A spreading virus threat, a big week of earnings, economic data including an FOMC rate decision as well as an ongoing impeachment trial, could prove to be the perfect storm for price volatility. Markets around the world are reacting to the quickly spreading threat of the coronavirus that’s injecting a huge economic uncertainty to its potential impacts. Markets hate uncertainty and not much that creates more fear than a spreading contagion with no cure. Plan your risk very carefully as quick news-driven reversals and large morning gaps are possible during this uncertainty.

Japan traded lower in response to the virus, while most Asian markets remain closed for the lunar holiday. European markets are falling sharply this morning as virus fears grow, and US Futures are reacting sharply lower this morning as well. At one point, Dow futures fell 500 points but have recovered slightly this morning now suggesting a gap down around 400 points at the open. Hold on for a bumpy ride!

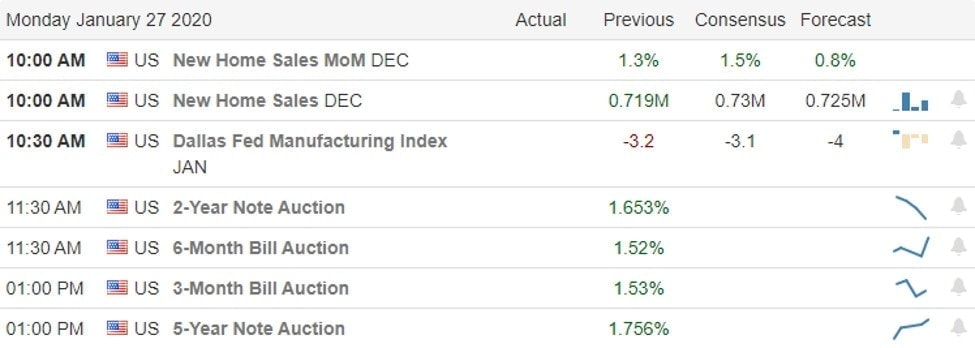

On the Calendar

On the Monday earnings calendar, we have over 70 companies reporting. Notable earnings include ARNC, CR, DHI, GGG, HMST, JNPR, & WHR.

Action Plan

We all knew there was an overextended condition in the market, but who could have guessed it would be a microscopic virus that would bring out the bears. With now five confirmed cases here in the US, nearly 2900 cases worldwide and over 450 people now listed as critical worries of severe economic impacts rose dramatically over the weekend. Oil prices dropped into the low 50’s as travelers are choosing to reduce their movements. In China, more than 25 million people are locked down in cities where public travel has stopped operating and many businesses have closed during their biggest holiday session. During the evening, the Dow futures dropped 500 points as markets around the world react to the quickly spreading virus.

We have a huge week of earnings with some of the biggest companies reporting this week along with and FOMC rate decision and a big week of economic reports. Combine all of that with virus jitters and ongoing impeachment trial, we have the conditions for the perfect storm of price volatility. Plan your risk very carefully! Inexperienced traders might want to consider sitting this out and protecting your capital until this uncertainty passes. Expect quick news generated price reversals and large morning gaps that could be up or down, and the market reacts to the unknown.

Trade Wisely,

Doug

Comments are closed.