Asian markets closed mixed overnight without the benefit of the ECB news clearing the deck for rate cuts and further asset purchases. European markets are bullish across the board this morning on the news and the US Futures have rallied sharply on the news as well. There is nothing quite like the smell of freshly minted money to inspire the bulls.

Ahead of the Existing Home Sales report at 8:30 AM Eastern Dow futures are pointing to more than a 100 point gap up with the Nasdaq leaping substantially higher as well. Remember not to chase the morning gap. Wait for proof that buyers will support the gap just in case the bear’s step in to defend resistance levels. Also keep in mind there could be a significant risk of loading up on positions ahead of the FOMC announcement at 2:00 PM Eastern, Wednesday. Plan your risk accordingly.

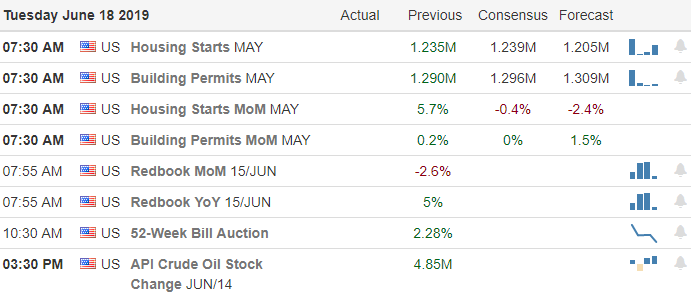

On the Calendar

On Tuesday’s Earnings Calendar we have 30 companies reporting today. Among the notable are ADBE, AMED, KHC & LZB.

Action Plan

Yesterday’s expected choppy price action is giving way to bullishness this morning on the news that the ECB has cleared the way for potential rate cuts and further asset purchases if inflation doesn’t’ reach its target. Markets love the smell of freshly printed money and US Futures are no different rallying on the news. Today begins the 2-day FOMC meeting and the market is expecting an action similar to the ECB.

Technically speaking yesterday consolidation price action was productive. The DIA and SPY held above their respective 50-day moving averages and the QQQ crossed back above its 50-day and managed to hold just 16 cents above by the close. Futures are currently pointing to a Dow gap up open of more than 100 points but we still have to clear the Existing Home Sales hurdle at 8:30 AM Eastern.

Trade Wisely,

Doug

Comments are closed.