If the tech titan’s earnings results are not enough, how about we toss in a big week of economic data and an FOMC decision for good measure! The daily reversals of last week left us guessing as the price support held, as did the price resistance setting the stage for another week of possible volatile big point moves. Prepare for the possibility of big gap opens, overnight reversals, and intraday whipsaws as we react to all the data. Will the week produce the thrill of victory or the agony of defeat?

Asian markets closed the day mixed but mostly lower as they monitor the terrible pandemic conditions in India. European markets trade flat this morning, with Germany set for a third wave lockdown that could last until June. Ahead of earnings and the latest reading on Durable Goods, U.S. Futures seem to be taking a wait-and-see approach pointing to a flat and mixed open.

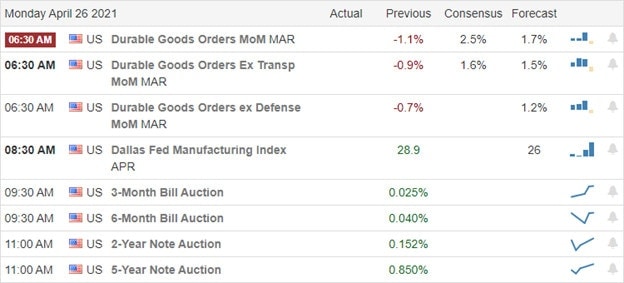

Economic Calendar

Earnings Calendar

This week is an enormous week of earnings reports highlighted by the tech giants. Today with begin with 72 companies listed on the calendar stepping up to report. Notable reports include AGNC, ACI, CNI, CAJ, CHKP, HMST, LII, OMF, OTIS, PKG, SBAC, SUI, & VALE.

New & Technicals’

Results from the tech titan’s earnings will likely be the driver for price movement for this week. It begins after the bell with TSLA today, GOOG and MSFT on Tuesday, FB on Wednesday with AMZN hitting the tape on Thursday. Inda reported its 5th straight day of more than 350,000 new infections. The U.S. said it would send the raw materials needed for India to ramp up the manufacturing of the vaccine and other necessary medical equipment. Germany has implemented tough new lockdown rules to curb the third wave of infections with measures that could last until June. Treasury yields are creeping up this morning ahead of the busy week of data, with the 10-year coming in at 1.579% and the 30-year climbing to 2.254%. Wells Fargo is now predicting that the recent slump in yields will soon end with bonds breaking higher as inflation worries increase.

Not only do we have a busy week of earnings, but we will also have a big week of economic data highlighted by the FOMC decision Wednesday afternoon. Friday proved to be another reversal day with a significant point recovery, but it fell short of breaking above the highs. With a week of daily reversals behind us and facing a week of market-moving data, we could have about anything happen. Technically the indexes are in good shape, but last week’s wild daily reversals provided clear evidence of just how dangerous this market can be with all the emotion it has generated with the big point moves. Good reports, and we could easily see considerable gaps in the market open. Should something stumble, be ready for the exact opposite as possible. Put on your big-boy pants and lace up some flexible shoes, because anything is possible!

Trade Wisely,

Doug

Comments are closed.