Friday brought a welcome relief raising hopes and leaving behind bullish engulfing patterns all over the place. Remember, hammer patterns must be validated with follow-through bullish price action. Soon money will begin to flow from the 1.9 trillion stimulus bill. Still, the question to be answered is can all the newly printed money overcome the consequences of rising inflation concerns as bond yields surge upward. Keep in mind the VIX remains elevated, so expect challenging price action so plan carefully.

Asian markets had a rough overnight session, with the HIS leading the declines closing down 1.92%. Across the pond, European markets trade modestly higher this morning, and the U.S. point to a flat open as investors monitor rising bond rates. Plan for choppy price action as the bulls and bears battle for control.

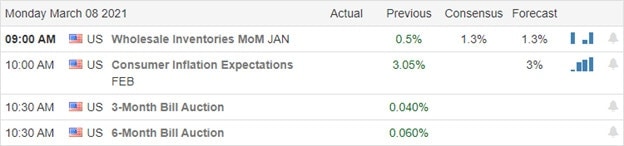

Economic Calendar

Earnings Calendar

On the Monday earnings calendar, we have 65 companies stepping up to report quarterly results. Notable reports include BNFT, CASY, TACO, NCMI, NIU, PVAC & SFIX.

News & Technicals’

Over the weekend, the Senate pass the 1.9 Trillion stimulus bills, and after another vote from the House, the money will begin to flow. While one would expect the market to celebrate, the newly printed money futures seem to be struggling a bit this morning. It turns out the massive printing continues to worry the market about inflation, with the 10-year Treasury yield topping 1.6%. Yemen’s Houthis attacked Saudi oil facilities this weekend, once again raising tensions in the region and pushing crude prices above $70 per barrel. The defense department stated the U.S. would hold accountable those responsible for the rocket attacks against the Iraqi base that hosts American troops.

On the technical front, last Friday’s relief rally left behind a lot of bullish hammer patterns lifting hopes that a market recovery had begun. Although buying the dip has been a good strategy in the past, I’m not sure it will work this time. Keep in mind a hammer pattern requires the price to follow-though to be valid. With rising bond rates spooking investors, can all the government stimulus still overcome the concerns of if it just made it worse? Then we still have the challenge of downtrends as well as overhead price resistance levels yet to overcome. With the VIX still elevated, I expect price action to remain challenging in the week ahead. Watch for overnight reversal and intraday whipsaws as the bulls and bears battle for control. Keep an eye on bonds, as I suspect it will be difficult for the tech sector to bounce back should they continue to rise.

Trade Wisely,

Doug

Comments are closed.