Earnings reports, FOMC rate decision and the US/Trade negotiation tensions as talks resume today offer the market a volatility trifecta to navigate. Both Asian and European markets show mixed results ahead of US/China trade talks, but the US Futures are bullish across the board on the heels of AAPL earnings. After the bell today MSFT will weigh its earnings results along with several other notable reports to keep traders on their toes.

Fast price action and volatility can be expected at the open today as the market responds to earnings and economic news but don’t be surprised if it slows down and becomes choppy as we wait for the Fed decision at 2 PM. As price tests, resistance levels keep an eye out for whipsaws and the possibility of reversal patterns. There is so much on the markets plate today anything is possible so set aside bias and focus on the price action. Buckle up; it could be a bumpy ride!

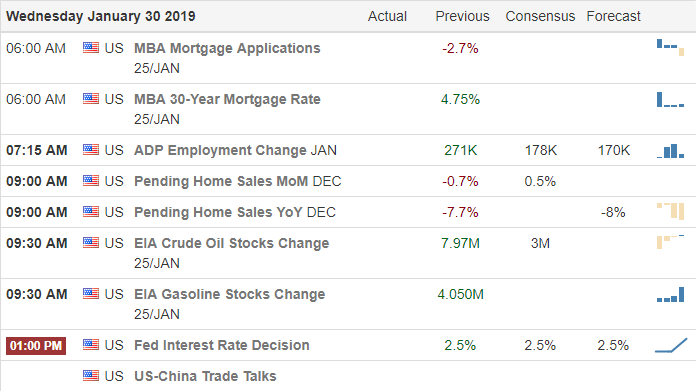

On the Calendar

On the Earnings Calendar, we have 137 companies reporting with notable reports from MCD, BABA, T, FB, MSFT, PYPL, QCOM, TSLA, WYNN and many more.

Action Plan

AAPL squeaked past its earnings report betting lowered estimates by a single penny. The good news is that was enough to please investors lifting the stock more than $8 per share in after-hours trading. We have another big day of earnings with the tech bellwether, MSFT reporting after the bell today. Also this afternoon at 2 PM Eastern we have the FOMC rate decision weighing the mind of the market. If that’s not enough to complicate the price action toss in the tensions of the US/China Trade negotiations that resume today.

Currently, US Futures are bullish across the board which is interesting due to Asian stocks closing mixed but mostly lower and European markets also currently mixed. I would expect some fast price action this morning as the market reacts to earnings and early economic reports such as the ADP and GDP. However, don’t be surprised if the market quiets down and price action becomes choppy as we wait for the Fed decision and the chairman’s press conference. The current market condition is more suited to day traders rather than swing & and position traders with so much market-moving news.

Trade Wisely,

Doug

Comments are closed.