The FOMC stands aside, the US and China are said to be outlining a trade deal, index trends are up, and the bulls point to the 9th straight day of gains. A truly extraordinary bull run that is also in the 9th straight week up without looking back. Oddly enough bonds continue to trend higher and even gold and silver have printed significant gains at the same time.

In a run such as this, profits have been easy to come by but its also very easy to become complacent. Such a strong bull run can lull traders to sleep and forgetting about the hungry bears lying in wait for their opportunity to attack. The trends are clearly bullish so stay with the trend but make sure you’re not chasing stocks late in their rally and over-trading. Respect resistance levels and exercise caution as price challenges them and remember to take some profits to the bank.

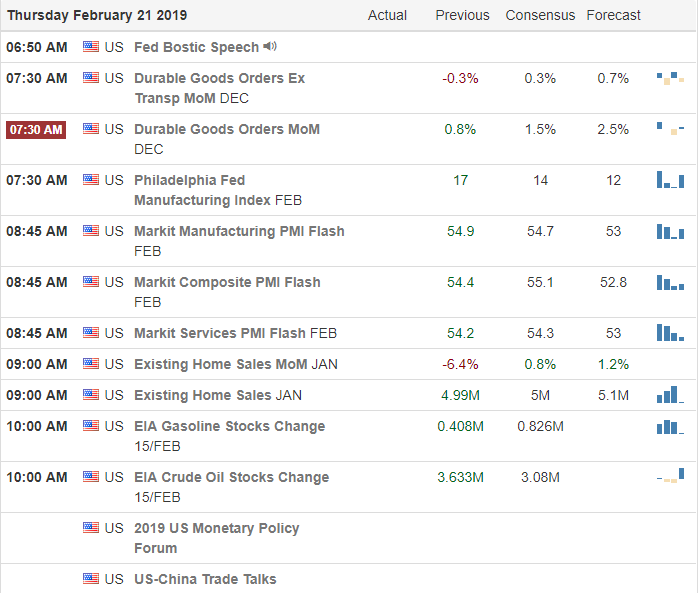

On the Calendar

On the Earnings Calendar we have a big day with more than 225 companies reporting results. Among the notable report are: BIDU, BCS, BYD, CZR, ED, CUBE, DLPH, DPZ, DBX, FSLR, FLR, HL, HPE, HRL, KHC, MORN, NEM, RMAX, STMP, STOR, VER, WEN, WIN & ZG.

Action Plan

Eight straight days of rally and in the 9th straight week of an extraordinary index rally and the bulls appear energized to continue that winning streak this morning. New overnight that US and China may now be outlining the details of a trade deal have the futures once again pointing to a modest gap up at the open. Asian markets closed mixed but modestly higher overall and European are currently mixed this morning as well.

Today we have very busy earnings and economic calendars to keep us on our toes as we progress toward the open. Yesterday the FOMC minutes yesterday reinforced that the committee expects to take a wait and see approach giving them more time to evaluate the economic impacts of past rate increases. As expected there was some price volatility after the minutes released but ultimately the bulls remained solidly in control as we push upward to test significant market resistance levels. At this time there is nothing in price action in the index charts to suggest bearishness but we must respect the resistance above and avoid chasing so late in the rally.

Trade Wisely,

Doug

Comments are closed.