While the DIA and SPY continue to hover just below around all-time high resistance levels, yesterday’s price action left more concern rather than confidence by the end of the day. Technically speaking the current trends in major indexes remain bullish even though the resistance above has proven to be difficult to penetrate thus far. With very little on the earnings or economic calendars today the market may struggle to find inspiration as we head into a weekend that could include retaliation for the Saudi oil field attacks.

Asian markets closed the week mixed but mostly higher as low-level trade talks begin. European indexes are modestly green across the board this morning, and the US Futures currently point to modest gains at the open. With contradictory candle signals, trends and all-time resistance levels just above ahead of an uncertain weekend anything is possible. Plan your weekend risk carefully.

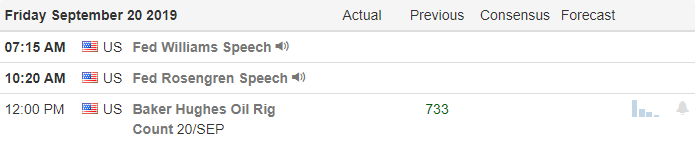

On the Calendar

On the Friday Earnings Calendar, we have just four companies reporting results today. I see no particularly notable reports today.

Action Plan

Vice President Mike Pence is now publicly calling the attack on Saudi oil fields as an act of war. According to reports, President Trump will be briefed on retaliation options in the next couple days. What comes next is anyone’s guess? The President has also granted a few more tariff exemptions as US and China move into low-level talks.

Although the indexes were unable to sustain yesterdays rally the DIA and SPY continue to hover around all-time high resistance levels. Current trends are clearly bullish, but yesterday’s price action was not exactly confidence inspiring by the end of the day. As we head into a weekend with trade talks and a possible retaliatory response on the oil fields it will be interesting to see how much risk traders will be willing to hold. With only Fed Speakers on the Economic Calendar and no notable earnings reports today, the market will have to search or inspiration elsewhere. Plan your risk carefully and have a wonderful weekend!

Trade Wisely,

Doug

Comments are closed.