Most of the time I approach the market with a directional assumption, but right now I feel much more comfortable sitting on the fence. After a run that produced the best January market performance n 32 years, I simply feels right to be a little cautious. Having produced substantial profits in the bull run, I went into the weekend holding only a few long positions and a couple of conservative hedge trades to reduce my long risk.

Let me be very clear that I am not at all bearish. There is nothing in the price action that suggests bearishness, and as a matter of fact, earnings could easily continue to inspire the bulls higher. I do believe the bull run is a little stretched however so it would be wise to be on the lookout for clues of a pullback or at a minimum a consolidation. My current watchlist chalked full of very good looking charts, but as of this morning I plan to take slow with more of a wait and see approach before adding new risk.

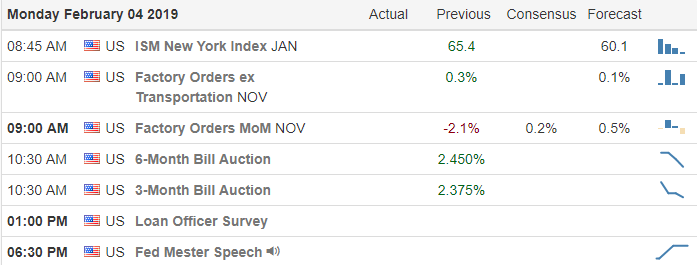

On the Calendar

On the Earnings Calendar, we have 80 companies reporting results today. Notable earnings today: AVB, CLX, GILD, GOOGL, LM, LEG, ON, STX & SYY.

Action Plan

A rather quiet market news weekend as the nation focused mostly on the Super Bowl and the resulting parties. Although we are about at the mid-point of earnings season, we have a very big week ahead of us with GOOGL reporting after the bell today. As I write this Futures are currently flat but keep in mind that CLX reports before the open among other potential market move reports, so anything is possible.

I went into the weekend light in my account wanting to protect capital and thinking a rest or even a market pullback could begin at any time. As of this morning, I’m still comfortable with that decision. However, I want to be clear that I’m not at all bearish just cautious after the best January market performance in 32 years. Earnings could easily continue to inspire the bulls propelling price even higher, but I think just a single stumble could also trigger some profit-taking. While I still have several long positions, I also have also added some positions to hedge to reduce my long risk. Although I’m choosing caution, there are a lot of very good looking charts on my watchlist ready to become active trades depending upon overall price action.

Trade Wisely,

Doug

Comments are closed.