Some candlestick patterns bear poetic or engaging titles – Evening Star, Dark Cloud Cover, Spinning Top, Falling Window, Morning Star – while others are decidedly less appealing. For example, consider the title of the Three Outside Up candlestick pattern. Though not ugly, the title feels disjointed and awkward, and it doesn’t convey a lovely image or idea. Yet despite its middling name, this bullish reversal pattern can help you forecast a change on the horizon. To learn more about the Three Outside Up candlestick pattern, please scroll down.

Three Outside Up Candlestick Pattern

Formation

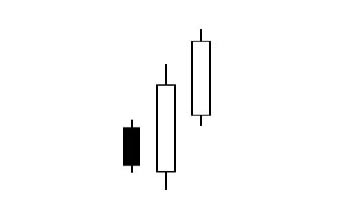

Essentially, the Three Outside Up candlestick pattern is comprised of a Bullish Engulfing signal and a confirming candle. It includes just three candlesticks, making it easy to identify and understand. To locate it, check for the following criteria:

First, a downtrend must characterize the market. Second, a small black (or red) candle must appear, continuing the downtrend. Third, a longer white (or green) candle must “engulf” the prior candle. This means that the top of its body will be above the prior candle’s body, and the bottom of its body will be below the prior candle’s body. Fourth and finally, another white (or green) candle will follow, confirming the sudden uptrend.

The opposite of this pattern (a confirmed Bearish Engulfing) is known as a Three Outside Down.

Meaning

The bears have controlled the market for awhile, and the first day of the pattern communicates this trend. In the wake of the clear downtrend, however, the bulls seize the reins. Although the second day opens below the prior day’s close (appearing to continue the downward trend), the price then surges as the bulls show their strength. This creates an engulfing candlestick, which swamps the price movement of the preceding day. Although some traders will act at this point, confident in the Bullish Engulfing pattern, others will lack courage until the third day, when the bulls push the price higher, creating another white candle. This long candle closes above the previous day’s close and proves that the reversal is not a fluke.

To better understand the Three Outside Up signal, review its characteristics. The taller the candles (especially the second, engulfing candle), the more significant and trustworthy the reversal. In addition, the stronger the downtrend at the start, the stronger the reversal. In fact, many investors consider the Three Outside Up to be an undeniably solid signal if it contains a strong downtrend to start and a long engulfing candle within.

_____

Although an Engulfing pattern provides moderate reliability as an indicator of a reversal, the confirmation supplied by a third candle in the Three Outside Up increases the consistency of the signal’s performance. So if you spot a Bullish Engulfing pattern, consider waiting for confirmation. That is to say, consider waiting for a Three Outside Up pattern. Good luck!

If you’re interested in mastering some simple but effective swing trading strategies, check out Hit & Run Candlesticks. Our methods are simple, yet powerful. We look for stocks positioned to make an unusually large percentage move, using high percentage profit patterns as well as powerful Japanese Candlesticks. Our services include coaching with experienced swing traders, training clinics, and daily trading ideas. To sign up for a membership, please click here.

Comments are closed.