Although yesterday’s selloff created a lot of technical damage it also offered a glimmer of hope for at least a little relief rally. With the Dow having tested the psychological support of 25,000 and the SP-500 testing its 200-day average both indexes left behind hammer candle patterns that indicate at least a short-term bottom is possible. Keep in mind that hammer patterns require follow through to be confirmed and that relief rallies may be very short-lived but a little break in the selling would is nice just the same.

Currency fluctuations, slipping bond rates and sharply rising grain commodities will continue to weigh heavily on the mind of the market let alone the happens in the trade war. The market is still very sensitive to the news cycle so stay on guard for the possibility of very quick reversals and high price volatility to continue challenging traders skills.

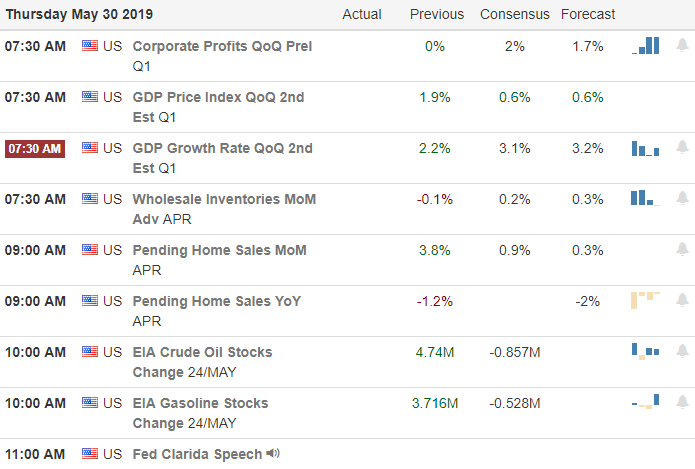

On the Calendar

On the Earnings Calendar we have just under 60 companies reporting today. Among the notable reports DG, COST, BURL, CSIQ, DELL, DLTR, EXPR, GME, GPS, LULU, MOV, NTNX, ULTA & VMW.

Action Plan

Spending considerable time looking through charts last night there is now widespread technical damage across the majority of market sectors. Having said that there is also a glimmer of light for a relief rally after the DIA tested 250 and the SPY found support at its 200-day average yesterday. Please note that I didn’t say recovery because there is still a lot of work needed before occurs but a little relief rally would certainly be nice even if it’s very short lived.

Although currency fluctuations and slipping bond rates have the market on edge future are currently pointing to a modestly higher open today. The GDP number, International Trade report and weekly Jobless Claims that all come out at 8:30 AM Eastern could lift the market spirits or dampen them quickly if the numbers disappoint. Expect price action volatility to remain very challenging with quick reversals due to news sensitivity.

Trade Wisely,

Doug

Comments are closed.