As the US House makes another attempt to pass a $2.4 Trillion stimulus package, Goldman Sacks cuts their 4th quarter GDP estimate in half, citing gridlock and fading hopes of additional stimulus. The early evening futures rally faded during the night, suggesting a substantial gap down at the open. With the DIA 200-day just over 1.85% lower, a test of that level is certainly within the realm of possibilities as we slide into a politically charged weekend.

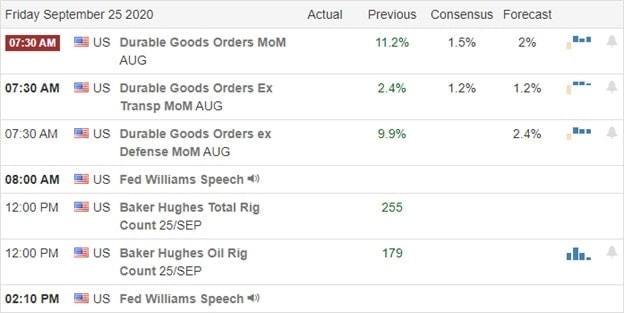

Asian markets closed mixed overnight in a volatile session. European markets, unfortunately, decidedly bearish this morning as travel and tech stocks suffer more bearish pressure. US futures point to a substantial gap down at the open with a Durable Good report pending, rising virus concerns, and a pending Supreme Court appointment adding uncertainty to the weekend.

Economic Calendar

Earnings Calendar

We have a very light Friday earnings calendar with only three confirmed quarterly reports, with none of them rising to notability status.

News & Technicals’

The overnight futures session turned out to be a volatile and challenging as Thursday’s market price action. News that the US House is preparing a new 2.4 trillion stimulus package, including more direct payments, perked up futures during the early evening. However, this morning the bears appear to remain tenacious, reversing the overnight bullishness, now pointing to a lower open on Friday. I suspect as the pressure of reelection continues to grow, there will be a stimulus deal struck this time around. Apple will be back in court soon with the EU appealing there 15 billion tax battle to their highest court, attempting to reverse the lower court decision that favored the company. Goldman Sachs cut fourth-quarter GDP forecast in half, citing the stalemate in Congress that has delayed further government stimulus. Amazon announced a slew of new tech devices to boost the holiday shopping seasion, including a self-flying drone home security device.

Yesterday volatile session added more questions than answers for traders and did nothing to improve the technicals of the index charts. With the lackluster performance of the bulls yesterday and the bears proving much more tenacious than earlier this year, the confidence of a substantial bounce-back rally seems to have faded. With the DIA only 1.85% from testing its 200-day average and the political fireworks expected this weekend, we should not rule out the possibility of a test. On the other hand, the hopefulness of another massive government stimulus package could easily inspire the bulls triggering a short-covering rally. In other words, anything is possible, and traders will need to remain focused and flexible as we slide toward the uncertainty of the weekend.

Trade Wisely,

Doug

Comments are closed.