With indexes at or near significant price resistance levels and their respective 50-day moving averages, traders should be careful about adding new long positions and thinking about banking some profits. Please understand that I am in no way suggesting bearishness. In fact, with the DIA and the SPY so close to testing their 50- day averages I would not want to rule a bullish effort to do just that. However, we can also not rule out the possibility of a pullback at resistance and some profit-taking to begin.

We have a lot of economic and earnings data coming out before the bell today, so anything is possible, but futures are currently pointing to gap down open. Asian market closed lower across the board, and European markets are also all in the red this morning. MS, has already reported an earnings miss this morning so we will need some good data to inspire the bulls. The price support built over the last week with the tight range consolidation may now provide some selloff protection if the bears decide to come to work today. As always, price is king so stay focused on price action for clues.

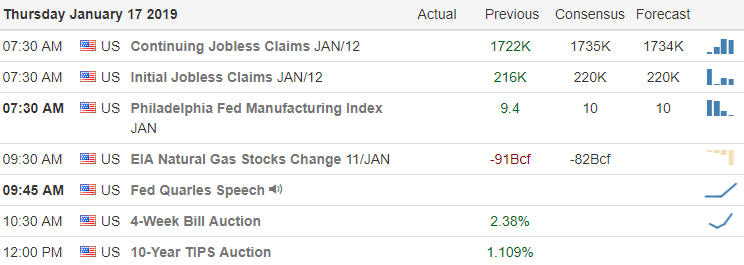

On the Calendar

We have 43 companies reporting earnings today with NFLX kicking off tech reports this afternoon. Notable reports today AXP, BBT, FAST, JBHT, KEY, MTB, MS, PPG & TSM.

Action Plan

Earnings and Economic reports will likely be the key driving force for the market this morning. On the Economic Calendar, we have Housing Starts, Jobless Claims, and the Philly Fed all coming out an hour before the market open. On the Earnings Calendar, we will hear from BBT, KEY, MS, MTB, and PPG before the bell which could obviously move the market. T2122 continues to suggest a pullback, or at a minimum, a consolidation could begin at any time, but so far, the bulls have had the energy and momentum to keep moving higher.

Currently, the Futures are suggesting a lower open, but with so much pending news anything is possible by the time we hear the bell ring. With the DIA and the SPY so close to testing their 50-day averages I would not rule out the possibility of a bullish effort to accomplish that task. If we do see some selling, the tight consolidation just below could easily serve to support prices keeping the bears in check. Remember the rule: we want to buy stocks at or near price support. With the indexes at or near price, resistance be very careful not to over-commit to long positions.

Trade Wisely,

Doug

Comments are closed.