Powell Disappoints the Market. The FOMC cut the rate by 25 basis points but provided the market no clarity to the future rate cuts the market has been pricing in the last couple months, creating a strong bearish reaction yesterday afternoon. Their action drew sharp criticism from the President, who has been trying to influence a bigger step from the committee. None the less, yesterdays violent selloff left behind a bearish engulfing pattern on the DIA, SPY, and QQQ while also setting a strong resistance level in the market that may be difficult to breach.

Asian markets closed mixed but mostly lower overnight after July numbers showed their manufacturing has contracted. European are currently mixed as well but have largely revered early losses due to better than expected earnings results. US Futures are pointing to a modestly bullish open ahead of busy earnings and economic calendars. Perhaps cooler heads will prevail, and the bulls will find enough inspiration in the earnings to hold index price supports, but I would not rule out the possibility of a bearish follow-through so keep a close eye on price action for clues.

On the Calendar

On the Thursday Earnings Calendar, we have the biggest day of the week with more than 460 reports. Some of the notable reports include, ABC, MT, AMD, AVP, CC, CI, CLX, ED, CROX, DVA, DISH, DNKN, DD, ETSY, EXC, FLSR, GM, GPRO, HBI, HFC, IRM, K, LM, NNN, PINS, RMAX, RDFN, SHOP, SQ, STOR, X, VZ, W, WU, WING, WYNN, XTL, YETI, and YUM.

Action Plan

Today the market has to come to grips with the possibility that yesterday’s quarter-point rate cut could be a one and done event. That’s much different then what the market had been pricing in over the last couple months. Powell, in fact, provided very little clarity to the futures actions of the FOMC which of course drew sharp criticism from the President. Traders focus will once again turn to a huge day of earnings reports, which is likely to continue offering up challenging and volatile price action.

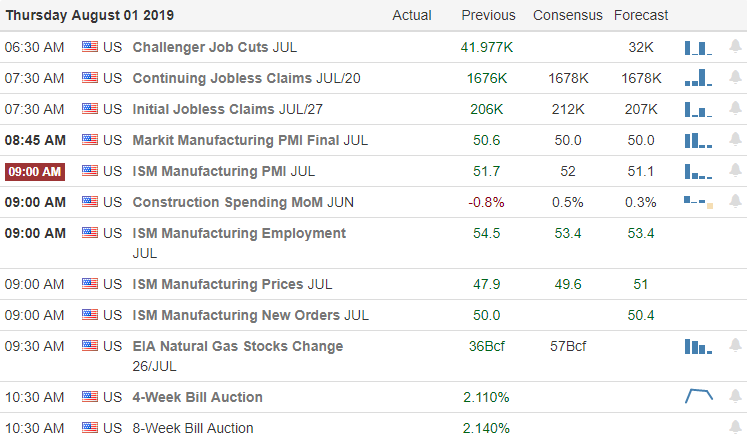

Unfortunately, the strong down reaction yesterday broke the uptrends in the DIA, SPY, and QQQ, leaving behind large bearish engulfing patterns. While this may have put in place a difficult to breach price resistance, let’s keep in mind that a bearish engulfing candle must follow-through to the downside. As of now, the US Futures indicate a modestly bullish open as earnings reports roll in and ahead of the Jobless Claims, PMI, ISM, Construction Spending economic reports. Having said that, as long as current support hold and prices don’t follow-through lower yesterdays steep decline could prove to be a one-off event.

Trade Wisely,

Doug

Comments are closed.