After a nasty gap down followed by an amazing recovery rally, futures are currently pointing to a gap down open of more than 100 points. Volatility is likely to remain high as the drama plays out between the US and China. Asian markets closed mixed overnight and European indexes are red across the board with new 25% tariffs scheduled to go into effect at 12:01 Friday. Tensions are high and according to reports China has walked back most of the major concessions previously made.

Add to that a week chalked full of earnings and the stage is set for considerable volatility the possibility of big overnight gaps making trading in the current environment more like gambling amidst all the turmoil. Day traders will likely have the upper hand and swing traders may find it difficult to impossible to hold on to an edge over the next several days. So far this has been a great year of profits be careful not to give those gains back trying to trade such uncertainty. It may be wise to back off, protecting your capital, and remember you don’t have to trade every day to be a successful trader.

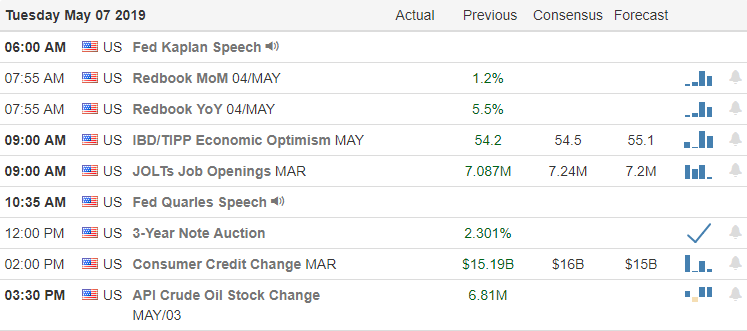

On the Calendar

On the Earnings Calendar we have a very big day with more than 380 companies reporting. Among the notable reports, DDD, ALGN, ABEV, BUD, CHUY, CNX, CROX, DBA, DF, DFRG, EA, EMR, ENR, RACE, IT, HUBS, JAZZ, KGC, LC, LPX, MLCO, MYL, OHI, PZZA, PBR, PBPB, QRVO, SEAS, SRE, RGR, TRIP, WU, & WING.

Action Plan

After a remarkable rebound rally yesterday where traders shrugged off trade war concerns and the escalation of tensions between the US and Iran face another gap down this morning as markets around the world respond lower. Although the Vice Premier is joining the trade negotiation team on Wednesday, China has walked back most of the major concessions made in the 150-page trade deal according to reports. The president as also followed through on his threat setting the 25% tariff increase for 12:01 Friday. I think it’s fair to say the tensions are high and currently relations have taken a big step back.

As I write this US futures are pointing to a gap down of more than 100 in the Dow but that could easily change considerably with so many companies reporting results this morning. The fact volatility is likely to remain quite high over the next several days setting the stage for big gaps and possible overnight reversals. In this kind of condition trading becomes much more like gambling and having any kind of edge for the swing trader is near to impossible. If you do decide to trade it would be wise to keep the positions smaller than normal in light of the volatility and be careful not over trade.

Trade Wisely,

Doug

Comments are closed.