I think the best description for the price action of late is Pop & Chop. An exciting gap up market open followed by sheer boredom as uncertain bulls and bears milling about waiting for the next tidbit of news hoping for clarity. The FOMC minutes provided no clarity, and now it looks like the best hope for inspiration is the Powell address at 10:00 AM Eastern from Jackson Hole. I would not be at all surprised is we see more of the choppy price action today as we wait.

Asian markets closed mixed overnight as manufacturing data showed a decline putting pressure on the Nikkei. Across the pond European indexes are seeing modest declines across the board in reaction to another US bond yield inversion. Here in the US, futures also point to modestly bearish open ahead of morning earnings reports and the weekly Jobless Claims.

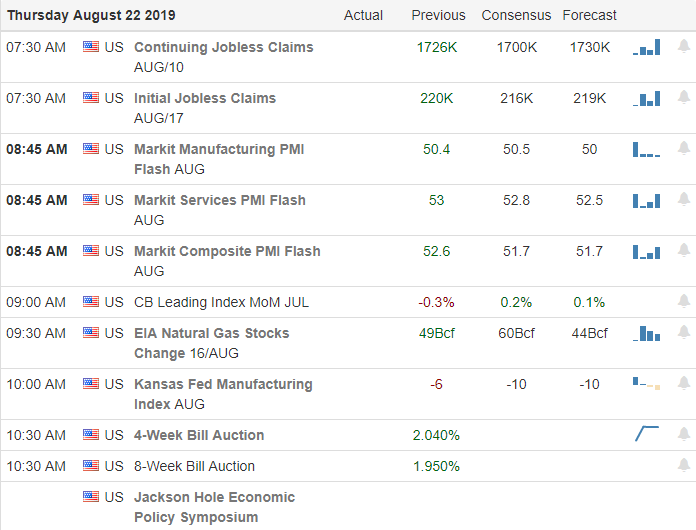

On the Calendar

We have more than 50 companies reporting earnings this Thursday. Among the notable reports are CRM, VMW, GPS, HPQ, INTU, ROST, DKS, FLWS & CM.

Action Plan

After great earnings results from LOW and TGT gaping the market higher at the open the price action once again went flat and chopped sideways the rest of the day. The FOMC minutes release was a non-event providing no further clarity as to interest rate path forward. Perhaps, Powell’s address in Jackson Hole Friday morning will provide enough inspiration the shake loose of the summer doldrums.

Once again the US 10-year bond rates have slightly inverted with the 2-year bond rates, but the market seems to be taking it in stride this morning lifting off the overnight lows slightly while still pointing to a modestly bearish open. However, that could easily change a earnings result roll in, and we get the latest reading on Jobless Claims. Overhead resistance of price and moving-averages continues to challenge the index charts clearly defining the battlefield of the bulls and bears. Although price action has been very challenging, let’s keep in mind the Dow is less than 5% below its record highs in July, which is a pretty mild correction at this point. Nonetheless its have still been very frustrating, and I would expect more chop today amid so much uncertainty.

Trade Wisely,

Doug

Comments are closed.