog and pony show is over we still face a Federal Government shutdown in early December. Who knows what kind of political drama that could create. I suggest if you do trade then trade small and stay on your toes because the price could be very bumpy the next couple weeks.

The US Senate is now the top focus of the market as the Tax Reform bill head to the floor for debate. According to reports, a vote could come before the end of business Friday. In my opinion, there is never a more dangerous time in the market then when Politicians, rhetoric and the Washington DC Spin machine is in control. Anything is possible, and high volatility and big intra-day swings can occur. Also, keep in mind that even after the Tax Reform dog and pony show is over we still face a Federal Government shutdown in early December. Who knows what kind of political drama that could create. I suggest if you do trade then trade small and stay on your toes because the price could be very bumpy the next couple weeks.

On the Calendar

The Thursday Economic Calendar begins at 8:30 AM Eastern with two important reports. First, the consensus for the Jobless Claims number this week is 240K vs. 239K on the previous reading. If not for the impacts of Puerto Rico Jobless Claims would be at or near historic lows. Second, is the Personal Income and Outlays report. Personal Income is see rising 0.3% while consumer spending could slow slightly to 0.3%. The Core index expects a 0.2% increase for a yearly rate fo 1.4%. Also at 8:30 AM we have a Fed Speaker and then another at 1:00 PM to pontificate on interest rates. At 9:45 AM is the Chicago PMI which forecasters are calling for a decline to 63.5 vs. 65.2.

On the Earnings Calendar, we have 38 companies reporting. Please continue to check current holdings as well as those you are considering for purchase for reporting dates. Just a few seconds of effort can save you from significant losses if a company reports poorly.

Acton Plan

Yesterday’s price action left behind patterns of uncertainty in the DIA, SPY, and IWM. The QQQ’s on the other hand, reminded us that the bears still exist and their teeth are very sharp! Many trends in the Tech sector broke down yesterday, and there are reversal patterns galore. As bad as it was, please remember it’s not the first move lower that matters. A failure to make a new high after it bounces is where the real selling could begin. The sky is not falling.

New out of Washington that the Senate voted mover the Tax Reform bill forward to floor debate has fired up the Futures this morning. Currently, the Dow futures are suggesting a large gap up at the open. Remember gaps to new market highs can create whipsaw price action producing fast intraday reversals. Be careful not chase and get caught up in the morning drama. A vote to pass the Tax bill could happen within the next 24 to 48 hours. If it happened to fail; well, use your imagination.

Trade Wisely,

Doug

Comments are closed.