One of the biggest one-day increase in oil prices in 30 years but the overall market seemed to take the blow in stride only losing about half of one percent on the day. Rising domestic production decreasing our dependence on foreign crude likely played a significant role in the muted market reaction. Another might be the no-rush response to retaliation of those responsible for the attack. Last but not least is the hopefulness that the FOMC will lower interest rates on Wednesday afternoon. The question rattling around in my head is what happens if the FOMC disappoints due to the rather strong US economic data?

The rising geopolitical concerns and rising energy prices led to Asian markets closed mixed with the Hong Kong exchange suffering the biggest decline. Across the pond European are also cautious this morning trading mixed but modestly lower overall. With the FOMC kicking of their 2-day meeting today and ahead of Industrial Production number the US Futures points to a modestly lower open and what could be another very choppy price action day as we wait for the Fed decision.

On the Calendar

We have 22 companies stepping up to report today according to the Earnings Calendar. Notable reports include FDX, CHWY, ADBE, & CBRL.

Action Plan

Although the oil made it’s biggest one day spike in nearly 30 years, the overall market barely flinched only falling about half a percent overall. While evidence mounts that the oil field attacks came from Iran, the President is exercising patience on retaliation as investigations continue. With US energy production so high nowadays we have decreased dependence on Saudi oil, but the other factor for a muted market reaction is the pending FOMC announcement on Wednesday afternoon. Although fed fund futures have recently decreased the odds of a rate cut slightly but as of yesterday, the probability remains at 26% of an FOMC accommodation.

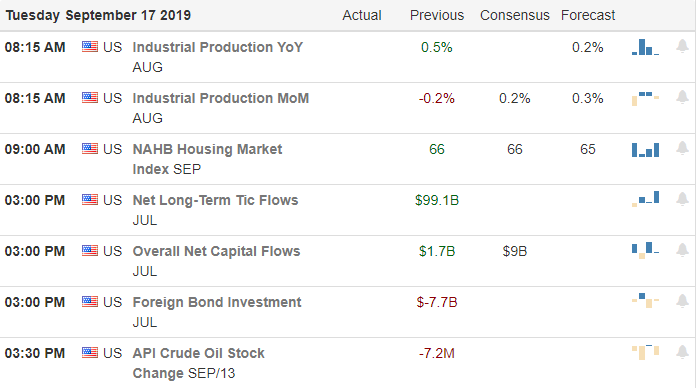

Ahead of the open US Futures are pointing to a modest decline as the FOMC begins its 2-day meeting. We have Industrial Production numbers at 9:15 and Housing Market Index reports on the economic calendar and after the bell earings from FDX and ADBE that could move the market. Although there could be a news-driven event that creates some price volatility, I’m largely expected a light and choppy day as the market waits on the Fed decision.

Trade Wisely,

Doug

Comments are closed.